MUMBAI (Commoditiescontrol) - Domestic cotton prices witnessed steady to easy trend during the week ending 13th June, 2015 as seesaw trend persisted in major markets throughout the country.

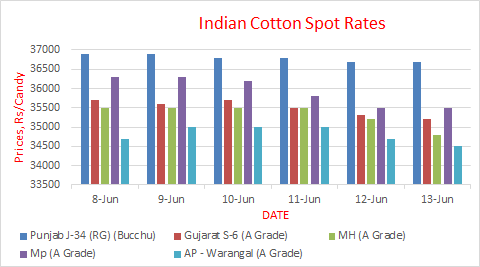

The fibre commenced the week on a steady tone and continued to trade flat for about two-three sessions in the backdrop of last week’s bearish close. Then on, the prices moved downward due to various local and global cues. Prices in north India traded in the range of Rs 3,850-3,875/maund (37.3kg each) (A-Grade), and S-6 cotton (A-Grade) in Gujarat traded in the range of Rs 35,200-35,700/candy (356kg each).

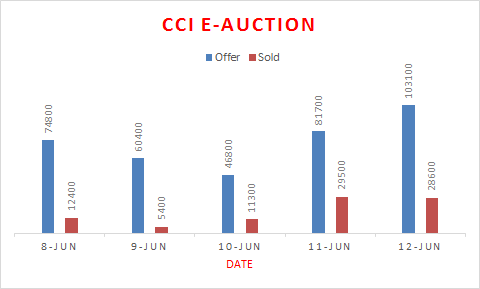

One of the main reasons that dampened market sentiments is the Cotton Corporation of India’s (CCI) selling policy. The government nodal agency cut its floor prices as per the demand. It reduced 300-900/candy in various centres at its E-auctions during the week. Many Indian spot markets experienced a dearth of buyers presence, especially north Indian markets, as the CCI reduced its floor prices in other regions. On the other hand, the agency did not reduce prices in north India. Therefore, market participants got diverted to those regions where the agency had reduced prices.

Fresh talks in markets that China, the leading consumer, would release about 8 million tonnes from its state reserves at discounted price, has discouraged sentiments in the domestic markets, and would certainly have a long-term impact the world over. Earlier, an announcement made by the state planner, NDRC, that China would soon release its massive stockpile, had already sent a negative signal to the markets. As it is, China’s decision to release limited imports quota this year had given a setback to export prospects of Indian cotton. But then, there were anticipations that the leading world cotton consumer could renew or extend its imports quota. This is after the International Cotton Advisory Committee (ICAC) estimates China’s cotton imports to decline 45 percent this year, the biggest year-over-year drop since 2007. The country attempts to pare down its strategic stockpiles built up after a worldwide shortage in 2011. Traders began shifting their focus towards India, which many estimates peg to surpass china next year in cotton production for the first time since 1963.

Furthermore, timely arrival and advancement of monsoon all over India is ensuring timely and healthy sowing of the next crop. Monsoon is progressing in a well manner despite the Indian Meteorological Department’s (IMD) predictions indicating towards weather system in Arabian Sea to intensify into a cyclonic storm, named ‘Ashobaa’.

The CCI had floated global tenders for exporting its cotton to Bangladesh on its website, media quoted CCI CMD B.K. Mishra. The corporation expects good response to the tender. The agency did not receive encouraging response from its tenders rolled out earlier because of price factor. The CCI quoted its cotton at 76-77 cents. The working price for exporters is 68-70 cents since the rupee value has increased to 62.15 from 62.70 against the U.S Dollar. Mr. B.K. Mishra said that the CCI is now reworking its pricing strategy for international buyers and may soon bring it down to 70 cents.

However, the downtrend in cotton prices looks very limited as cotton prices are already higher than what they were four or five months ago. Prices are likely to rise a bit in the months to come, media quoted Vardhaman Textiles. The company is of the opinion that for the next year, there are indications that area under cotton cultivation world over as well as in India will come down.

But, in India yields are likely to improve from the current levels. So the Indian crop is likely to be almost the same as this year and one possible advantage of a little lower monsoon is that cotton is a crop that requires less moisture. So the possibilities could be that the drop in area under cultivation for cotton may be less than earlier estimated. So we will wait and see. Managing Director of Vardhaman Textiles, Mr. Sachit Jain, says that there will be shortage of cotton in the country when the new season begin, from October and then November. So domestic buyers will be seen active as they have about one-and-a-half to two months stock of cotton average. But the prices may see some correction when markets start receiving heavy arrivals.

