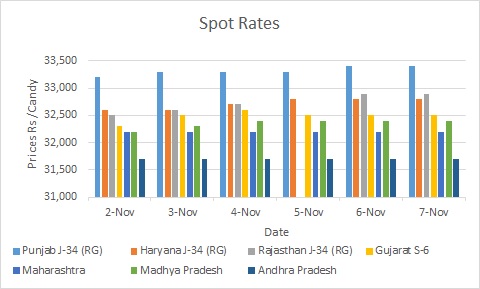

MUMBAI (Commoditiescontrol) - Through the week ending 7th November, 2015, cotton prices in domestic spot markets displayed steady to firm trend. In north and central India, the commodity commenced the week lower when compared to prices in the last weekend. Prices then on traded steady to firm throughout the week. During the week, the commodity gained Rs 300 in Haryana and Rs 400 in Rajasthan, while it was steady elsewhere.

The current rates are attracting strong domestic and exports demand, while the Cotton Corporation of India (CCI) is playing its role as the major buyer in south India.

Noticeable arrival pressure was seen in mid-week after strike of ginners in Haryana was called off after getting assurance of the government that their demand will be considered.

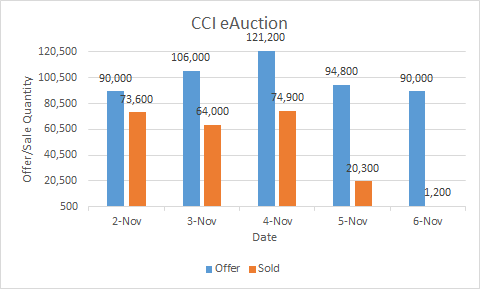

The government nodal agency CCI received strong response for three straight sessions this week, while the selling slowed down later in the week. It liquidated 2,34,000 bales out of 5,02,000 bales offered throughout the week, which is around 46 percent of the total volume offered.

FACTORS TO INFLUENCE DOMESTIC COTTON MARKET

BULLISH FACTORS

1. Lower Crop Estimates In 2015-16

One of the major factors that would drive cotton prices is lower crop forecasts in 2015/16 by several sources. In its first meeting for the current season held in Mumbai, the Cotton Advisory Board (CAB) estimated India’s production in the year at 365 lakh bales, which is about 15 lakh bales less than the previous season. The Cotton Association of India (CAI) estimated production at 377 lakh bales.

At the same time, private agencies and market experts placed their estimate for total output in the season at around 320-330 lakh bales, which are all lower than 380 lakh bales in the last season.

2. Hand To Mouth Cotton Stock Position With Mills

Though demand from domestic mills is seen good at the current level, they are buying for their immediate requirements. Mills are not willing to buy large volume of cotton to build up inventory.

3. Slow Domestic Cotton Supply, Particularly In North India

New crop supplies this year are comparatively lower than the last season. Arrival pressure is yet to be seen, especially in north India. This factor is building market sentiment. Cotton crop in Punjab and Haryana suffered losses due to severe whitefly attack. Estimated daily arrivals across the country are at around 1.5 lakh bales at the moment.

4. Exports Demand May Rise From Pakistan, Vietnam & Bangladesh

Asian countries such as Pakistan, Bangladesh, Indonesia and Vietnam are likely to emerge as the leading importers of Indian cotton in the current season. This will offset poor demand from China. Domestic production in Bangladesh is lower and consumption is likely to increase in the country. Pakistan has already began importing Indian cotton from the last few days.

Last year too, Bangladesh replaced China as the largest buyer of Indian cotton. India has exported around 6.5 lakh bales in October (as per HC Code 5201) and 3.5 lakh bales in September. As on 31st October, exports of more than 10 lakh bales have been estimated. Major buyers were Bangladesh, Indonesia and Viatnam.

5. Indian Prices Cheaper In International Markets

At present, Indian cotton is cheaper in overseas markets compared to their domestic prices, which is driving export orders. So much so that exporters are buying nearly 60 percent of total cotton being sold in domestic markets.

Market analysts expect total booked export orders to jump to around 25 lakh bales in October and November as Indian cotton is competitive in international markets. Further, constant weakness in the Indian currency would back upside in demand. Indian Rupee closed the week at 66.13 against a dollar.

