MUMBAI (Commoditiescontrol) - Domestic cotton prices were seen moving upside on major spot markets for most of the sessions during the week ending 18th July, 2015. Prices of S-6 cotton in Gujarat witnessed gain of Rs 500 to trade in the range of Rs 35,000-35,500/candy. Similarly, J-34 cotton prices surged up Rs 30/maund to end the week between Rs 3,790-3,810/maund.

.jpg)

CCI Sale Ignites Positive Sentiment

One of the major reasons that fueled positive sentiment among market participants is the sale of cotton by Cotton Corporation of India (CCI). Tracking the aggressive selling by the government procurement agency in the midst of increasing demand, cotton prices were gradually raised in physical markets too. CCI sold 3,42,400 bales of cotton during the week from 5,21,000 bales offered from its stockpile. It increased floor prices by Rs 300/candy, while bid prices were raised by Rs 300-700/candy across various centres.

The major buyers of cotton released by the agency remained textile mills, traders and big corporates. CCI sold largest qualities in Maharashtra, Telangana and Gujarat.

.jpg)

Limited Unsold Stocks Pull Buyers

Another chief reason for growing appetite for the fibre in the domestic markets is limited unsold stocks of cotton with traders and stockists. According to market sources, an unsold stock of around 7-7.50 lakh bales of cotton is left with traders throughout the country. Topping it up, the quality of cotton left with them is of inferior/medium quality.

Weather Concerns Back Prices

Besides, prolonged dry weather conditions in major growing regions across the country have led to speculations with regards to serious impact on already sown crop, resulting in re-sowing in many cotton belts. This has raised likeliness of delayed arrival of the next crop in markets. Going by the market talks, new crop may not reach market yards before 15th September, 2015. Fears of serious crop damage in Gujarat has loomed due to absence of rainfall. The condition is this bad that it is facing a drought like situation now. Monsoon rains have given a miss to most of the central and western parts of the country for over 20 days. Cotton crop sown so far in the growing areas of the state has started wilting and dying. Temperature has increased by 3 degree celcius due to dry conditions prevailing throughout Rajasthan, Gujarat, Maharashtra, Karnataka and parts of Andhra Pradesh. Few farmers in these regions have tubewells, but then such a long break in seasonal rains does not look good, traders noted.

In many growing regions, soil moisture needs a serious boost to avoid a serious possible lose to production. In its previous estimate, the Indian Meteorological Department (IMD) had predicted less than normal rainfall in July and during August.

Tight Sellers’ Position Creates Unavailability Of The Fibre

Furthermore, taking opportunity of the rising demand from domestic buyers, most of the sellers chose to stay sidelined and hold liquidating their stocks. They anticipate further rise in demand in the days to come, and release their cotton when prices appreciate further.

Exports Of Cotton & Cotton Yarn

As per data received from the Ministry of Commerce, India exported around 79,327 (170 kg each) bales of cotton between 29th June - 5th July, 2015. Exports to China, the leading cotton consumer in the world, were seen at around 27,632 bales. However, in the period between 6-12 July, 2015, India exported just 3,479 bales of cotton to China.

At cotton yarn exports front, India exported around 26.6 million kg of cotton yarn to international markets between 29th June-5th July. China imported around 15.5 million kg during the period. Same has reduced to 13.3 million kg between 6th July-12th July.

With China releasing its massive cotton stockpile, export demand prospects looks largely shady now. There are concerns looming in the already distressed markets the world over. The Indian Cotton Federation (ICF) fears that exports are unlikely to see significant growth this year as Chinese demand would remain muted. In the 2014-15 season that started in October 2014, the cotton supply situation is likely to remain the same as in the 2013-14 season, noted ICF.

