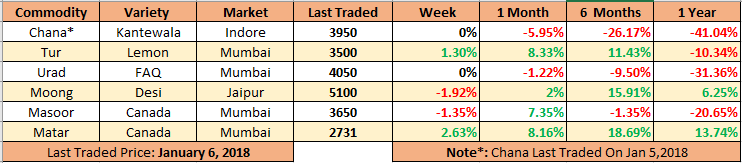

MUMBAI (Commoditiescontrol) – Tur, White Pea and Kabuli chickpea gained on buying support from millers and traders during the week ending on Saturday (Jan 1 - 6). While, Chana, Masoor and Moong declined due to absence of buying support, poor offtake in processed pulses. On other hand, Urad prices remained flat amid slow trade activity.

Week Highlights

# India's Rabi pulses sowing is up by 8 % as on January 5 to 154.91 lakh Ha vs 143.45 last year at the same period. Chana : 103.80 vs 92.13, Masoor : 17.04 vs 16.56, Field Pea : 9.49 vs 9.85, Urad: 6.93 vs 7.29, Moong : 4.20 vs 4.15,Other Pulses: 5.61 vs 5.70.

# Registration For Tur Procurement In Maharashtra Likely To Continue Till Jan 14. Tur Procurement Likely To Start From Jan 15 At MSP 5450.

# India Government Extends Mandatory Packaging Norms Under Jute Packaging Material Act 1987.The Approval Mandates 90% Of Foodgrains & 20% Of Sugar Products Shall Be Packed In Jute Bags.

# Maharashtra State Government To Sell Tur Dal To Malls & Supermarkets.

# Australian Exports In Dismay After Import Duty Tarrif On Masoor & Chana.

# Agri Minister: Government Procures 5LT Pulses From States In FY 2017-18 (Apr-Mar). Around 13 States Have Sent Proposal To Centre For Pulses Procurement.

# India Apr-Oct (Y/Y)Pulses Import Up 39.33% At 38.89 Lakh Tonnes.

Burma Lemon Tur:

Burma origin Tur Lemon variety gained by Rs.50 at Rs.3,900/100Kgs at Mumbai amid better millers and traders buying support. Arrivals of new domestic tur had not been increased as per expectation and are delayed on weather concern. The markets will witness full flow of new tur from January mid onwards (after Sankrant).

Procurement by government are expected to commence soon in Maharashtra and Karnataka. More purchase centres have opened up as harvest of tur has gained pace. Tur arrivals have begun in a slow way and farmers are holding onto their crop so that they don’t get into losses. Most of retailers/Wholesalers are buying as per need and are not stocking up. This year better step taken by government to support farmer by procuring new Tur through online registration, hiring private godowns, fast payment through RTGS. But, still most warehouses are occupied with inventories of old tur (kharif 2016-17).

.png)

Demand and trading activity for monthly counter in processed tur were reported limited at existing prices as per requirement from retailers/wholesalers as pipeline is empty.

Prices of processed Tur was traded firm on fresh buying activity. Maharashtra origin (Hinghanghat/Nagpur), tur dal old Phatka Sortex quality priced up Rs 50 at Rs 5,850/100 Kg, semi-Sortex at Rs 5,700 and regular at Rs 5,600.

Gujarat origin Wasat Phatka variety new traded at Rs 6,300-6,500/100Kg and old at Rs 5,900-6,000.

Latur origin new Phatka variety offered at Rs 6,150/100kg and old at Rs 6,000. Jalna origin new phatka variety priced at Rs 6,300-6,500/100Kg and no stock of old phatka were available.

As per market talk, increase arrivals in near future of new domestic tur from producing centers coupled with consumption demand in dal is shifted to green vegetables during winter season will limit the gains. Prices of tur likely to trade range bound or might dip by Rs 200-300/100Kg on arrivals pressure for short term period.

Burma Urad:

In Mumbai, Old and new crop of Burma Urad FAQ variety remained flat at Rs.4,050 and Rs.4,150 per quintal respectively on thin buying support from mills despite depleting stock of imported urad. Moreover, millers were purchasing domestic urad as they were getting superior quality stocks at cheaper rates.

Officials in the Department of Agriculture said that the Maharashtra state government has received an extension for the purchase of domestic urad at MSP (Rs 5,400/100Kg) from the Centre till January 12.

Demand in processed urad also reported slack from consumption centers at prevailing rates. But, prices are likely to get support at lower rates as demand may witness from North India due to winter season. Prices of urad seem to have found a floor now.

.png)

Bikaner origin branded Urad dal price offered Rs 5,000-5,200/100Kg. Tiranga brand of Mumbai at Rs 5,650/100Kg. Parivar brand of Jalgaon at Rs 5,400/100Kg.

At Chennai, Urad SQ ruled firm by Rs 50 to Rs 5,200/100Kg, but sellers were active in the market. On other hand, Urad FAQ variety quoted unchanged at Rs 4,300.

Statewise Rabi Urad Sowing Down 4.94 % As On Jan 3 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:2.95 Vs 3.34, Tamil Nadu:2.11 Vs 2.01, Odisha:1.63 Vs 1.58. Total:6.93 Vs 7.29.