Also, the Cotton Association of India (CAI) had reduced its estimate on cotton crop for 2014-15 to 382.75 lakh bales (170kg each) from 384.50 lakh bales. Further, the association estimates India’s 2015-16 cotton acreage down 7 percent compared to 2014-15’s 13 million hectares, the most in over a decade. The U.S. Agriculture Department (USDA) has also cut its forecast for India’s cotton crop for 2014-15 to 29.6 million bales. Furthermore, Xinjiang has cut its cotton planting area to 319,500 hectares this year pursuant to figure by the end of May, as per local agricultural authorities. Continuously declining arrivals across the country is also supportive for prices. Total requirement of mills at present is close to 85,000-90,000 bales per day whereas markets are receiving supplies of around 15,000-20,000 bales per day. Private traders and farmers are left with meager quantity of cotton with them, which they do not want to sell at the moment on hopes of better returns later. The CCI also has been offering only 40,000 bales. Country’s total cotton arrivals as on 13th June, 2015 is estimated around 354.30 lakh bales till date compared to 376.83 lakh bales in the corresponding period last year. All these factors ensure that the prices may not see much downfall in the long-run and remain stable.

Stock Position At Exchange Warehouses

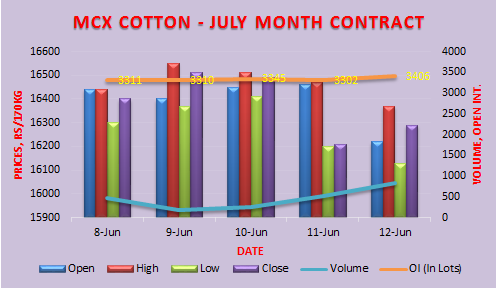

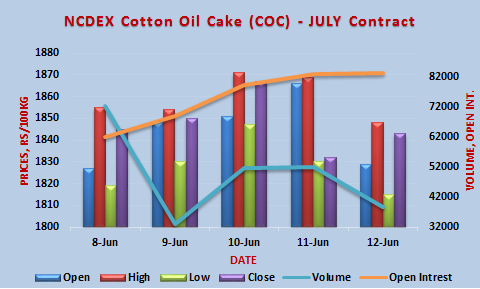

Cotton stocks at National Commodity and Derivatives Exchange (NCDEX) accredited warehouses remained unchanged at 300 bales as on 12th June, 2015. Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses reduced 4,600 bales to 93,000 as on 11th June, 2015 compared to 97,600 on 6th June, 2015.

NCDEX, MCX Weekly Update

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

.png)

NCDEX CoC Weekly Technical Update. Click Here

U.S. Market Through The Week

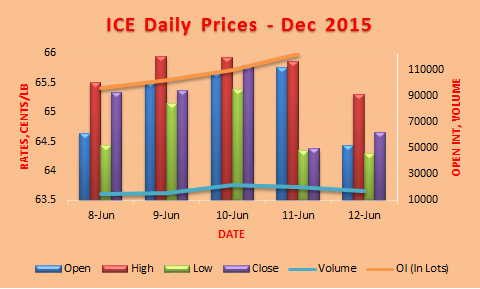

ICE cotton futures managed to close the week with marginal gains that ended on 12th June, 2015 supported by forecast of lower beginning and ending stocks in India during 2014-15. However, the gain was capped by poor weekly export sales, weak crude and reports that China will sell cotton from its state reserve.

The most-active December cotton on ICE exchange closed the week with gain of 0.16 percent to 64.66 cents per pound.

According to the USDA, weekly sales report released on Thursday showed U.S net sales of 43,500 bales of cotton from the 2014-15 crop year last week, down from the previous week, though exports of 312,100 bales were up from the previous week and the prior four-week average.

Market rumors have swirled for weeks that Beijing was preparing to release some of its holdings, which have swelled to around 10 million tonnes - more than 40 percent of world stocks under a now-abandoned state buying scheme to support farmers. China, the world's top consumer of the fiber, would issue detailed sale plans in the next 10 days, Yin Jian, an official at the National Development and Reform Commission (NDRC) told an industry conference.

Meanwhile U.S. Commodity Futures Trading Commission’s weekly report showed that speculators have raised net long position by 7,174 contracts to 21,882 in week to 9th June. However, a week earlier they have cut net long position by 6,700 contracts to 14,708.

Also, USDA on Monday after market close released planting reports that suggest that 81 percent of cotton sowing was completed in U.S against 61 a week ago, while down from 89 percent of average 5-year. The report reveals that 7 percent of crop condition is poor, while rest 93 percent are in fair-good-excellent condition.

TOP STORIES THROUGH THE WEEK

CAI Cuts Forecast On Cotton Crop For 2014-15 To 382.75 Lakh Bales

CAI in its May estimate has further revised down its cotton crop estimate for the season 2014-15 beginning 1st October 2014 to 382.75 lakh bales (170kg each) from 384.50 lakh bales estimated a month ago. The projected Balance Sheet drawn by the CAI for the year 2014-15 estimates total cotton supply at 453.65 lakh bales, while domestic consumption is estimated at 310.00 lakh bales, thus leaving an available surplus of 143.65 lakh bales. Prediction of a below normal rainfall is a cause of concern but not a cause of panic, the association said.

