MUMBAI(Commoditiescontrol)- US cotton futures retraces 61.8% levels this week after preliminary estimates of Texas crop damage and quality degradation. Indian cotton market continued to witness sideways oscillation with bearish bias alive.

US MARKET:

The US cotton futures rode the bull with the benchmark December ending the week 3.73 cents/lb higher at 71.88 cents/lb as on Friday.

Prices breached the key resistance of 70 cents/lb during the week and now is challenging the next target of 72 cents/lb.

Estimates of nearly 0.5 million bales of Texas crop impacted after Storm Harvey made landfall on August 25 and possibilities of quality degradation has made the bears uncomfortable.

As of August 31, Open interest dropped nearly 5,000 contracts since August 22 amid 3.12 cents rise in price to 70.93 cents from 67.81 cents/lb indicating a clear sign of short covering since the news of Harvey of looming in the market.

Prices recovered all the losses it incurred after USDA’s WASDE report which put US cotton production forecast at 20.55 million bales, a 11 year high.

Taking into account, the damage of 0.5 million bales will bring the production forecast down to 20.05 million bales which still is a pretty high production figure. However, traders seem to be more worried about the shortage of high grade cotton to meet September and October shipment than the large production forecast.

The first phase of concern was evident on the spot prices of Texas region which is trading in backwardation since Aug 28. (Full Report)

Further, The storm is currently headed up the Mississippi river as a tropical depression, dumping at times heavy rain on the 4 million cotton bales in the upper Delta, which could lead to some boll rot.

.jpg) On the demand side, USDA weekly net export sales decreased 15.77 percent to 239,644 Running Bales(RB) for the week ended August 24 from previous week's 284,520 RB. Shipments were recorded at 158,144 RB during the week (Aug 18-24) which dropped 29 percent from previous week’s 222,877 RB.

On the demand side, USDA weekly net export sales decreased 15.77 percent to 239,644 Running Bales(RB) for the week ended August 24 from previous week's 284,520 RB. Shipments were recorded at 158,144 RB during the week (Aug 18-24) which dropped 29 percent from previous week’s 222,877 RB.

Total commitment for the 2017/18 MY reached 7.02 million 480lb bales(49.43%) of USDA’s forecast at 14.2 million 480lb bales of which 7.22 million 480lb bales(5%) have already been shipped.

The market is currently trending on concern of crop damage and quality degradation. Shippers have raised their offering basis quite considerably this week, which means that they don’t want to commit any additional premium grades until the situation becomes clearer.

Technically, the December futures is heading towards the 61.8% retracement levels at 71.88 cents/lb and the next key resistance is seen at 73.66 cents/lb with bullish bias.

CHINA MARKET:

.jpg) The ZCE cotton futures continued to extend sideways trend as price marginally increased week on week amid drop in open interest for the week ended September 1.

The ZCE cotton futures continued to extend sideways trend as price marginally increased week on week amid drop in open interest for the week ended September 1.

The benchmark January contract settled at 15,315 yuan/tonne on Friday, modestly gained 35 yuan/tonne over the week while open interest dropped 2 percent to 258,408 lots.

Prices continued to exhibit a sideways trend, closing in a tight range of 15,200-15,400 yuan/tonne with the intraday highs and lows trending between 15,000 to 15,500 yuan/tonne since August 4.

The market seems in a consolidation phase with immediate support at 15,150 yuan/tonne and resistance at 15,450 yuan/tonne.

Meanwhile, the state reserve auctioned a total of 146,247 tonnes from which it sold a total of 145,221 tonnes for the week ended September 1, recording the best weekly turnover at 99 percent since commencement.

State Reserve has sold around 2,687,611 tonnes (15.81 million 170kg bales) were sold from the total offered quantity of 3,805,636 tonnes (22.39 million 170kg bales).

INDIAN MARKET:

The Indian cotton futures exhibited a bullish trend for the second consecutive week tracking the uptrend on the ICE cotton futures market.

