MUMBAI (Commoditiescontrol) - ICE sugar futures ended mixed on Friday, as raw sugar edged up while white sugar dropped marginally.

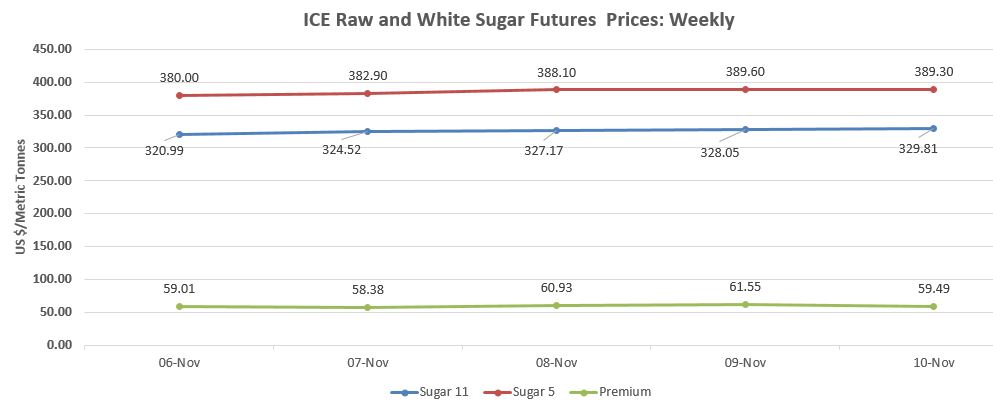

Raw and white sugar futures also closed firm during the trading week.

On Friday, ICE March raw sugar ended up with a marginal rise of 0.08 cents, or 0.54%, at 14.96 cents per pound, after hitting 14.99 cents, a highest level since August 2.

While raw sugar futures also closed up 4.03% week on week. Raw futures majorly surged over increased international oil prices, and expected drop in sugar output at Centre-South Brazil.

International oil prices jumped up and hit three-year high since July 2015 on Monday in past week. Oil prices increased over supply cuts by OPEC exporters as well as due to political tensions in Saudi Arabia. Whereas, demand remained stronger in global market.

On other hand, the Brazilian sugar mills continued to favour ethanol production due to better demand and attractive returns. Brazil is the world's biggest sugar producer as well as exporter.

In contrast to that, the production mix for sugar expected to remain lower during second half of October month in Centre-South Brazil, state the S&P Global Platts survey. According to the survey, Centre-South mills expected to have produced 17.21 lakh tonnes of sugar, with a sugar mix of 42.36%, down from 49.29% in the same period in last season.

It was also lesser from first half of October month. According to UNICA data, sugar mills used 43.76% of sugarcane to produce sugar during the first two-week period of October. And sugar production was 19.78 lakh tonnes.

Centre-South region contributes the 90% total sugarcane production of Brazil.

Additionally, domestic sugar prices in Brazil also became more competitive against the international rates. Although, local producers started supplying sugar in domestic markets besides of exporting it.

Crystal sugar on Friday closed higher by 8% during a week, at BRL 63.63 (US$19.41)/bag of 50Kg.

Further, recent rain in Brazil also hampered the sugarcane harvest in North-North East Brazil, which also helped the domestic as well as international sweetener prices.

On other hand, white sugar futures have rose 3.13 during a week, but slightly dropped on Friday. As, most active London March white sugar contract fell 30 cents, or 0.08%, and settled at $389.30 per tonne in previous session, while December white sugar ended up 50 cents, or 0.13%, at $396.20 a tonne on ICE Europe Exchange.

The December premium over March also rose at $6.90 in last session. The premium majorly increased ahead of December contract's expiry on November 15.

Demand for the white sugar increased due to tight nearby supplies, as new season's sugar will reach in market by next year only. While, there will be surplus supply from the European Union, and other major producers like Thailand, India, Pakistan etc in current season.

However, the EU sugar producers were hedging their produce against the March white sugar contract. Subsequent to which the marginal fall was witnessed in futures on Friday.

Sugar production in the EU is estimated to cross 200 lakh tonnes during current season 2017-18 (October-September), after the removal of quota regime.

On other hand, December/March white premium, or the price difference between the white and raw sugar slightly recovered in spot and traded at $66 per tonne in spot. The rise in white premium will improve the raw sugar demand from refineries.

However, international sugar futures prices may see further rally as Brazilian mills have continued to favour ethanol over sugar. And, the rally in global oil prices will also support sugar futures. As, OPEC countries are expected to extend supply cut, beyond the expiry in March 2018.

But still the international sugar futures will remain under supply pressure over the estimated higher sugar production of current season and expected surplus production in next season (2018-19) also.

According to the International Sugar Organization, global sugar production will reach upto 1792 lakh tonnes in the 2017-18, about 115 lakh tonnes higher from last season. While ISO also estimated the consumption at 1747 lakh tonnes.

Although, there will 43 lakh tonnes of surplus in global sugar industry in ongoing sugar season.

(By Commoditiescontrol Bureau: +91-22-40015532)