CAI Sees India’s 2015-16 Cotton Acreage Down 7 Percent

The Cotton Association of India (CAI) estimates India’s cotton acreage down 7 percent in 2015-16 compared to 2014-15’s 13 million hectares, the most in over a decade, a media agency reported. The acreage will drop amid plunging prices and fears of a drought prompt farmers to switch to cultivating pulses. CAI President Mr. Dhiren Sheth said that lower output in India should help give legs to a recovery in global benchmark prices that have risen 13 percent from a five-year low of 57.05 cents/pound plumbed in January.

USDA Cuts India’s 2014-15 Cotton Output To 29.6 Mln Bales - USDA Attache

The USDA in its latest Attache report has reduced its estimates on India’s 2014-15 cotton output to 29.6 million bales (480 lb each) from earlier 30.5 million forecast earlier, from harvested area of 12.9 million bales. 2014-15 export estimate has been revised to 4 million bales from 3.9 million bales. The agriculture department has kept import estimates unchanged at 1.1 million bales. USDA estimates country’s beginning stocks at 11.1 million bales against previous estimate of 11.6 million bales. Country’s total cotton supply is seen at 41.8 bales compared to 42.7 million bales. Season’s total domestic consumption is estimated unchanged at 24.5 million bales, while ending stocks are estimated at 13.3 million bales compared to 14.3 million bales. Estimations on MY 2015-16 cotton harvested area remains unchanged from USDA’s official forecast of 12 million bales. Production is forecast marginally lower at 29.3 million bales from 29.5 million bales on reduced yields due to delayed sowing, weather, and price realization vis-a-vis other crops. Cotton planting in the north has reached 0.88 million hectares. Planting in northern states of Punjab and Haryana is slower by 19 percent and 6 percent respectively, compared to last year.

USDA Cuts Forecast On World Cotton Output, Ending Stocks For 2015-16 - WASDE

The USDA has raised production, use and trade of cotton for 2015-16 are all raised slightly. Ending stocks are lowered. The U.S. season-average farm price is projected at 60 cents/pound, with the mid-point slightly lower than the current season estimate. For 2014-15, world production and ending stocks are reduced. World trade is raised on somewhat higher expected Chinese imports, while use is raised slightly. Forecasts for U.S. production and exports for 2014-15 are unchanged. The forecast for the U.S. season-average farm price is increased to 60.5 cents/pound. USDA has revised world cotton trade outlook for 2015-16 according to which Benin’s exports are likely to rise 75,000 bales to 650,000 on large exportable supplies. Also, Turkey’s imports are expected to increase 100,000 bales to 3.7 million on tight supplies.

FICCI Wants CCI To Release Adequate Cotton

The Federation of Indian Chambers of Commerce and Industry (FICCI) has sought urgent intervention of govt in adequate release of cotton procured by the CCI. Cotton prices in India have increased during the last few weeks amid supply crunch. Total requirement of mills is close to 85,000-90,000 bales per day whereas CCI has been offering only 40,000 bales per day. But then, the CCI is unable to sell all of the cotton put up of auction because of excessively high prices. Of 85.8 lakh bales of cotton procured by CCI in the current season, it has till date sold only 10.8 lakh bales, and hence it is carrying stocks of 75 lakh bales. In states like Andhra Pradesh, Telangana and Maharashtra, CCI has bought large quantities through MSP operations, creating a shortage of cotton in these states. Local mills are forced to buy cotton from distant places, incurring additional transportation and other costs.

Xinjiang Reduces Cotton Planting Area By Over 16 Percent

Xinjiang cut its cotton planting area by 319,500 hectares this year pursuant to figure by the end of May, as per local agricultural authorities. The planting area of cotton reduced to 1.658 million hectares, down 16.1 percent from 1.978 million hectares in 2014. Instead, 62,666 hectares of wheat, 74,000 hectares of corn, 15,263 hectares of vegetables, 21,333 hectares of melons and 142,000 hectares of specialty crops were planted. Xinjiang would have 60 percent national total planting area of cotton and generate 73 percent of the nation's total cotton output in 2015.

India May Have 60-70 Lakh Bales Cotton As Ending Stock - SIMA

India may have a comfortable cotton ending stock of around 60-70 lakh bales by the end of 2014-15 season, said the Southern India Mills’ Association (SIMA). This would ensure better stability in prices during the current calender year. Weak import demand for the indian cotton in the current season has resulted in larger ending stocks of around 70 lakh bales, highest ever carried by india after 2008-09, SIMA said. Meanwhile, the association has urged the central government to consider industry’s long pending demand of restructuring the Cotton Advisory Board (CAB) by inducting major stakeholders of cotton so that better strategy and policy could be adopted by the CCI. SIMA also expressed concerns over rumors that the government was again making attempts to have government to government (G2G) arrangement to export definite quantity of cotton to countries like China, Thailand, Bangladesh, Pakistan and Vietnam.