The benchmark October futures settled at 18,760/bale, higher nearly 1 percent or Rs 180 over the week and hitting more than 3 week high.

Open interest rose 2 percent to 2,302 lots(57,5520 bales of 170kg) suggesting new buying in the market.

Prices recovered most of the weekly losses incurred in the previous week(Aug 14-18) when October settled down Rs 360 to Rs 18,260/bale on August 18.

Strategy indicates to hold long and traders holding the same need to maintain the stop loss at 18,000. Further breakout and close above Rs 19,140 with a bullish candle can keep the uptrend rally alive next week.

Weaker opening and correction first to 18,620-18,450 can be used for buying with a stop loss of 18,000.

However, prices recovered to settle at Rs 18,760 with a bullish candle on the chart. Currently, we recommend accumulate with weekly resistance levels of 18,930and 19,140 could likely be tested while inter week support is seen between Rs 18,450-17,970.

.jpg)

DOMESTIC SPOT MARKET:

.jpg) Spot market witnessed as sideways trend with marginal movements in the weekly averages of benchmark spot prices during the week Aug 28-Sept 1.

Spot market witnessed as sideways trend with marginal movements in the weekly averages of benchmark spot prices during the week Aug 28-Sept 1.

The weekly average of benchmark Gujarat S6 cotton rose Rs 160 to Rs 43,020/candy while the Andhra Pradesh/Telangana dropped Rs 250/candy to a weekly average of Rs 44,500/candy.

Further, the market traded the entire week compared to previous two weeks where public holidays restricted trade to a maximum of 4 out 5 trading days as week, hence the weekly averages showed a mixed trend.

Trade activity was nothing boastful as spinning mills preferred to stay off trading ring mainly due to the on-going gloomy situation in the domestic yarn market.

The 2016/17 season for the textile sector could be ranked as the worst year with two big economic moves, Demonetization in November of 2016 and GST in July of 2017, hitting the trade activity. Gone are the days when traders and stockists in the yarn market used to procure to stock their inventories. Now they prefer to run their operations on a hand to mouth basis and offload their stock depending on immediate demand supply factors.

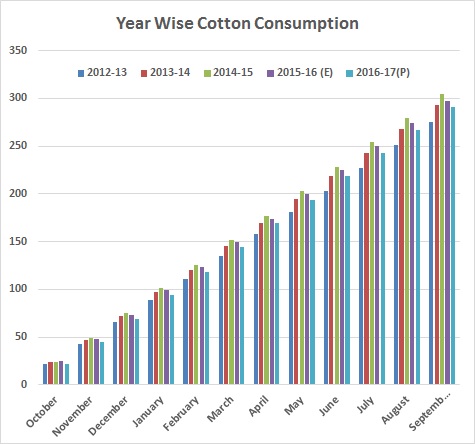

This is clearly evident in the ministry of textiles data as the cotton stock with spinning mills in the month of June, projected at 51.56 lakh bales(170kg each), which was the higest level since 2009-10 when cotton stock for the month of June was at 62.48 lakh bales. Further, monthly consumption in June projected at 24.7 lakh bales, hit a two year low compared to June of 2013/14 at 23.11 lakh bales. We expect a downward revision as more data is available for the remaining three months(July-Sept) of the cotton season 2016/17.

This is clearly evident in the ministry of textiles data as the cotton stock with spinning mills in the month of June, projected at 51.56 lakh bales(170kg each), which was the higest level since 2009-10 when cotton stock for the month of June was at 62.48 lakh bales. Further, monthly consumption in June projected at 24.7 lakh bales, hit a two year low compared to June of 2013/14 at 23.11 lakh bales. We expect a downward revision as more data is available for the remaining three months(July-Sept) of the cotton season 2016/17.

Taking the previous 5 year average for the remaining three months of missing data, the total consumption for 2016/17 is projected at 29.1 million bales which would be the lowest since 2012-13 season at 27.53 million bales.

