MUMBAI (Commoditiescontrol) - Upsurge in maize prices at Gulab bagh mandi, a single notified market in Bihar, a key maize producing state where 30 percent of the rabi crop of maize is grown has been, consistently, witnessed and price observed at Gulab bagh has become the benchmark price of maize in the ongoing rabi season.

NCDEX polled prices show that the prices in Gulab bagh bottomed at around 1150/100kg (NCDEX) in second week of April 2016. Spot prices have gained by close to 6 percent since the bottom was formed.

Total acreage under rabi maize was slightly higher by 0.9% to 18.66 lakh hectares in 2015-16 against 18.49 lakh hectares sown during 2014-15, largely due to higher sowing in Bihar. Lack of soil moisture resulted in lower area in states like Andhra Pradesh, Telangana, Maharashtra and Karnataka and same problem has impacted the yields as well.

Industry estimates suggest that the total rabi production in current year could turn out to be 67 lakh tonnes, as against the government third advance estimate of 55 lakh tonnes. This is down from the final rabi crop estimate of 2014-15 crop at 71.6 lakh tonnes. Lower production in Andhra Pradesh, Telangana, Karnataka and Maharashtra is said to have compensated by higher productivity in Bihar and Tamil Nadu.

Trade analysts believe that rabi maize production in Bihar for current year could be up by 18-20 percent at around 23 lakh tonnes or more against 19 lakh tonnes produced during last year. Total maize production including the kharif crop is now estimated in the range of 18-22 million tonnes down by around 15% year on year. However, trade estimate is at 18 million tonnes while and 22 million tonnes is being projected by the government as well as USDA estimate.

Harvest of rabi crop this year has begun earlier than normal due to above average temperatures. As a result, the arrivals have been staggered. Due to very tight balance sheet, very high prices of other feed ingredients like barley, bajra, broken rice etc., ongoing Gram Panchayat elections in Bihar and some scattered rains since last one week or so, there has been a slowdown in farmers selling. Many believe that the arrivals will continue to remain selective this season as farmers’ holding will be strong. Maize remains one of the cheapest feed grain as of now.

While stockiest are interested in holding this feed grain but most of the warehouses at the ground remain empty due to slow selling by the farmers. There are also reports that some of the crop may have already moved out of the state by road and that relatively lower rake movement out of Bihar could be a misleading picture. The poultry margins are said to be very good and the end user is also keen on stocking this feed grain till the seasonality compels the prices to stay lower.

While there may not be unanimity on being the tightest balance sheet for Maize in India, it can be safely said that year 2015-16 is one of the tightest demand and supply years in recent years. The lower demand is a result of lower supply of this feed grain. Competing feed crops like barley and bajra are already quoting at all-time high. While NCDEX barley basis Jaipur is at around 1600/100kg, same source bajra is close to 1690/100kg. Green grass availability is at its minimal for the below normal monsoon for a second year in the row. Some other ingredients oilseed meal and cake, broken rice and feed grain wheat all have seen an uptick in prices and remain relatively expensive. Lack of availability in the feed complex will sustain the demand for it even at higher prices, and could result in very small carry forward stocks.

Very high prices at home and global prices still languishing at the bottom of the lower range established since October 2014, has presented a case for imports. But the fact that India does not allow imports of genetically modified food and feed has restricted the potential of quantity that can possibly be imported to meet the domestic deficit.

The next monsoon is expected to improve sharply and many crops would need to compete for acreage. Pulses, oilseed and grains are expected to see keen competition due to good current as well as expected prices. Maize is expected to attract good acreage due to relatively less weather sensitive crop, especially in context of pulses and oilseeds.

Global markets are also expected to trade range bound to firm in response to relatively bullish USDA report. However, sharp upside is unlikely for global prices of this grain. In the latest May 2016 USDA report, global corn production for 2016-17 is estimated at 1011 million tonnes against 968 million tonnes harvested during last year. This is up by 4.4 percent year on year and second highest ever. USA is expected to harvest record corn crop of 366 million tonnes.

Production in China is expected to be lower towards 218 million tonnes against 224.5 million tonnes of last year production. Global corn consumption is pegged at 43 million tonnes higher year on year. IGC (International Grain Council) has raised global corn (maize) production for 2016/17 to 998 million tonnes, up from a previous projection of 993 million tonnes and the prior season's 973 million tonnes. Excess supplies in global market coupled with projected higher production would keep corn prices under pressure for the coming month. This in turn would limit and export demand for Indian maize during current season.

Going forward the seasonal lows are probably already in place and the down side to the prices stay limited. Maize is expected to stay firm till the next season crops enters the market in October.