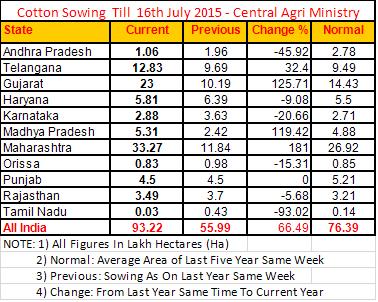

Sowing Of Cotton 74 Percent Completed

Cotton growers in all the major growing regions in the country have displayed enhanced willingness to plant cotton this year. Till 16th July, 2015, cotton sowing was nearly 74 percent completed in many cotton growing belts, according to the Union Agriculture Ministry. The soft commodity was sown in around 93.22 lakh hectares till 16th July, 2015. Though, the country witnessed a record crop last year from an area of 127 lakh hectares. However, this figure was of the entire cotton season.

Below is the state-wise cotton sowing data as on 17th July, 2015

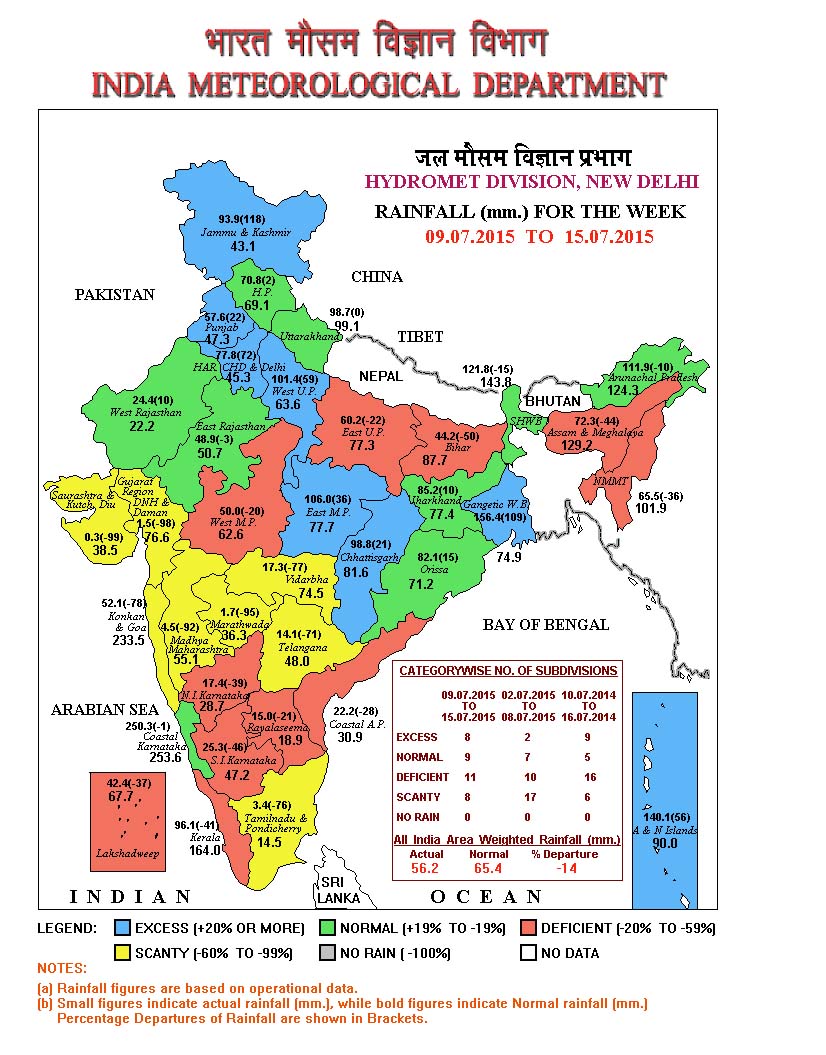

Weekly Weather Roundup

During the week, few portions of Punjab, Haryana, Vidarbha and Telangana continued to receive good rains. Few districts of north Karnataka also observed rains. However, most places in Gujarat and Marathwada remained dry, with rainfall playing hide and seek with the farmers. Rainfall was below normal by 14 percent over the country as a whole during the week.