6. Dying Units Start In Rajasthan

After a ban of five months, over 700 textile units in Balotra of Rajasthan would soon resume operations after the National Green Tribunal (NGT) withdrew closure order.

The withdrawal of ban will have a positive impact on cloth market as raw material is shipped from Maharashtra, Tamil Nadu and local markets to textile units in Balotra for dying. The ban had halted this movement, resulting in piling up of raw material, said Mr. Arun Dalal, a veteran trader.

BEARISH FACTORS

1. High Unsold Stock With CCI As Well As Big Merchants

CCI is left with an unsold stock of around 7 lakh bales from the last season. It has already started procuring cotton from farmers at minimum support price (MSP). Moreover, nearly 17 lakh bales of purchased cotton from CCI is yet to be lifted from its warehouses. Besides, there are quality issues with CCI cotton, as per trade sources.

2. Huge Chinese Stocks

In 2015/16 cotton season too, demand from China will remain weak due to the country’s continuous attempt to encourage buying in domestic grown cotton. China has a huge reserve stock of around 12 million tons, which it tried to reduce through reserve auctions in July. But the auctions could not help much as very little of the offered quantity was sold. Only 63,412 tons of cotton were liquidated, just 3.4 percent of the total offered.

Also, much to market disappointment, China has kept low-tariff import quota for cotton in 2016 unchanged at 894,000 tons. The import quota of 894,000 tons is as per the World Trade Organization (WTO) rule, but markets had expected some hike in the country’s import quota for the new season.

3. Slow Consumption In Near-Term

Given the upcoming festival season, prices would be pressured by slow domestic consumption in the near-term. Also, overall functioning in the industry will be slowed down due to labor shortage.

4. Liquidity Pressure In Cotton Complex

Textile mills in the country are facing liquidity crunch at the moment amid large inventory of yarn lying with them due to slow offtake.

5. Power/Electricity Problems

Power generation in the country has been impacted due to less rains this year. Powerlooms face disruption in electricity distribution, effecting their overall production.

SPECIAL COVERAGE THROUGH THE WEEK

Govt Mulls Replicating China Policy To Save Cotton Farmers, Ginners From Losses

The Indian government is planning to transfer the difference between the minimum support price (MSP) and market price directly to farmers' bank accounts, informed Textile Commissioner Kavita Gupta after a CAB meeting. "We are planning to start a pilot project in Maharashtra. Under the project, if farmers sell cotton to traders below the MSP, then the government will pay the difference directly to farmer," Gupta said.

(Click Here For Full Report)

Cotton Prices Likely To Rally On Falling Arrivals

Cotton crop loss due to whiteflies attack or other pest related diseage in key cotton growing states of Haryana and Punjab is considerably higher this year as compared to last year. Presently, cotton arrivals is seen consistently rising in the markets of Haryana and Punjab and most of the cotton will reach to the markets by the end of December, as per the market observers.

(Click Here For Full Report)

ICE’s New World Cotton Contract Forays With Lackluster Trade

ICE’s new world cotton contract witnessed lackluster trade on Monday, its first trade, with just 21 contracts exchanging hands. The new world cotton contract offers merchants, mills and growers their first alternative to pricing on the exchange. (Click Here For Full Report)

India’s 2015/16 Cotton Output Seen At 365 Lakh Bales: CAB

The Cotton Advisory Board (CAB) estimated India’s 2015/16 cotton output at 365 lakh bales. Closing stocks are seen at 38 lakh bales compared to 52 lakh bales year ago, CAB forecasts. Opening stocks pegged at around 52 lakh bales, imports seen at 12 lakh bales, exports seen at 68 lakh bales and consumption seen at 323 lakh bales. (Click Here For Full Report)

Govt Amends MEIS To Boost Textile, Garment Exports

Taking due note of the recommendations of the Union Minister of State for Textiles, Santosh Kumar Gangwar, the government has extended duty incentives under the Merchandise Exports from India Scheme (MEIS).

