MUMBAI (Commoditiescontrol) – Cotton prices last week (Oct 26 to Oct 31) exhibited bearish tone amid subdued demand from domestic mills, low offtake in cotton yarn and increasing supply.

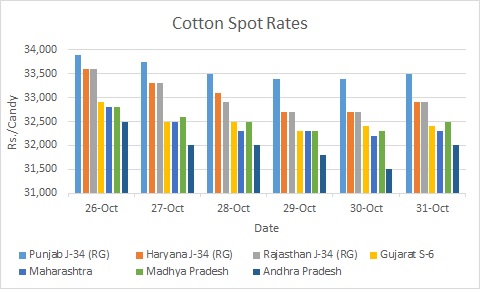

Cotton prices during the week dropped by Rs 600/candy (356kg each) in major markets across Central and South India, whereas cotton receded by Rs 50/maund (37.3kg each) in North India.

Good demand was observed by mills in the last couple of session as prices have now become attractive, which prompted them to source cotton for their near term requirement. The big mills have no issue in sourcing the commodity, while small-to medium size mills are not among major buyers since they have a large quantity of unsold inventory and also facing liquidity crisis.

Poor domestic demand for cotton yarn was among the main culprit behind the bearish tone in the market due to many mills are not enthusiastic in sourcing.

Weekly Highlights

♣ Cotton Supply On Rise; May Peak After Diwali

Cotton arrivals in the country has picked up pace during the current week and totaled at 4.80 lakh bales (170kg each) versus 2.75 lakh bales. The market received 1.02 lakh bales of cotton on Friday, highest arrivals so far for current season that begins from October 1, 2015. According to trade sources, the supply is expected to pick up further after Diwali.

Cotton supplies in the country as on October 27, 2015 totaled at 13.13 lakh bales versus 8.46 lakh bales a year ago same period, according to trade sources.

♣ Sale Of Cotton By CCI

The government procurement agency, Cotton Corporation of India (CCI) auctioning process also lent to prevailing bearish factors to drag prices down in physical markets. Attempting to shift most of the cotton put up sale at its E-auctions, the agency had kept its floor prices mostly flat throughout all the centres. But then, it received a mix bag of response for its cotton this week. It sold 1.01 lakh bales out of 4.02 lakh bales offered to sell during the week. However, the cotton quantity put up for sale by the agency is decreasing day by day. As on today, CCI has an unsold cotton stock of around 22 lakh bales (including 9 lakh bales yet to be delivered to buyers)

♣ Extended Subdued Movement In Yarn Markets

Yarn prices traded more or less steady this week, with 32 carded in Ichalkaranji quoted in the range of Rs 160-160/kg and 30 carded weft offered in the range of Rs 130-145/kg in Coimbatore, while 30 carded in Gujarat was offered in the range of Rs 160-165/kg. But offtake was reported sluggish at the current rates. Unless demand at domestic and export front is improved, yarn prices cannot see any major revival.

Weekly Technical Update

MCX Cotton Bales Weekly November: Expect Lower Range To Be Tested

Traders can buy if breakout and close above 16180 is witnessed.

Resistance is at 15887-16180.Click Here

NCDEX Kapas April’16 Weekly: Cover Short Position

Exit long on rise from 872 to 889 range as the opportunity arises. Expect lower range of 860-831 to be tested. Further rally is above 918. Click Here

NCDEX CoC Weekly December: Expect Higher Range To Be Tested

Traders long can keep the stop loss at 1645. Accumulate at 1653 with a stop loss of 1645. Resistance is at 1682-1690.

Click Here

SPECIAL COVERAGE THROUGH THE WEEK

India 2015-16 Cotton Crop Likely At 370 Lakh Bales – CAI

India is likely to produce around 370 lakh bales (170kg each), 7 bales lower than previous estimate, Cotton Association of India (CAI) said in released on Wednesday. (Click Here For Full Report).

Haryana Cotton Ginners Association Calls Meeting On Nov 4 To Discuss VAT Row

Haryana Cotton Ginners Association along with representatives of other industries, trade union will hold a state level joint meeting on November 4, 2015 in Hissar. (Click Here For Full Report).

Low Quality Cotton Supply Increases In Brazil; Prices Weaken

Cotton supply is high in the Brazilian market, especially for low qualities. Trades have been closed at slightly lower prices. Purchasers need to trade for prompt delivery and sellers, to make cash. Traders are active as they need to accomplish contracts. (Click Here For Full Report).

Govt. Willing To Extend Help & Financial Support For Reviving Sick Industrial Units: Anup Pujari

Government is willing to extend help and financial support to people who come up with an idea to revive industrial units that have turned sick, a top MSME Ministry official said at an ASSOCHAM event held in New Delhi today. (Click Here For Full Report).

Govt Extend Incentives To Boost Exports

Shocked by declining exports, the government has moved into action to alter the course and ensure there is no further pressure on balance of payment. The Central Government has decided to extend duty incentives to several products, including textiles and electronics to boost exports from the country. (Click Here For Full Report).

TEXPROCIL Welcomes Enlargement Of MEIS To Include More Products/Markets

The Cotton Textiles Exports Promotion Council (TEXPROCIL) has welcomed the inclusion of exports of cotton fabrics –both woven and knitted - and Madeups to leading markets including African countries under the Merchandise Exports from India Scheme (MEIS) vide Public Notice No. 44 dated October 29, 2015 issued by the Director General of Foreign Trade (DGFT). (Click Here For Full Report).