Synthetic Textiles Industry Seeks Excise Duty Removed

India’s synthetic textiles industry has urged the textiles ministry for a complete removal of excise duty and customs regime to be able to compete with Bangladesh, China and Vietnam. The industry said that high excise duty makes domestic produce expensive and imports cheaper. The industry says that imports of Rs 5,000 crore between April 2013 and February this year had depressed man-made fiber market.

Maharashtra Govt Cuts BT Cotton Seeds Prices

Maharashtra government directs seed companies selling varieties BT Bollguard 1 and 2 to cut prices by Rs 100. But, there will be no change in prices of non-BT hybrid cotton seeds, as per a government notification. Apart, as 40 companies did not comply with provisions of law, government has confiscated 30.26 lakh BT seed packets and cancelled 40 licences, State Agriculture Minister Eknath Khadse said. The state government had earlier appealed to BT cotton seeds producers to reduce prices by Rs 100 for 450 grams in view of the agrarian distress in the state.

Govt To Implement Crop Insurance On Cotton, Soya On A Pilot Basis

The central government is set to implement its weather-based crop insurance scheme on a pilot basis in Nagpur and Wardha districts. The scheme is learnt to cover two main cash crops, cotton and soyabean. These two districts will be part of 12 districts where the scheme is being implemented in the state, as per a government notification. In the notified area of the two districts, the scheme is compulsory for those availing institutional finance and voluntary for those not availing bank loans. The insurance premium rates are Rs 2,090 per hectare for cotton in Nagpur. Of this, farmers have to contribute only Rs 1,056 per ha. Similarly in Wardha, it is cotton Rs 2,486/Ha (Farmer pays Rs 1,245).

ICF Seeks Interest Rate For Textile Mills At 7 Percent

The Indian Cotton Federation (ICF) wants the govt and banks to keep interest rate for textile mills at 7 percent. ICF said textile mills need augmentation in financial limits to hold the crop to make the industry somewhat viable due to sluggish offtake of yarn and fabrics. Similarly, interest on cotton holding should be limited to 7 per cent for cotton growers, traders and govt agencies like CCI to boost the industry and trade, ICF Vice President K N Vishwanathan told media agencies. He said that this year more cotton stocks are lying with the CCI, rather than with domestic mills.

ICF Says Cotton Prices May Remain Stable

The ICF says that it does not see big fluctuations in cotton prices this season. The federation says that comfortable stock position, poor export demand, limited buying by domestic mills have helped keep prices under control. This year, due to lean buying by the mill sector, huge volumes have been purchased by the CCI. China has been a non-importer for some time and demand from domestic mills limited to their sale of yarn and fabrics. Farmers are happy with the MSP this year and will keep the area under cotton at the same level the next season, says ICF.

Telangana Prepares To Grow Dry Crops

Telangana government on Wednesday said that it is preparing to grow dry crops such as ragi and bajra in view of an impending drought in the backdrop of heat wave. The government is piling up stocks of millet, pulses, bajra, jowar and ragi seeds, and has conducted workshops with farmer bodies in all districts between May 26 and June 5. Monsoon has been delayed and if the IMD’s forecast of deficient rainfall turns out to be correct, cotton production will come down by half and paddy and other crops will suffer a lot. Weather experts said Telangana is vulnerable to extreme weather events such as unseasonal rains, severe heat waves and drought.

Telangana Announces New Industrial Policy

The government of Telangana announced its new industrial policy with much fanfare in Hyderabad on Friday. The key feature of the state's new industrial policy is its quick approval process mechanism. Called TS-iPASS (Telangana State Industrial Project Approval & Self Certification System), it is a self-certification process where an entrepreneur could go ahead and start his or her enterprise and simultaneously apply for clearances. The clearances would be given in about two weeks. In case they do not, then the project would be deemed to have been approved.

OUTLOOK FOR NEXT WEEK

We at commoditiescontrol.com see cotton prices moving sideways throughout the next week in the wake of enhanced sowing of the crop coupled with muted demand in yarn. Demand in yarn has slowed down significantly over the last few sessions. Also, talks of China releasing of its massive state stockpile will have its impact in cotton market for the next 15-20 days. Furthermore, the sale policy of the CCI would be a major determinant of any major movement in prices. The agency is sitting with an unsold stock of around 70 lakh bales.

Click here to read our last week's cotton report.

(By Commoditiescontrol Bureau; +91-22-40015534).