MUMBAI (Commoditiescontrol) – After slow start during last quarter of 2015 of the current season cotton prices has shown very strong trend in the domestic markets with every passing month on ideas of lower production and strong demand.

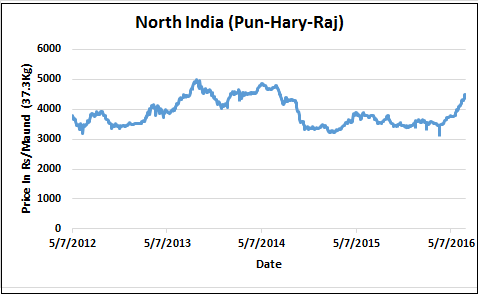

Cotton prices in North India has rose to 2-year high at 4,500/maund (37.3kg) on Friday, however later on receded to 4,480 as buyers turned cautious at the higher level. As far as weekly trend is concerned the fibre rose as much as 2.7 percent, while Shankar 6 (Gujarat) variety cotton recorded 4.9 percent rise and last traded at 43,000/candy (356kg each).

Cotton prices in North India has rose to 2-year high at 4,500/maund (37.3kg) on Friday, however later on receded to 4,480 as buyers turned cautious at the higher level. As far as weekly trend is concerned the fibre rose as much as 2.7 percent, while Shankar 6 (Gujarat) variety cotton recorded 4.9 percent rise and last traded at 43,000/candy (356kg each).

Domestic demand remained strong mostly throughout the week as mills with low inventory were looking to source the fibre to get set in comfortable position as next year crop likely to reach the market slightly delayed amid slow monsoon progress. Further there also concern about the production for next 2016-17 season on expectation of shrink in acreage.

.jpg) However the recent surge in prices is likely to change the sentiment of farmers and may prompt them not to shift to other crop as current rates of cotton is very attractive.

However the recent surge in prices is likely to change the sentiment of farmers and may prompt them not to shift to other crop as current rates of cotton is very attractive.

Earlier trade experts had said that acreage may fall as much as 15 percent, as farmers may shift to pulses, oilseed and paddy for better remuneration, but some recovery in acreage likely as crop sowing still to accelerate in many states other than North India (Punjab-Haryana-Rajasthan).

India Cotton Sowing Sharply Declines

The latest agriculture ministry data revealed that cotton planting in the country as on June 30 is just around half of what has been sown in same period last year. The total cotton acreage stood at 30.59 lakh hectares versus 60.16 lakh hectares in 2015-16.

.jpg)

Cotton planting in Rajasthan has sown significant growth with tad up in Tamil Nadu, while acreage was in negative territory in rest of the states. Sowing has almost completed in North India and plants are in good sharp due to favorable weather condition.

The monsoon progress has turned better in the last few days in Maharashtra, Madhya Pradesh and South India, which is likely to help to accelerate sowing process. However, rainfall is deficit in Gujarat, largest producer in the country.

India Cotton Balance Sheet Very-Very Tight

A brief survey conducted between trade experts revealed that cotton output during the season 2015-16 stands not more than 320 lakh bales compared to 352 lakh bales last year. With opening stock of 40 lakh bales and including imports (as on date) of 11 lakh bales. The total supply as on date is somewhere around 371 lakh bales.

The country has shipped around 65 lakh bales, while small and non-mills consumption likely at 222 lakh bales as on June, which takes the total consumption tally to 287 lakh bales. There are still 4 months left for new crop. The total availability for remaining season will be 84 lakh bales and even if we consume 80 lakh bales in next four months the left over ending stock will be around 14 lakh bales (we expect 10 lakh bales more imports in coming four months). The ending stock for the season could be lowest in more than a decade.

Click Hear: Cotton Balance Sheet

Will Current Rise Sustainable?

Now the million-dollar question is whether the current rise in domestic market is sustainable or prices would correct going forward.

One should not forget that cotton (Shankar 6) prices since April rose 30 percent, while yarn and cloth prices didn’t rose proportionately, which has forced mills to hold their stocks from selling. In order to sustain the current rise either yarn and cloth prices to gain in line with cotton or correction in cotton prices is what will have required.

Further the domestic cotton market has risen following China market as well, which rose 44.47 percent in last four months.

The Factor Going To Influence Cotton Prices Ahead

# Overseas cotton is available at much competitive rates, which could prompt domestic mills to source more cotton. Further domestic availability is also tight.

# Mills cotton consumption may decline due to poor margin in finished products and sluggish demand.

# Even many mills are shifting gradually towards synthetic yarn, which may result lower cotton consumption.

# India cotton production may rise next season despite of lower acreage as better yield due to good monsoon likely to offset acreage losses.

# Any major weakness in crude oil after ‘Brexit’ may make synthetic yarn more attractive domestically and internationally hurting cotton demand to some extent.

# China state reserve sold more than 1 million tonnes of cotton, which has made the cotton availability very much comfortable for domestic mills and at very attractive rates and hence imports of cotton likely to drop from Indian and other countries.

# It will be interesting to see how Indian yarn and garment exporters to compete with China in the international market due to competitive rates.

# Further currency of many major nation involved in cotton trade depreciated in the recent months, while Indian rupee has not weakened in line with them is also likely to hurt exports prospect.

India Textiles & Apparels Exports May Touch $50 Billion In FY2016

Helped by the government's special package and marketing plans, India's textiles and apparel exports are expected to touch $50 billion mark this fiscal from $38 billion in FY16, according to a senior official.

The Union Cabinet last week approved a Rs 6,000-crore package for the sector with an aim to create one crore new jobs in three years and attract investments of $11 billion while eyeing additional $30 billion in exports.

China Weekly Auction Report (Full Report) ;

CCI Weekly Auction Report (Full Report)

(By Commoditiescontrol Bureau; +91-22-40015533)