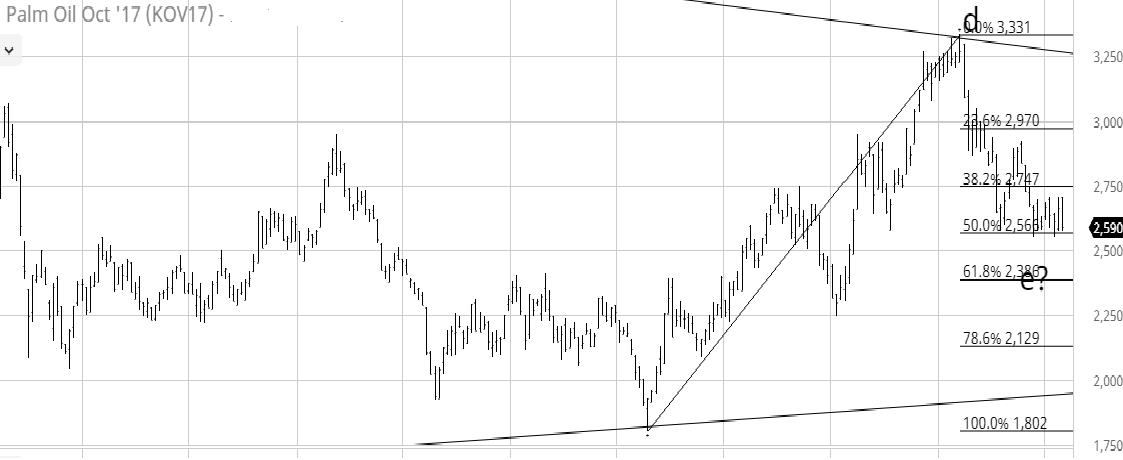

BMD Palm Oil Futures Long Term Outlook

Dated 05/08/2017

BMD FCPO C1 since 2002: Lower range could provide support for bottom

In the above chart which is from the year 2002 we can see a long term triangle pattern.

Correction for Wave e is in progress and may halt the slide at current level of 2590-2550 or at the demand zone of 2451-2249.

Wave d is from 1800 to 3335.

The 50% and 61.8% retracement level are placed at 2566 and 2638 and the same is shown in the second chart.

Resistance is at 2705.

A rise and close above 2705 can end the correction and upside movement may be restored.

In that case firstly, FCPO will test the Wave d top which is at 3335 in its due course of time depending if the breakout is witnessed. Secondly, can provide long term breakout for 61.8% of the largest leg of triangle that is Wave a.

Wave a is from 4298 to 1370.

It will be 61.8% of the range from 3335.

The rally can be substantial in super long term.

On the immediate ground, FCPO must find support at current level or at the demand zone. Subsequently must move above 2705 to test 3335. The picture to come into existence could take anywhere from 1 month to 3 months.

On the 6 months chart, trend is down and reversal can be caused on trading breakout and close above 2705. The close has to be with bullish candle.

Earlier on 6 month and 1 year chart, we have seen a breakout above 2564 to recent high of 2705.

Minor correction is being witnessed and will test 2564.

Support for near term can be expected at 2564 -2530-2494.

Minor correction trend is probably for a higher bottom at the above mentioned near term support.

For near term to short term correction to support could be opportunity to enter trading long as long as 2494 is not violated.

Conclusion

FCPO prices will be searching for bottom at current level or at 20 years demand zone of 2451-2249.

Long term investors can think that downside could be limited as Wave e is progress which could end now or at long term demand zone in near term to short term.

Reversal confirmation is on first breakout and close above 2705.