Mumbai, May 06 (Commoditiescontrol): During the week ending May 06th, 2023, prices of imported Tur from Burma and African origins continued to extend its gains. The price surge was driven by a combination of factors, including active need-based buying by mills attempting to meet their immediate requirements and a decline in overseas supply due to import disparities and low domestic stock levels among millers and traders resulting from lower domestic arrivals.

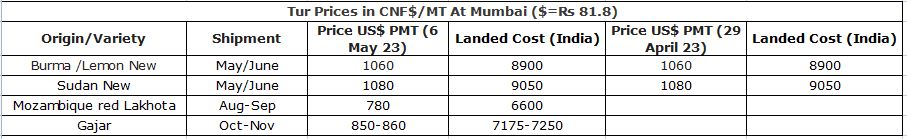

The forward deal for Tur Lemon's June delivery in Chennai was Rs 8,550, while for July and August deliveries, the prices were Rs 8,750 and Rs 8,950,respectively. Whereas Burma Lemon Tur is trading low in CNF Chennai terms, with a decline of $10-15 at $1040-$1045. Despite the weakness in CNF prices, there is still an import disparity compared to the spot price of Tur in Chennai, which is Rs 8,325 per 100/kg.

The price of desi Tur at the Akola market increased by Rs 125 during the week, reaching Rs 9,000-9,025/100 kg in Bilty trade. The rise in price can be attributed to the increasing demand for raw Tur from local and outstation mills, as there has been an uptick in offtake in Tur dal. Similarly, in Gulbarga's mandi trade, Tur prices have increased by Rs 100-200, and they now range between Rs 8,400-8,700/100 kg, depending on the quality.

During the week, the prices of Tur dal increased at Katni and Gulbarga markets, with domestically processed Tur dal made from the new crop Tur in both markets rising by Rs 200/quintal. In Akola, the price of Tur dal also increased by Rs 300/100kg.

Furthermore, there has been a surge in demand for Tur dal processed from Burma, Sudan, and Mozambique origin Tur, which led to a Rs 400/100Kg increase in their prices. However, Tur dal processed from African origin Tur is still available at a significant discount when compared to domestically processed Tur dal.

Prices of Sudan, Malawi and Mozambique (Gajiri-white variety) Tur, which are of African origin, have increased by Rs 50-300/100Kg due to depleting stock of Africa Tur and negligible supply from Sudan due to civil war.

Indian authorities have advised custom authorities at various ports in the country to do away with the Certificate of Origin in case of imports of Toor whole, chick peas and other pulses imported from Sudan, the African countries which in turmoil from civil war. High Commission in Sudan has informed about its inability to provide with the Certificate of Origin due to infighting.

.jpg)

News from Burma is not favourable either. As per reports from Burma traders, most of Tur's stock is in strong hands. They are not interested in liquidating it at the current price as they anticipate a further rise due to a shortfall in Indian production. However, considering current CNF prices for Chennai, there is a huge import disparity discouraging imports. Meanwhile, the Burmese kyat remained steady against the US dollar at 2,850 Kyat/dollar.

As per technical chart - Akola Desi Tur - Trending higher/Next Resistance at Rs 9,000. Click here

As per technical chart - Mumbai Lemon Tur - Trending higher / Next resistance at Rs 8,400. Click here

As per technical chart - Burma Tur (CNF $) - Trending higher / Next resistance at Rs $1,100. Click here

Trend: The price of Tur may experience a decline in the upcoming week due to multiple factors. First, higher rates and a liquidity crunch in the market could lead to decreased demand and price reductions. Second, Marketmen fear additional government intervention as its earlier step to enforce stock disclosure by market participants has failed to give desirable results. Hence they are doing need-based buying resulting in reduced demand, contributing to a decline in the price of Tur. Moreover, a gradual increase in ongoing arrivals of Moong, Chana, and Masoor in the market could gradually decrease their prices, causing a shift in demand from Tur to these other varieties. Additionally, seasonal trends could also play a role in the downward pressure on the price of Tur, as the shift in demand towards Mangoes during summer could lead to reduced demand for Tur and a drop in its price.

(By Commoditiescontrol Bureau: 09820130172)