A revival in the yarn market could interest spinners in procuring cotton bales however judging by the current scenario, the odds of that happening would be 50 percent of the possible 100 percent.

As previously mentioned, the months of August and September is known as the off season for cotton traders as most of them were in preparation to procure new cotton crop, with the first phase to hit North India in early September and progressing towards Central India, beginning from October, and South India, beginning from November. Cotton supply reaches full potential from end of October onwards across the country.

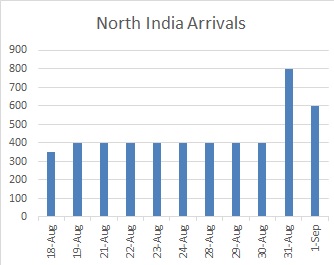

New crop supply has already commenced in Haryana with the total arrivals recorded at 4,950 bales to date(Aug 18-Sept 1), daily arrivals used to average at 400 bales until August 30 after which it picked up pace to reach 800 bales recorded on August 31 and 600 bales recorded on Sept 1.

New crop supply has already commenced in Haryana with the total arrivals recorded at 4,950 bales to date(Aug 18-Sept 1), daily arrivals used to average at 400 bales until August 30 after which it picked up pace to reach 800 bales recorded on August 31 and 600 bales recorded on Sept 1.

In North India, spinners were eager to procure new cotton with some small lots deals agreed as of Sept 1. However, major spinners preferred to hold their buying as high moisture content and rise in arrivals during September to likely weigh on spot price, kept them off trading ring. No takers were reported for old cotton stock in North India which was the reason for spot prices falling to 5 week low on Friday, Sept 1, ranging between Rs 4,385-4,400/maund(37.3kg each)(Rs 41,950-42,000/candy).

Meanwhile, the Ministry of Agriculture did not release the weekly cotton planting state wise report for the week ended Aug 31 except the total area figures which reached 119.88 lakh ha covering nearly 97.9 percent of total normal area at 122.46 lakh ha while remained ahead by 17.6 percent at 101.88 in 2016.

.jpg)

Further, the fear of poor yield due to lack of rains in Maharashtra has completely faded with the market lashed with good rains throughout August 15-30. New concerns were raised that if rains persisted throughout September then new crop supply could likely be delayed by 10-15 days. We do not disagree with the possibilities of crop being delayed however mother nature is always unpredictable hence we reserve our conclusion until mid-September.

We still keep our production forecast at 37.1 million bales with an average yield at 526 kg/ha(5 year avg) while market speculates figures to be north of 40 million bales with an average yield at 550 kg/ha.

Conclusion:

.jpg)

The price chart continued to show a sideways trend with prices now slightly tilting downwards however we have taken all superior varieties of cotton(30mm) as a benchmark for analysis. There maybe fluctuations in some lower grade varieties depending on the availability and demand.

The benchmark Gujarat S6(30mm) rose this week to an average of Rs 43,100/candy(85.92 cents/lb) as of September 1 with key resistance at Rs 44,000/candy(87.72 cents/lb).

With several factors in favor of the bears on a fundamental basis, prices has a potential to fall rather than witness major rise. Usually, cotton prices should be on an uptrend at the fag end of the season however all past bull rally efforts were demolished.

Historically, sellers prefer to either keep price at the same level or offload at higher rates depending on the demand potential. Hence, prices may either stay at same levels or may witness minor fluctuations around the 43,000/candy(85.72 cents/lb) levels until new crop/forward rates hit the market.

However, the market tested this sentiment in North India and when new arrivals hit the market along with forward rates, prices of old crop fell to a 5 week low with possibilities of further downfall. Hence, we are more inclined to a bearish side than the bulls.

MNCs forward quotations have already hit the market which is ranging between Rs 37,500-39,500/candy for the Gujarat S6 29mm variety for November delivery.

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015534)