Chana Kantewala (Indore):

In Indore market, Chana prices ruled unchanged at Rs 3,950/100Kg amid dull millers buying support due to lackluster sales counter in processed Chana, adequate stock, higher progressive sowing.

On other hand, Australia origin Chana at Mumbai and Mundra port drifted down by Rs 150-175 to Rs 4,000/100Kg and Rs 4,075 respectively following weak cues on futures.

At National Commodity and Derivatives Exchange (NCDEX) chana for March contract settled down by 0.5 per cent or Rs.18 at Rs.3,826/100Kgs. Earlier in the day, the contract had slid to Rs.3,805 and touched a high of Rs.3,863 per quintal respectively.

.png)

Analysts said the trend is down in Chana futures for January contract but a recovery cannot be ruled out at this stage. Cover short positions if any on dips to 4030 – 4000 levels or below as the opportunity arises. Wait for any fresh positions for the time-being.

Statewise Rabi Chana Sowing Up 12.67 % As On Jan 3 Vs Same Period Last Yr (LAKH HA). Maharashtra:18.07 Vs 17.74, Rajasthan:15.07 Vs 15.80, Karnataka:13.80 Vs 10.81, Madhya Pradesh:35.23 Vs 29.19, Uttar Pradesh:5.55 Vs 6.35, Telangana:0.95 Vs 1.11, Andhra Pradesh:4.99 Vs 3.41, Haryana:0.53 Vs 0.58. Total:103.80 Vs 92.13.

Australian chana dal offered steady at Rs 5,000/100 Kg due to negligible trade from wholesalers/retailers counters since alternate option of cheapest dal such as Matar dal is available.

Domestic chana dal of Maharashtra also ruled flat at Rs 5,200 and regular chana dal at Rs 5,000/100Kg. On other hand, Chana besan was offered firm by Rs 75 at Rs 3,400/50Kg. Vatana besan gained by Rs 40 at Rs 1,800/50 Kg and vatana dal at Rs 3,150, up Rs 100.

Kabuli Chana advanced by Rs 500/100Kg at Indore amid good trade activity and lower inflow. However, prices of commodity unlikely to sustain at higher level as supply of new crop from is likely to begin from mid-January.

Although government in recent had announced several measures, but prices failed to capitalize it due to weak fundamentals. Centre has raised 30% import duty on Chana. There is ample Chana availability in the country to meet domestic demand. Traders have been keeping an eye on the sowing progress and weather.

The government will have to go for procurement operations in case of chana also. But, government finding difficulties itself in tur procurement because of storage capacity despite tur crop size is much lower compare to chana crop size.

Imported Masoor (Mumbai):

Canada Crimson variety fell by Rs 50 to Rs 3,550-3,650/100Kg in Mumbai due to slow millers buying coupled with sufficient imported stock. Demand in processed Masoor was reported slack from consumption centers. Similarly, Australia nugget masoor declined by Rs 200 to Rs 3,700-3,800.

Rates of Canada Masoor dal of Bhiwandi mills were traded flat at Rs 4,600/100Kgs, for APMC Vashi market delivery on thin trade activity.

.png)

State-wise Rabi Masoor Sowing Up 2.90 % As On Jan 3 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:5.96 Vs 5.63, Uttar Pradesh:5.96 Vs 6.59, Bihar:2.13 Vs 2.10, West Bengal:1.46 Vs 1.09. Total:17.04 Vs 16.56.

Prices of Masoor likely to get support at lower rates as no supply pressure from overseas after government imposed 30% import duty and also selective number of importers and participants hold imported Masoor of good quality, which made them reluctant to sell inventories of Masoor at lower rates.

Imported White Pea (Mumbai):

Canada, Ukraine and Russia origin White Pea at Mumbai were gained by Rs 75-100 to Rs 2,731/100Kgs, 2,661 and Rs 2,641 respectively amid improved millers buying and also no supply pressure from overseas in break bulk vessel at Mumbai port after 50% duty imposed. Importers hold white pea inventory and were reluctant to sell at lower rates.

.png)

However, demand for processed Matar from consumption centers was reported good due to cheaper prices compare to processed chana.

State-wise Rabi Field Pea Sowing Down 3.65 % As On Jan 3 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:2.91 Vs 3.11, Uttar Pradesh:4.16 Vs 4.61, Jharkhand:0.51 Vs 0.30, Assam:0.37 Vs 0.31, Chhatisgarh:0.47 Vs 0.47.Total:9.49 Vs 9.85.

Moong (Jaipur):

Moong remained weak by Rs 100/100Kg in Jaipur market at Rs 5,100/100Kg during the last week on subdued buying support and sufficient availability of stock despite slow arrivals in major states.

Similarly, Moong dal prices priced lower by Rs 100 at Rs 6,200/100Kg.

State-wise Rabi Moong Sowing Up 1.2 % As On Jan 3 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:0.76 Vs 0.63, Tamil Nadu:0.47 Vs 0.53, Odisha:2.82 Vs 2.70. Total:4.20 Vs 4.15.

.png)

(By Commoditiescontrol Bureau; +91-22-40015513)