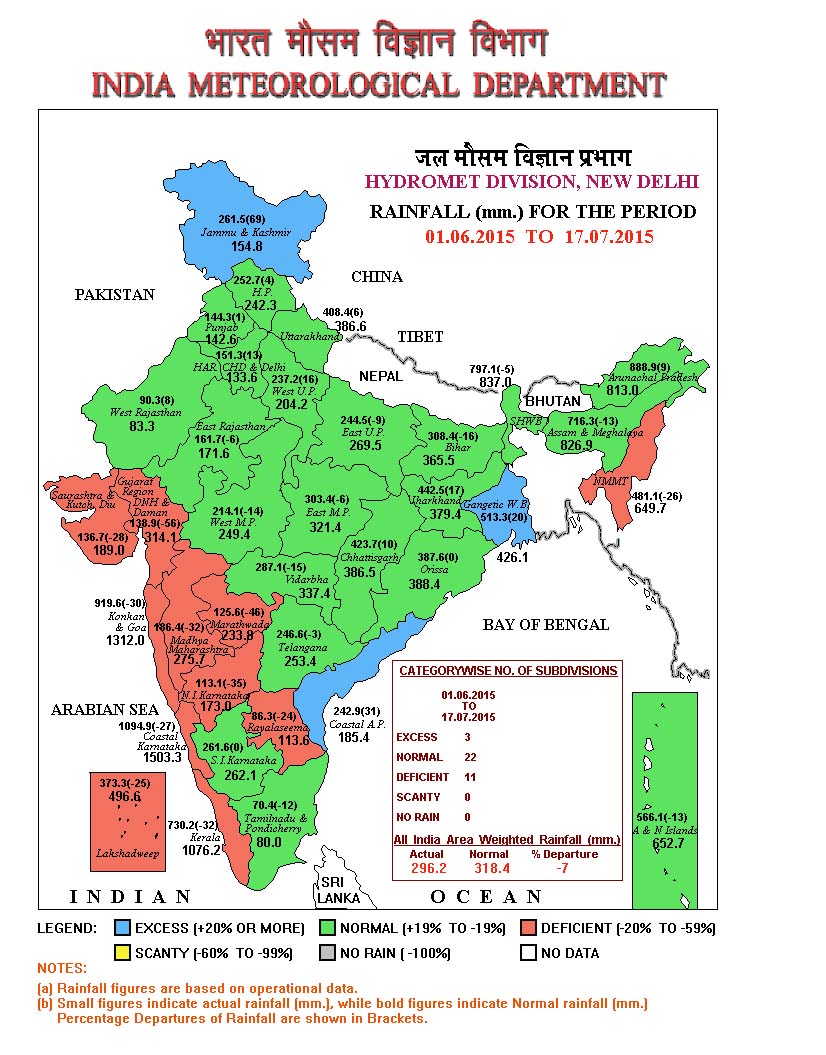

Rainfall Scenario (01 June to 15 July, 2015)

For the country as a whole, cumulative rainfall during this year’s monsoon has so far upto 15 July been 06% below the Long Period Average (LPA). Rainfall activity was near normal in all the broad homogeneous regions of India.

Forecast For Next Week

Rains would continue over Punjab, Haryana, at few places over Vidarbha and Telangana; whereas Marathwada, Gujarat and Karnataka would also experience light rains during second half of the week. The sufficient moisture over Punjab, Haryana and northwest Rajasthan has benefited cotton crop.

Special Coverage Throughout The Week

DGFT Extends MEIS Rewards For Textile Exports

The Directorate General Of Foreign Trade (DGFT) has amended Table 1 (containing list of country groups) and Table 2 (containing ITC (HS) code wide list of products with reward rates) of Appendix 3B under the Merchandise Exports from India Scheme (MEIS) through public notice numbers 27 and 28.