TECHNICAL ANALYSIS

NCDEX Maize c1 chart (Weekly)

While analyzing the weekly chart for Maize c1 futures on NCDEX Exchange, it is observed that the prices are trying to pull off from the recent lows in conjunction with the oversold territory.

An important higher bottom is likely in place at 1180 for the time-being and as long as this support holds, maize prices may try to recover towards 1346 – 1370 levels in coming weeks.

.png)

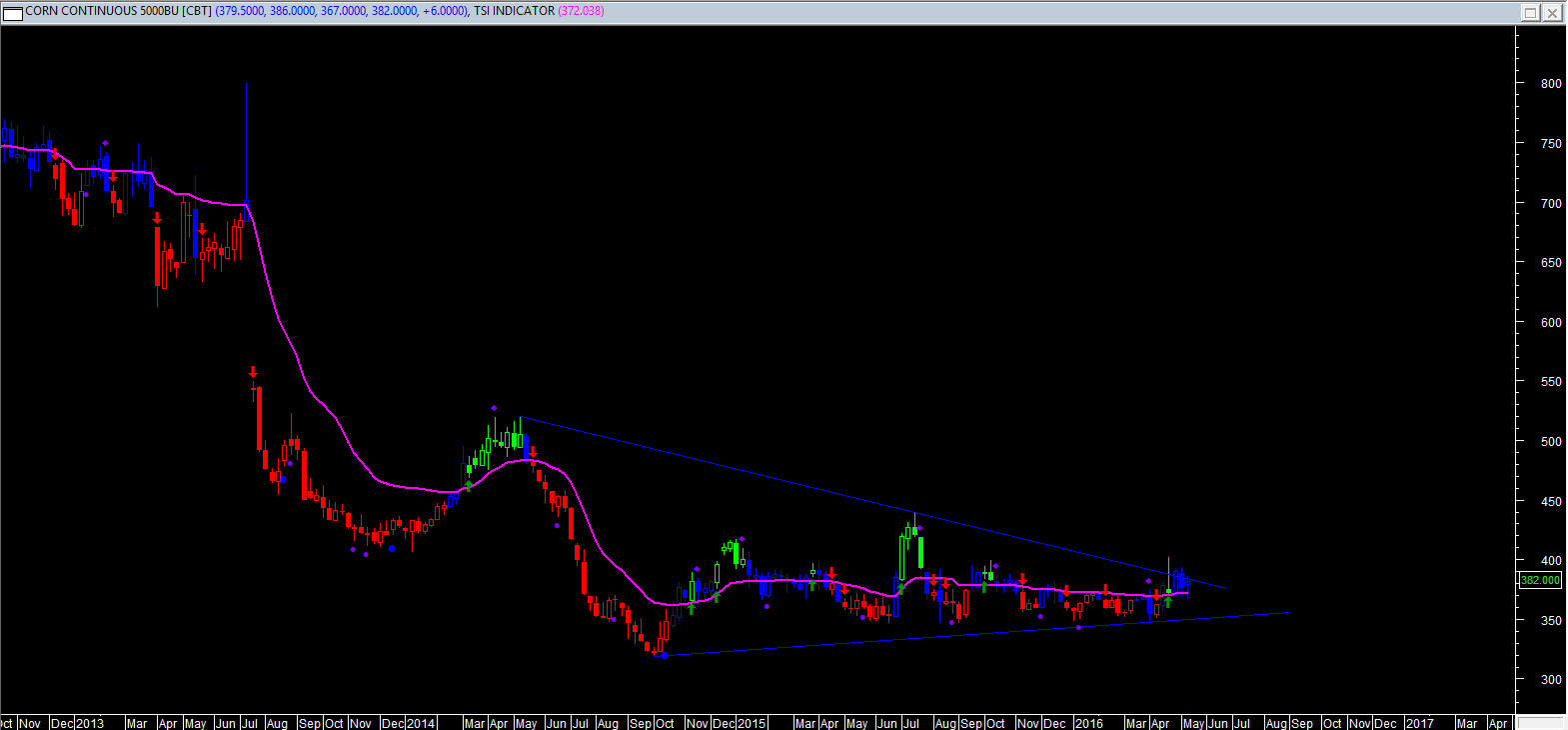

CBOT Corn c1 chart (Weekly)

Corn prices on CBOT have been trading range-bound in 347-402 Cents/bushels for last few weeks now.

The overall momentum is lacking a breakout of the range to have a decisive trend.

Crucial resistance is at 402 Cents/bushels and a sharp rise and close above it may favor long positions with higher levels of 418-438 Cents/bushels in sight.

However, support of 367 Cents/bushels should not be broken if above assessment has to come true.

So, basically it is a sideways momentum which needs a breakout above 402 or below 367 Cents/bushels levels to obtain a decisive trend.

(By Commoditiescontrol Bureau; +91-22-40015533)