MUMBAI (Commoditiescontrol) – Tur, Masoor along with White and Green Pea declined during the week ended Saturday (October 8-13) amid slackened millers trade activity as sale counter in processed pulses remained thin. While, Moong, Urad and Chana prices traded almost flat as per requirement.

Week Highlights

# CNBC Awaaz Reported That Govt May Lift Restriction On Urad/Tur Futures Trade. Proposal Likely To Be Sent To SEBI Next Week.

# Imports At Tuticorin Port (MT) Sept 18 Vs Sept 17. Chana: 1468 Vs 6275, Masoor: 2703 Vs 931, Moong: 4504 Vs 512, Matar: 3767 Vs 31194, Tur: 99 Vs 270, Urad: 717 Vs 100, Others: 342 Vs 1538, Total: 13599 Vs 40820.

# Maharashtra Agri Dept Kharif Crop Est (LT) Vs 2017-18. Tur: 10.56 Vs 10.72, Urad: 1.40 Vs 1.77, Moong: 1.44 Vs 1.64.

# Maharashtra Govt Extends Registration Date For Procurement Of Urad/Moong To Oct 24 From Oct 9. Moong/Urad Procurement Will Start From Oct 11 At MSP. So Far Around 6183 Farmers Registered For Mung & 8851 For Urad.

# SEBI Allows Foreign Entities To Hedge Commodity Exposure Via Derivatives.

# NCDEX In Circular Said That Chana Options Trade Will Start From Oct 9 & It Will Attract Special Margin Of 20% On Short Side Of All Running Contract & Yet To Be Launched.

.jpg)

Burma Lemon Tur:

Tur Lemon variety of Burma origin remained weak by Rs 25 to Rs 3,300/100Kg at Mumbai amid sluggish enquiries from mills despite cheaper prices. Overall sentiments are still bearish due to supply from overseas at cheaper prices. Sufficient stock of domestic tur is still lying with government to cater consumption demand ahead for three months before arrivals of new crop.

On the other hand in Mumbai, Mozambique origin red and white tur traded flat each at Rs 3,100/100Kg and Rs 3,325, respectively.

Domestic tur in bilty trade at Akola fell by Rs 50 at Rs 3,750-3,775/100Kg.

Meanwhile, millers instead of buying pulses from spot market are preferring to buy raw material from Nafed, which is available at competitive rates as Nafed is consistently liquidating tur below MSP.

Demand and sales counters in Tur dal remained slow as per requirement. Latur origin Phatka variety ruled unchanged at Rs 5,600/100Kg for Mumbai delivery on sluggish trade activity.

Similarly, Khamgaon origin phatka variety at Rs 5,600/100Kg, Gujarat origin Wasat Phatka variety at Rs 6,000-6,300/100Kg and Jalna origin phatka variety at Rs 5,900/100Kg (Mumbai Delivery).

According to traders, “Immediate rain is required at some producing belts of domestic tur in Maharashtra (Marathwada) and Karnataka (Bijapur/Gulbarga) as growth of crop had been stopped due to heat. Yield will be get affected sharply if rain does not arrive on time.”

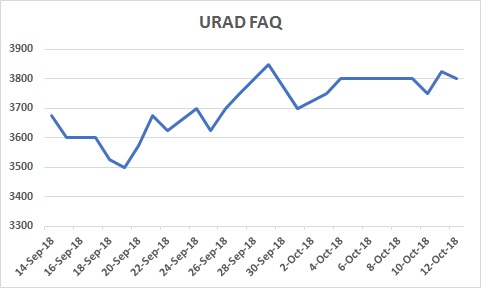

Burma Urad:

Burma Urad:

Burma urad FAQ variety remained steady at Rs 3,800/100Kg in Mumbai amid slow trade activity, ongoing arrivals and liquidation of procured stock by the government agency.

Similarly in Chennai, Urad FAQ/SQ new traded steady each at Rs 3,550100Kg and Rs 4,500, respectively in ready delivery as per condition.

Meanwhile, the Madras High Court has given relief to the petitioner and further extended a stay order till October 22 against DGFT notification to restrict import.

Shipments from Burma lying at Chennai Port with around 600 containers are being cleared by customs department. Another 1,200 containers are expected to arrive soon at Chennai port.

Moreover, demand in processed Urad was reported to be thin from consumption centres. Bikaner origin branded Urad dal offered at Rs 5,100-5,400/100Kg for Mumbai delivery. Tiranga brand of Mumbai was at Rs 5,500/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 5,400/100Kg for Mumbai delivery.

The upcoming supply from Burma at cheaper rates and regular arrivals of new produce in major states are likely to make further pressure on prices.

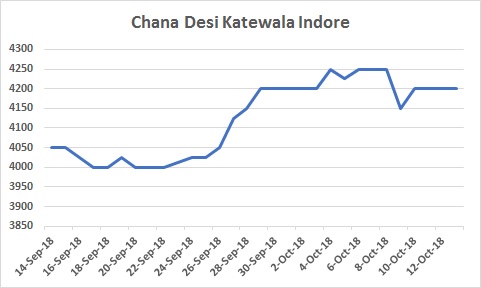

Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices traded lower by Rs 100 at Rs 4,100-4,125/100Kg amid slow millers demand as sale counter in processed chana/ besan remained limited. Nafed activeness in liquidating procured stock at existing prices also forced mills to remain cautious.