(Click Here To Read The Full Story)

Cotton Imports By China Drop Nearly 26 Percent In June

China imported 161,800 tons of cotton in June, down 26 percent from last year, according to industry body Reinhart. The Switzerland-based firm attributed the slump to high international prices and a lack of quotas for shipments curbed appetite for overseas purchases, according to China customs data.

(Click Here To Read The Full Story)

China’s Textile, Garment Exports Fall 8.79% In June

China’s textile and apparel exports fell 8.79 percent to $233.92 billion in June, 2015, according to China customs data. While, exports of textile yarn, fabrics and related products saw an increase of 2.25 percent to $94.68 billion, exports of clothing and accessories fell 3.09 percent to $158.81 billion in the month.

(Click Here To Read The Full Story)

Brazilian Cotton Prices Remain Firm Amid Slow Supply

Cotton prices in Brazil stayed firm in Brazil in the week ended July 6-13, according to the CEPEA. Slow cotton supplies and buyers needing to trade is pushing quotes up in the first fortnight of July. In the upcoming weeks, advance of harvesting should make cotton farmers turn their attention to accomplish delivery cotton from contracts.

(Click Here To Read The Full Story)

U.S. Cotton Crop Condition Maintained At 57% Good/Excellent

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ending 12th July, 2015, maintained the U.S. cotton crop condition at 57 percent good/excellent, same as the last week. Crop has been rated 35 percent fair.

(Click Here To Read The Full Story)

Dry-Spell Threatens 23 Lakh Ha Sowed Farmland In Maharashtra, Calls For Urgent Steps

Marathwada and Vidarbha, two prominent regions in Maharashtra's Soybean and Cotton farming, are witnessing severe drought like conditions. If urgent steps are not taken, making available water or an artificial rainfall, that would force the farmers to consider re-sowing besides damaging their financial condition. Farmers are all eyes to heaven, praying for rain-gods to shower mercy upon them. However, the state government has initiated steps of artificial rains by second week of August if the conditions persists.

(Click Here To Read The Full Story)

Stock Position At Exchange Warehouses

Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses reduced 9,500 bales to 48,600 bales as on 16th July, 2015 from 58,100 bales on 11th July, 2015.

Weekly Technical Update

MCX Cotton Bales Weekly: Further Rise Is Above 16300

(Price are in INR (Rs)/Bales)

Traders by chance long and holding the same need to maintain the stop loss at 15430. The DRV is flat and horizontal which suggest sideways price movement as last week follow up rise was not seen. Traders can buy above 16300 with low of the week as the stop loss or 15890 whichever is higher. Lower range of 15797-15607 can be for accumulation. Downside momentum can resume below 15430.

For Full Story: CLICK HERE

NCDEX Kapas April’16 Weekly: Sideways Correction Being Witnessed

(Price are in INR (Rs)/20 Kg)

Traders long can hold the same with a stop loss of 890. The movement for last few weeks has been between 927 and 903. Further rally can be seen above 927. Resistance is at 915-920-927. Lower range is 907-895. Sideways correction currently is being witnessed. Accumulate at 907-895 with a stop loss of 890. Buy above 930 with low of the week as the stop loss or 903 whichever is lower.

For Full Story: CLICK HERE

NCDEX CoC Weekly July: Further Rise Is Above 1957

(Price in Rs/Quintal)

Traders long can keep the stop loss at 1910. The stop loss is revised up to 1910 as doji star is being witnessed which suggest momentary halt to the rise for minor correction before moving higher. Alternatively, if immediate rise above 1957 is witnessed with bullish candle rally continues with momentum. Further rise can continue above 1957. Correction down to 1885 or below can be used for accumulation with a stop loss of 1840.

For Full Story: CLICK HERE

U.S. Market Through The Week

Benchmark cotton futures on ICE witnessed weekly loss of 0.4 percent, dipping to their third weekly loss in range-bound trade pressured by gains in the U.S dollar and worries about long-term demand. Other hand, ICE cotton speculators cut net long position by 775 contracts to 46,110 in week to July 14.

