Mumbai, March 6 (CommoditiesControl): Turmeric prices in major markets showed signs of stability, with only Duggirala reporting a slight increase of Rs 100 per quintal. Spot market prices have steadied following a notable surge in the previous week. Support from domestic and export inquiries, coupled with lower output, has contributed to maintaining the current price levels.

Arrivals, however, witnessed a decline to 32,300 bags from the previous session's 38,700 bags. The closure of some markets in Maharashtra, coinciding with lower arrivals, played a role in the reduced supply. Nizamabad reported 11,000 bags, Erode 5,300 bags, Sangli 15,000 bags, and Nanded 700 bags. Market updates suggest that arrivals were 30-40% lower than anticipated, primarily due to a significant decrease in output.

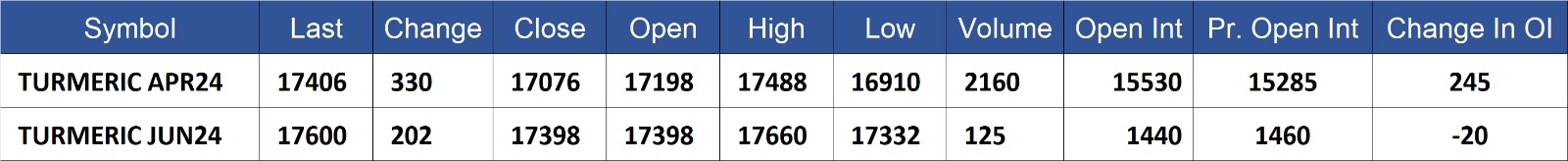

Turmeric futures prices on the NCDEX market exhibited a rebound, rising by 1-2% following a weak session and witnessing bargain buying activity. Notably, there was a 1.9% increase in April contracts and a 1.2% rise in June contracts. The anticipation of significantly lower arrivals, as farmers and village-level aggregators stockpile material in anticipation of higher prices later in the season, is a contributing factor to the upward momentum in futures prices.

NCDEX Spot and Future Prices:

- Spot Prices (RS/Qtl):

- Nizamabad - NCDEX Polished: 15,414

- Nizamabad - NCDEX Unpolished: 14,472

- Sangli - NCDEX Rajapore: 17,564

- Futures Prices (RS/Qtl):

- Apr-24: 17,406 (+330, +1.9%)

- Jun-24: 17,600 (+202, +1.2%)

.jpeg)

Turmeric contract for APR delivery settled at Rs 17406/quintal showing an rise of Rs 330 over previous close of Rs 17076/quintal,The contract moved in the range of Rs 16910-17488 for the day. Open interest increased by 245 MT to 15530 MT, while trading volume decreased by -90 to 2160 MT.

Turmeric contract for JUN delivery settled at Rs 17600/quintal showing an rise of Rs 202 over previous close of Rs 17398/quintal,The contract moved in the range of Rs 17332-17660 for the day. Open interest decreased by -20 MT to 1440 MT, while trading volume decreased by -50 to 125 MT.

Currently The spread between APR and JUN contract is -194 Rs/quintal.