U.S Cotton Export Sales Declines 22% Vs Last Week

U.S cotton net upland sales totaling 76,100 RB for 2015/2016 were down 22 percent from the previous week and 38 percent from the prior 4-week average. (Click Here For Full Report)

TOP STORIES THROUGH THE WEEK

NCDEX FINAL SETTLEMENT

Final Settlement Prices Of NCDEX Contracts Expired On Oct 30, 2015

Shankar Kapas Price Settle At Rs 880.75/20Kg

PAKISTAN IMPOSED DUTY ON EIGHT DIFFERENT TYPES OF COTTON YARNS

Pakistan Federal Board of Revenue (FBR) has imposed 10 percent regulatory duty (RD) on eight different types of cotton yarns including woven fabrics of cotton from November 1, 2015. In this regard, the FBR has issued S.R.O.1055 (i)/2015 to amend S.R.O. 568(i)/2014, dated the June 26, 2014, here on Friday.

BULLISH-BEARISH FACTORS TO INFLUECE DOMESTIC COTTON MARKET

BULLISH FACTORS

Lower crop estimates in 2015-16

Hand to mouth mills cotton stock position

Slow domestic cotton supply, Particularly In North India

Exports demand may rise from Pakistan, Vietnam & Bangladesh

Indian prices cheaper in international markets

Increased consumption due rising spindleage capacities as lots of new mills comping up

BEARISH FACTORS

High unsold stock with CCI as well big merchants

Recession in world economies so less immediate demand for textiles products

Huge Chinese stocks

Slow global consumption

Liquidity pressure in cotton complex

Power/electricity problems

Very slow domestic off takes in yarn and fabrics

Most importantly textile products became last priority for consumers as major portion of disposable income is spend on daily living and on online showings of electronics so very less left over for garment and textiles

WORLD COTTON CONTRACT LAUNCHES SUNDAY

US cotton stands to lose its place as the sole pricing bellwether for cotton around the world with the launch of a new global cotton futures contract next week.

The new contract, which will trade under the symbol WCT, begins trading on the ice futures U.S. exchange at 9 PM Sunday alongside the U/S. "Cotton No. 2" contract, a physically settled contract for US origin cotton that has long provided the only hedging option for cotton traders.

Demand for the contract's launch is indicative of the US cotton industry's dwindling role in the world cotton market. While the US is still the world's top exporter of the fiber, India, Brazil and Australia have emerged as significant competitors in recent years investing in production while fewer US farmers plant cotton.

INDIAN TEXTILE AND GARMENT FIRMS MAY SHIFT BASE TO VIETNAM

Indian textile and garment companies facing duty disadvantage at home, some have already prompted to expand outside India in recent years. Moreover, with the recently negotiated trans-pacific partnership (TPP), some more the Indian companies may shift their base to Vietnam to grab the advantage of duty-free access to us and other TPP markets, like they did some years ago to Bangladesh to take the benefit of duty in exports as well as low labour costs, according to analysts.

There are some other players, while recognizing potential threat from Vietnam chose to await the full text of the TPP, expected to be released next month.

MADHYA PRADESH DECLARES DROUGHT IN 35 DISTRICTS

Madhya Pradesh has declared 35 out of 51 districts in the state as drought affected and sought an initial central assistance of Rs.2,400 crore, indicating deepening rural distress.

Karnataka, Maharashtra and Odisha have already declared parts of their state as drought affected.

Madhya Pradesh Finance Minister Jayant Malaiya and agriculture minister Gouri Shankar Bisen met union finance minister Arun Jaitley on Monday evening and briefed him on the situation.

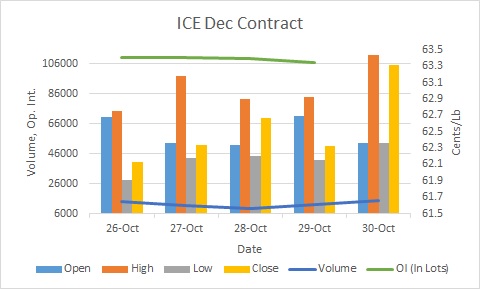

ICE COTTON UPDATE DURING WEEK

ICE Cotton during the week posted marginal gain this week compared with a week earlier supported by concerns about cotton crop due to recent rains in major growing regions. Rainfall continued in Texas and North Carolina during the week, which has raised concern among market participants about the crop loss, however a major chunk of traders were uncertain and waiting for clear picture. Rains persisted in West Texas, the top U.S. producing region, were seen leaving the crop susceptible to quality damage and prompting concerns about yield loss with more rain forecast for next week.

However recent U.S crop progress was better than expectation as it showed that U.S cotton harvest progressed to 42 percent, up from 31 percent a week ago, but down from 43 percent a year ago.

Boll opening was recorded at 95 percent, while 47 percent of crop was in good to excellent conditions.

On the other hand, the U.S. Commodity Futures Trading Commission (CFTC) data released this Friday suggests that speculators cut net long positions by 2,673 contracts to 36,134 in week to October 27.

OUTLOOK FOR NEXT WEEK:

Cotton prices may trade steady to easy in the near with thin activity in the market ahead of holidays for Diwali. Arrivals in the domestic markets is unlikely to rise in the coming days amid festival mood. However activity may increase after the festival as many mills are desperate to build stocks as crop numbers for current year seems to lower than the industry projection. But any sharp rise in cotton prices will be capped to slow business in cotton yarn.

(By Commoditiescontrol Bureau; +91-22-40015533)