USDA released weekly exports sales on Thursday that suggests export sales for the 2014-15 crop totalled 51,200 running bales, up 69 percent from the prior week. Shipments fell 36 percent week-over-week to 136,200 bales.

The greenback touched April highs, capping fiber's gains throughout the session as it makes dollar-traded commodities more expensive to holders of other currencies.

China has sold less than 10 percent of cotton on offer from state reserves, confirming expectations of poor demand.

.jpg)

TOP STORIES THROUGH THE WEEK

China Receives Lukewarm Response At State Reserve Cotton Sale

China sold 8.78 percent of cotton on offer from its state reserves after the first week of sales, confirming expectations of poor demand. Beijing is aiming to sell as much as 1 million tonnes of fibre from state stocks by the end of August as part of a plan to gradually reduce its bulging reserves.

But with plenty of commercial inventory still available in the market, and the state auction prices relatively high, mills have held back from bidding. After selling almost a third of the offer on the first day of sales, selling slumped to as little as 2 percent of the volume on offer later in the week. Total volumes sold to date are 23,551 tonnes. Mills were mainly interested in the cheapest crop, the 2011 domestic cotton. None of the 2012 domestic cotton has been sold, and only limited quantities of imported fibre attracted buyers early in the week.

Govt Of Egypt May Step Back From Cotton Import Ban

The Govt Of Egypt Is Likely To Cancel The Minister of Agriculture’s Decision To Ban Import Of Cotton, As Per Official At The Ministry of Industry. It Is Likely That The Government Is Fearing That Importers, Especially In The European Union, Would In Return Apply Restrictions On Egyptian Goods. Sources Added That The Decision Was Taken Single handedly By The Minister. Producers Of Textiles And Garments Have Objected To It. But then, the decision was reversed later on, according to a Cabinet statement. The Cabinet has permitted imports of cotton for this year. Meantime, Egypt’s Prime Minister has requested a study on the country’s cotton policy.

Pakistan Textile Sector’s Share In World Market Drops 1.8% In Last 5 Years

Pakistan’s textile sector’s share in world market drops 1.8 percent in the last 5 years. The industry remained at a disadvantage position with respect to energy supply, input cost, subsidies, machinery import and value addition as compared to other regional competitors. Pakistan compound growth rate textile and apparel export from 2005 to 2013 stood at 3.6 percent, India at 11.3 percent, while Bangladesh's at 16.2 percent. Pakistan was the only country in the region which did not provide taxation subsidies, interest rate support in investment, zero rating on exports, capital support, cluster development schemes and long-term policy supports, according to a letter written to Prime Minister and Finance Minister.

Indian Textile Exports Highly Vulnerable To Greek Crisis

Jayant Sinha, Minister of State for Finance, India says that indian textile exports are highly vulnerable to the ongoing Greek crisis. The Eurozone constitutes almost 48 percent of Indian textile export market and constitutes 60 percent of the leather export market. And hence any decline in the Euro will certainly worsen the situation, says Sinha. In the past five months, Indian exports from this sector to European markets has fallen by 10-15 percent, as per Federation of Indian Export Organisations.

Indian, Pakistan Textile Sector Concern Over Greek Crisis

Greek debt crisis has worried Indian and Pakistan textile sectors with regards to exports. Depreciating Euro against the US Dollar and the Indian Rupee, the textile sector fears that exports to Eurozone will be badly hit. The Eurozone constitutes almost 48 percent of the Indian textile export market and constitutes 60 percent of the leather export market.

Greece Offered Third Bailout

Eurozone leaders have unanimously decided to offer greece a third bailout and keep it in the Euro Zone after 17 hours of talks. The Move has removed an immediate threat that Greece could collapse financially and leave the Euro.