(Click Here For Full Report)

NGT Lifts Ban On Over 700 Textile Units In Balotra; Cheers Cloth Market

The National Green Tribunal (NGT) on Wednesday lifted ban on over 700 textile units in Balotra (Rajasthan) and surrounding areas of Jasol and Bithuja. The tribunal had ordered the closure of the units after finding irregularities in common affluent treatment plant norms. The decision came as a gift to the owners and workers of the factories have reasons to celebrate this Diwali cheerfully. (Click Here For Full Report)

Around 50% U.S. Cotton Crop Harvested - USDA

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ended 2nd November, 2015 stated that around 50 percent of U.S. cotton crop has been harvested, higher than 49 percent last year same time but below five year average of 54 percent. (Click Here For Full Report)

U.S. Net Upland Sales Of 2015/16 Cotton Totals 147,200, Up 94%

The U.S. Department of Agriculture (USDA) reported net export sales of 147,200 running bales (RB) of U.S. 2015/16 cotton, up 94 percent from last week. Increases were reported for Turkey (23,600 RB), Egypt (23,400 RB), Vietnam (22,000 RB), Indonesia (20,100 RB) and Taiwan (13,600 RB).

(Click Here For Full Report)

Excluding China, Other Asian Nations To Raise Cotton Imports In 2015/16 - ICAC

In its latest forecast, the International Cotton Advisory Committee (ICAC) stated that other Asian countries, barring China, are likely to increase cotton imports in 2015-16 as China’s market share declined significantly. ICAC said that China will likely remain the world’s largest importer in 2015/16, but its share of world imports has fallen from 55% in 2011/12 to 22% in 2014/15 and may only reach 17% in 2015/16. (Click Here For Full Report)

Brazil Cotton Index Loses Strength, Falls 1% In October

Brazil cotton Index decreased 1 percent in October due to high cotton availability, but with low quality. Supply of cotton from type 41-4 above keeps low in the domestic markets. Sellers have become more active in liquidating their stocks. The cotton Index decreased in the month after recording gains for four consecutive months to touch the highest price in 2015 (at 2.3656 BRL per pound on October 2). (Click Here For Full Report)

TOP STORIES THROUGH THE WEEK

MAHAFED Ready To Buy Up To 100 Quintals Cotton

MAHAFED is ready to buy 100 lakh quintals this year compared to 27 lakh quintals last year, said N.P Hirani, federation chairman. It started centres early this year, usually it does after Diwali. On Thursday, it bought 225 quintals paying Rs 4,100 per quintal for best grade cotton. Farmers were paid directly into their bank accounts through RTGS/NEFT. The federation would open upto 96 centres and procure on behalf of CCI.

Resurgent Rajasthan Partnership Summit

Rajasthan govt attracts investment of over Rs 1.5 lakh crore in the run up to the resurgent Rajasthan partnership summit. Agreement have been signed with companies from solar, mining, textiles and petroleum sectors. Resurgent Rajasthan partnership summit 2015 is slated to be held in Jaipur on November 19 and 20. Textiles is the only sector in the state which gets an interest subsidy on term loan taken from financial institutions. This is in addition to the interest subsidy offered by the government of India under technology upgradation fund (TUF) scheme. Combining these two subsidies, the effective interest rate in the textile sector in the state becomes negligible.

Cotton Fabrics Exports To Rise 10-15% This Year

The inclusion of African countries under the Merchandise Exports From India Scheme (MEIS) is set to boost India’s cotton fabrics exports by 10-15 per cent in the current financial year. In the latest notification on October 29, the Directorate General Of Foreign Trade (DGFT) included African countries under MEIS for exports of cotton fabrics (woven and knitted) and madeups.

Cut Excise Duty On Man Made Fibres To 6%

The office of the Textile Commissioner has recommended to the centre to reduce excise duty on man made fibres (MMF) from 12% to 6%. The recommendations were made based on discussions with various export promotion councils and traders bodies some days ago, Textile Commissioner Kavita Gupta said, adding that yarns made of MMF like polyester and synthetic are in good demand. Addressing a meeting with Tirupur Exporters' Association at Tirupur, Gupta said it was for the government to decide on the reduction, according to sources. She said that if garment manufacturers from Tirupur, whose exports have crossed Rs 20,000 crore, enter the technical textile sector, the revenue would increase manifold.

