Ahmedabad, March 6 (CommoditiesControl): The arrival of cumin in Gujarat reached significant number today, with 75,000 bags arriving into mandis. The continuous rise in cumin supply has led to a consistent softening of prices, marking the third consecutive day of downward pressure on the market. Prices in the spot market experienced a decline of Rs 100 per 20 kg, further emphasizing the impact of the substantial arrivals.

In Unja alone, more than 42,000 bags of cumin (1 bag = 55 kg) arrived today, indicating a noteworthy increase. The continuous arrival of new cumin from Rajasthan has begun slowly in Unja, and reports suggest an anticipation of an increased crop yield in Rajasthan this year. Traders express concerns that if the influx from Rajasthan escalates in Gujarat, it could potentially impact prices. The market may experience downward pressure if purchasing activity does not match the rate of cumin arrivals.

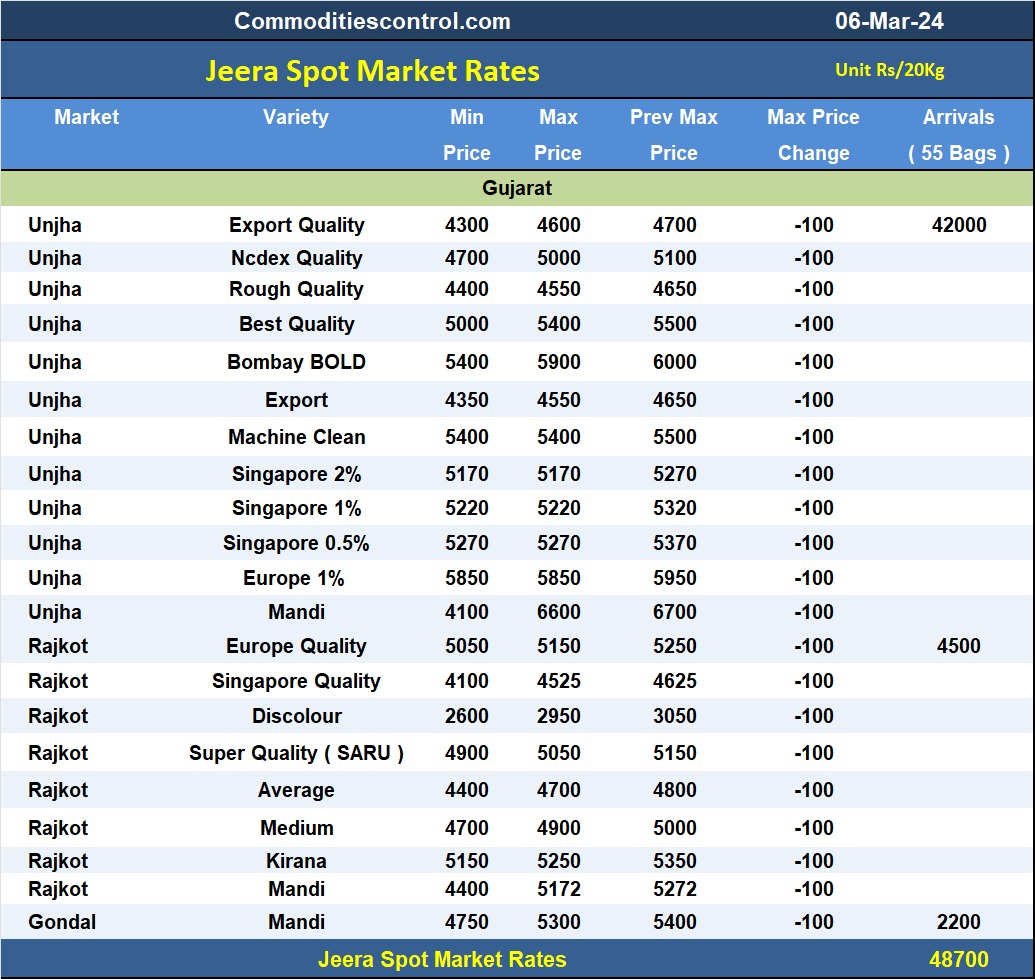

Traders reported that rough cumin in Unja was priced at Rs 4400-4550 per 20 kg, the best quality ranged from Rs 5000-5400 per 20 kg, and Bombay Bold was priced between Rs 5400-5900 per 20 kg. An additional 27,000 sacks were reported from nearby businesses. The overall cumin arrivals in the state today surpassed 75,000 bags.

In Rajkot mandi, approximately 4,500 bags of cumin arrived, with prices ranging from Rs 4400 to Rs 5172. Gondal Mandi reported an arrival of 2,200 bags, with prices today hovering between Rs 4750 and Rs 5300 per 20 kg, dependent on the quality.

Jeeraunjha contract for MAR delivery settled at Rs 26100/quintal showing an rise of Rs 665 over previous close of Rs 25435/quintal,The contract moved in the range of Rs 24910-26450 for the day. Open interest decreased by -270 MT to 1176 MT, while trading volume increased by 717 to 1101 MT.

Jeeraunjha contract for APR delivery settled at Rs 24695/quintal showing an rise of Rs 490 over previous close of Rs 24205/quintal,The contract moved in the range of Rs 23750-24900 for the day. Open interest increased by 132 MT to 2397 MT, while trading volume increased by 717 to 1308 MT.

Jeeraunjha contract for MAY delivery settled at Rs 24700/quintal showing an rise of Rs 860 over previous close of Rs 23840/quintal,The contract moved in the range of Rs 23400-24700 for the day. Open interest increased by 9 MT to 342 MT, while trading volume increased by 27 to 60 MT.

Currently The spread between MAR and APR contract is 1405 Rs/quintal

Currently The spread between APR and MAY contract is -5 Rs/quintal.

Currently The spread between MAR and MAY contract is 1400 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 06-Mar-2024, was NA MT

.jpeg)

(By Commoditiescontrol Bureau: +91 9820130172)