Slow Demand In Yarn Hits Textile Mills

Textile mills in the southern regions have been suffering since the last 6 months due to slow movement in yarn, said the South India Spinners Association. Also, mills were unable to repay the bank loans and would be forced to shut down if the situation remains the same. The textile units in the region also had to pay higher value added tax (5 percent) compared to central sales tax (2 percent). Hence, yarn that was made in other states and sold here was priced lower than the yarn made by the mills in the state. The number of mills that used polyester fibre was on the increase.

Stable Outlook For Indian Textile Sector: India Ratings

India Ratings and Research maintained an overall stable outlook for the cotton textile sector for 2015-16. Stable profit margins in cotton yarn segment, range-bound cotton prices, favourable domestic and export demand for downstream fabrics and apparel would help the sector. But, the agency has rated cotton yarn outlook negative due to a slowdown in demand for yarn particularly from China. Oversupply of cotton and cotton yarn over 2015-16 coupled with lower average crude prices could also cause the price of polyester fibres to decline, the agency said. Apparel exports could continue to show a positive growth trend in 2015-16, Ratings Agency said.

Zimbabwean Textile Manufacturers Seek Ban On Chinese Imports

Cheap Chinese imports have hit local markets in Zimbabwe. Imports of low priced Chinese goods have had a negative impact on local clothing industry in Zimbabwe. Textile manufacturers in the country want tariff codes that carry 10 percent duty to be aligned with the tariffs codes that carry duty of 40 percent.

Bangladesh Cuts Cash Subsidy On Textiles Exports

The government of Bangladesh on Tuesday announced a list of 14 exportable products that would receive cash subsidy in 2015-16. Cash subsidy on textiles exports has been reduced, as per government officials. Exporters will receive cash subsidy on the products against net repatriation of the FOB (Free-on-board) prices from July 01, 2015 to June 30, 2016. Also, small and medium industries in textiles sector and export-oriented local textile industries was reduced slightly.

Mali Hopeful To Achieve 650,000 Tons Cotton Target

Mali is hopeful to achieve 650,000 tons cotton target in 2015-16 due to heavy rains in the West African country. The country produced nearly 550,000 tons of raw cotton in the 2014-2015 season. But, there were concerns of probable loss in output in June due to lack of rain.

Spinning Mills In Tamil Nadu To Close On Weekends

Textile spinning mills which produce blended yarn are set to shut their units during weekends in the backdrop of mounting losses and falling prices. This decision was taken at a meeting of the managing directors of nearby 90 mills organised by Indian Texpreneurs' Federation (ITF). The units have been incurring losses of Rs 15-20 per kg (for yarn). The stoppage of production during the weekends would result in a 25-30 percent reduction in output, which mills hope would be able to reverse the continuing fall in prices.

ICE To Launch World Cotton Futures Contract Later This Year

ICE on Tuesday said that it will launch world cotton futures contract later this year. The U.S. Congress passed a bill on 9th July that will allow U.S. Exchanges to handle foreign-grown cotton at delivery points around the world. ICE futures U.S. President Ben Jackson called that move a common sense solution that will improve the ability of cotton market participants to hedge in a global market. However, the proposal still needs to be signed by President Barack Obama.

China Hopeful Of Achieving 2015 Growth Target - China Stats Bureau

China is confident of achieving 2015 full-year growth target, according to China's Statistics Bureau. The Bureau said that stable stock market vital for stabilisation of economy. It said China’s overall debt levels are under control. The Bureau added that China GDP revision in line with international norms and that it will not affect growth trend in 2015.

Vietnam’s Textile Exports Reach $12 Mln In First Six Months Of This Fiscal

Vietnam’s textile exports since the beginning of the year reached $12 million, for growth of 9 per cent compared to the same period last year, according to Vietnam Textile & Apparel Association (VITAS). But, this is the lowest growth recorded in the last three years, it added. The textile industry has faced many difficulties this year, with smaller orders coming from regular markets such as Japan and the EU. The reasons behind the smaller orders include an increase in the VND-USD exchange rate as well the economic crisis in Greece, which is affecting the EU economy.