Cotton Ginner In Haryana Called Off Strike

Cotton ginners in Haryana called off week long strike after getting assurance from state Chief Minister/FM. The Finance Minister Capt Abhimayu assured to withdraw the notification released in September about non refund of VAT.

Blended Yarn Price Inches Up In India

Blended yarn prices were steady to up in Asian markets in the fourth week of October. In India, prices gained on domestic demand while exports were weak. 30s (65/35) Pv yarn prices were flat in Indore market. In Ludhiana, Pc 30s (52/48) prices gained us cents 3 a kg on the week. In September, blended spun yarns export were down 16 per cent Yoy while volumes fell 9 per cent. In Pakistan, prices were increasing on the domestic markets on demand recovery from the textile producers and the rebound of cotton prices.

Telangana Govt Wants Hike In Cotton MSP To Rs 5,000/Qtl

Telangana govt requested centre to increase MSP of cotton to Rs 5,000/Quintal and relax procurement norms. MSP was set at Rs 3,936 to Rs 4,100 per quintal, but farmers are not getting even Rs 3,936. CCI urged to open all 84 centres and purchase cotton for at least five days a week. CCI has purchased nearly 50,000 quintals of cotton so far against over 1 lakh quintals same time last year.

Maharashtra Cotton Growers Federation Expects Bumper Crop This Year

A bumper cotton crop is expected in the state this year which is likely to bring cheers to growers in the Vidarbha region too, Maharashtra State Cotton Growers Co-Operative Federation Chairman N P Hirani has said. Vidarbha has the largest area under cotton cultivation in the state and the cash crop has an influence on its rural farm economy in a big way. This year, the yield is expected to be between 350 and 380 lakh quintals against 300 lakh quintals last season, Hirani said.

Rajasthan Eyes 1,000 Kg Per Ha Cotton Yield

Confederation Of Indian Textile Industry Cotton Development And Research Association, which has been active in Rajasthan for the past few years, now plans to raise yield there to 1,000 kg per ha. With higher yield, Rajasthan’s production has also increased to around 170,000 bales. P D Patodia, Chairman, Citi Standing Committee on cotton, said they had set a target of raising yield to 1,000 kg (per ha).

SIMA Hails Lifting Of Ban On Textile Units In Rajasthan

Southern India Mills' Association (SIMA) appraised National Green Tribunal's (NGT) decision to lift ban on over 700 textile units in Balotra and its surrounding areas of Jasol, Bithuja in Rajasthan.

ECC Not Informed About 10% RD On Cotton Yarn Imports - PAF

Pakistan Apparel Forum (PAF) said govt did not take approval of Economic Co-ordination Committee (ECC) before imposing 10% regulatory duty on cotton yarn imports. Govt also bypassed Ministry Of Commerce and Ministry Of Textile in taking the decision.

Pakistan Govt Likely To Reduce Import Duty On Cotton Yarn

A source in the Ministry of Finance has hinted that the government is likely to consider reduction in regulatory duty on the import of cotton yarn to benefit the garment sector. The cotton yarn, fabric commercial and value addition sector exporters are now facing 10% regulatory duty on imports from November 1, 2015.

Pakistan Cotton Arrivals Reach 64,65,600 Bales By 1st Nov

Pakistan 2015-16 cotton arrivals reach 64,65,600 bales by Nov 1st, a reduce of 22.86% than last year - PCGA. 2014-15 same date cotton arrival reached at 83,82,419 bales. Local mills bought 4,216,665 bales, exporters bought 333,555 bales. Unsold stocks with ginners seen at 19,15,380 bales same time last year 2,083,034 bales. Unsold stock (press bales: 847,977 bales, phutti (kapas) 1,067,403 bales). Total 993 factories are in operation.

U.S. Cotton Exports In September

U.S. exported around 82,929 rb of upland cotton in September 2015 compared to 1,21,746 rb in August 2015. The country had exported same volume of upland cotton in the corresponding period last year.

OUTLOOK FOR NEXT WEEK

Cotton prices are likely to stay flat in the next week as well on account of Diwali festival. Market players will be festive mood and thin activity is expected in the commodity. Daily arrivals of cotton would be negligible as well. Supplies may pick up post Diwali, checking gains in prices.

(By Commoditiescontrol Bureau; +91-22-40015532)