Prices are likely to get support at lower rates as monthly demand is expected ahead during festive period amid shortage in White Pea supply from overseas.

Matar is close substitute of chana and extension of import restrictions may also shift demand to chana to some extent.

Australia origin Chana in ready business at Mumbai and Mundra port remained unchanged each at Rs 4,175/100kg and Rs4,225-4,250, respectively. However quality of the pulse available in Mumbai for trade was reported to be average.

Burma origin chana traded flat at Rs 4,250/100Kg on millers' buying.

At National Commodity and Derivatives Exchange (NCDEX), Chana benchmark November contract settled lower 1 per cent or Rs 45 at Rs.4,163/100Kgs on Friday.

Chana stocks at NCDEX accredited warehouses stood at 32,674 metric tonnes (Akola: 31327, Bikaner 583, Jaipur 764) as on 12th October, similar from the previous session, the exchange data showed.

Australian chana dal traded at Rs 5,150/100 Kg for Mumbai delivery amid limited buying activity. Similarly, domestic chana dal of Pistol brand firm at Rs 5,350 for Mumbai delivery, Samrat brand at Rs 5,800 for Mumbai delivery, Angel brand at Rs 5,700 for Mumbai delivery. On other hand, Chana besan remained steady at Rs 3,100/50Kg, Vatana besan at Rs 2,961/50 Kg and Vatana dal at Rs 5,000.

In Mumbai, Sudan and Burma origin kabuli priced flat at Rs 4,250/100Kg and Rs 4,350, respectively amid limited buying support from besan flour millers and competitive prices as compared to chana & white pea.

Kabuli chana of 42-44 and 44-46 counts fell by Rs 300/100Kg at Indore market on the absence of local buying support.

Similarly, Kabuli Chana dollar variety also declined by Rs 300 at Rs.5,000-5,400/100Kgs as per quality at Indore.

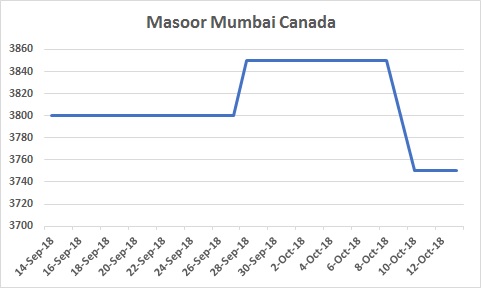

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor both Vessel and Containers along with Australia masoor in container declined by Rs 100/100Kg in Mumbai amid dull millers' buying support, average quality supply coupled with fresh shipments from Canada at Mumbai port and also as government has not yet increased duty on import of Masoor.

Moreover, selling of procured Masoor by Nafed in Madhya Pradesh pressurised sentiments. Demand in processed masoor remained also thin from consumption centres.

Canada crimson variety masoor in vessel and container each fell by Rs 100 to Rs 3,650-3,750/100Kg and Rs 3,800-3,950, respectively.

Similarly, MMTC were active in selling procured old Canada masoor stock at Rs 3,550/100Kg, down further by Rs 100 in Mumbai.

Australia masoor nugget variety also ruled weak by Rs 100 at Rs 4,000-4,100/100Kg as per quality against limited stock availability.

Demand in processed Masoor has reported slack from consumption centres. Canada Masoor Khopoli spot priced steady at Rs 4,950/100Kg.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira ports slipped by Rs 25/100Kg as per quality due to slackened trade at higher rates.

Canada White Pea traded at Rs 4,700/100Kg at Mumbai, Rs 4,521-4,551 at Mundra and Rs 4,550 at Hajira port. Russia origin Baltic variety quoted at Rs 4,500 in Mundra. Ukraine White Pea ruled at Rs 4,600 at Mumbai and at Rs 4,550 at Mundra and Hajira.

Millers and traders are still preferring to purchase domestic chana or Sudan/Burma origin kabuli chickpea due to cheaper prices as compared to white pea and also amid shortage of white pea ready stock.

Moreover, demand in matar dal/besan remained slow at prevailing rates. But, prices are likely to get support in the next few weeks amid ongoing festival season.

.jpg) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded flat at Rs 4,900-5,200/100Kg as per quality at Jaipur market amid slower arrivals.

Big farmers at major producing centres are bringing their produce slowly and in very low quantity at existing levels as government will start procurement soon at MSP. But, small farmers are not in a same position as they had already sold it.

Moreover, mills were seen active in purchasing superior quality new moong from markets or from government at cheaper rates on expectation of festive demand.

Demand and sale counters in processed moong remained limited at existing rates.

Moong dal prices also traded unchanged at Rs 6,300-6,400/100Kg depending on the variety.

Meanwhile, government agency has started procurement of moong at MSP of Rs 6,975/100Kg at Merta market of Rajasthan.

As per market talk, Nafed is likely to stop selling of old procured pulses stock soon.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai declined by Rs 300-400 at Rs 7,400/100Kg (cleaned) and Rs 7,300/100Kg (uncleaned) amid dull buying at higher rates despite shortage of ready stock and no supply pressure from overseas.

(By Commoditiescontrol Bureau; +91-22-40015513)