India May Not Meet Garment Export Target

Virender Uppal, Chairman of Apparel Exports Promotion Council (AEPC) said that India may find it difficult to meet garment export target in 2015-16 unless govt provides adequate policy support. Government of India set clothing export target at $18.70 billion for the current fiscal, eyeing a growth of 11 percent from the actual level of 2014-15. The country’s garment exports touched $16.85 billion in the last fiscal, up 12.2% from a year before. India’s overall textile and garment exports grew roughly 5 percent in the last fiscal to $41.4 billion from a year before. With demand from crisis-ridden Europe, which accounts for almost 41 percent of the country’s garment exports, remaining tepid and the chances of a free-trade agreement with the EU in the current fiscal still remotes.

India’s Trade Deficit Widens To $10.83 Billion In June

India’s trade deficit in June widened to $10.83 billion from $10.41 a month earlier, according to a statement of the Federal government. The gap was at $11.76 billion in the same month a year earlier. Merchandise exports fell 15.82 percent from a year earlier to $22.29 billion in June. Imports declined 13.40 percent on year to $33.12 billions.

Missing Rainfall Threatens Cotton, Groundnut Crop In Gujarat

Cotton, groundnut crop in Gujarat require rainfall immediately now. Farmers here say that their crop has started wilting and dying. wells do not have water and if it does not rain, cotton and groundnut crop will die. With no significant rains expected for the next six days, farmers in Marathwada, Karnataka and Rajasthan, too, are concerned about weak rains during the crucial germination period. The state government is providing 10 hours of electricity to farmers for agricultural purposes and has also released water in canals. Cotton will be planted on 2.6 million hectares in Gujarat.

Water Storage Level In India Jumps 33 Percent Till Now

Water storage level across India jumped 33 percent till 16th July from a year earlier, as per a data compiled by Ministry of Water Resources. But it reduced over the benchmark 10-year average to 12 percent from as high as 45 percent until July 2 due to deficient rainfall in July. Monsoon rainfall lost intensity over the last few days to drop 6 percent from the long-period average (LPA) till 16th July. Water reserves across 91 reservoirs touched 51.62 billion cubic metres (BCM) so far, against 38.96 BCM a year earlier and the normal 10-year average of 46.20 BCM.

Govt Issues Advisory To Tackle Erratic Weather

Government of India has issued a region-wise advisory to farmers on how to tackle erratic weather. Madhya Maharashtra and Marathwada regions received 30 percent and 44 percent less-than-normal monsoon rains, respectively. The government advisory suggested the application of protective irrigation like drip or sprinkle to early-sown crops like soybean, cotton, red gram and jowar in view of prevailing water stress condition.

OUTLOOK FOR NEXT WEEK (Cotton)

If the forecast by IMD is proved right, cotton prices will come under pressure if it rains next week. If the dry spell continues, we see prices moving sideways as China’s reserve sale would restrict any major movement in markets. Market participants may opt to stay sidelined and watch China’s sale pattern.

Further, mills have large inventory of yarn and demand in grey market is gloom at the moment. Also, exports demand in cotton remains insignificant. If CCI brings its base prices down, cotton prices on spot markets may see some correction. Therefore, all these factors would check rise in prices.

OUTLOOK (CoC & COTTON SEED)

Prices of cottonseed oilcake (CoC) and cotton seed are also expected to trade positive in the next week due to lower cotton seed stocks compared to last year. In fact, prices of seed and khal are constantly moving upside from the last couple of days, gaining almost 4 percent, or Rs 50-70/100kg during the course of this week. The Cotton Advisory Board (CAB) had revised its production estimate for cotton seed to 390 lakh bales from its earlier estimate of 400 lakh bales for 2014-15. However, if we look at the daily arrivals of cotton, i.e., 4,000-5,000 bales, it would be difficult to reach the estimate set by CAB by the end of the season.

(By Commoditiescontrol Bureau; +91-22-40015534)