March ’19 Veg oil Import up by – 26% on Y-o-Y Basis

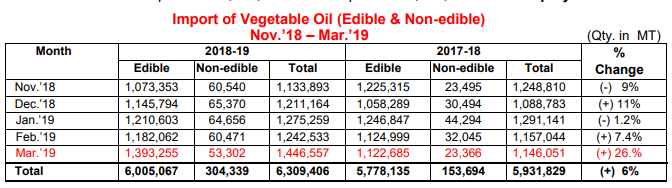

The Solvent Extractors’ Association of India has compiled the Import data of Vegetable Oils (edible & non-edible) for the month of March 2019. Import of vegetable oils during March 2019 sharply increased by 26% to 1,446,557 tons compared to 1,146,051 tons in March 2018, consisting 1,393,255 tons of edible oils and 53,302 tons of non-edible oils. The overall import of vegetable oils during November 2018 to March 2019 is reported at 6,309,406 tons compared to 5,931,829 tons during previous year i.e. up by 6%.

Sharp Increase in Import of RBD Palmolien

Ministry of Finance w.e.f. 1.1.2019 reduced import duty on palm oil and also reduced the duty difference between crude and palm oil from 10% to 5% on palmolein to be imported from Malaysia. As anticipated, worst fears have come true and India is flooded with RBD Palmolein from Malaysia. Reduction in duty difference between CPO and Palmolein sourced from Malaysia has resulted in RBD Palmolein imports going up from 130,000 tons in December 2018 to over 300,000 tons in March 2019.

This development has also the potential of sounding the death knell of Palm Refining Industry in India. This also has seriously impacted the prices of mustard seed and being currently quoted Rs. 700-800 per quintal below of MSP of Rs. 4,200 per quintal. Needless to mention Mustard harvest is nearly completed and arrivals in mandies are at peak level. This will have a huge negative impact on incomes of mustard farmers. This anomaly needs to be corrected. If this aberration is not rectified, the farmer will be greatly affected and discouraged, while domestic Palm Refineries would be destroyed and “Make in India” would remain a pipe dream. There is urgent need to create duty difference of 10% between CPO and RBD Palmolein as was prevailing before 1st January, 2019 to survive in this situation.

Stock Position at Port & in Pipeline

The stock of edible oils as on 1st April, 2019 at various ports is estimated at 970,000 tons (CPO 410,000 tons, RBD Palmolein 250,000 tons, Degummed Soybean Oil 140,000 tons and Crude Sunflower Oil 170,000 tons to and about 14,00,000 tons in pipelines. Total stock at ports and in pipelines is reported at 2,370,000 tons, increased by 175,000 tons from 2,195,000 tons as on 1st March, 2019. India’s monthly requirement is about 19.0 lakh tons and operate at 30 days stock against which currently holding stock over 23.70 lakh tons equal to 37 days requirements.

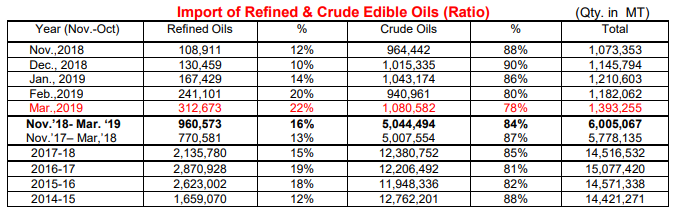

Import of Refined & Crude Oil Ratio:-

During Nov’18.-Mar.’19, Import of refined oil (RBD Palmolein) increased to 960,573 tons from 770,581 tons in same period of last year, however, Import of crude oil also marginally increased and reported at 5,044,494 tons from 5,007,554 tons during the same period of last year. During Nov.- Dec.’18, the share of RBD Palmolein was just 10 to 12%, where as now increased to 22%.

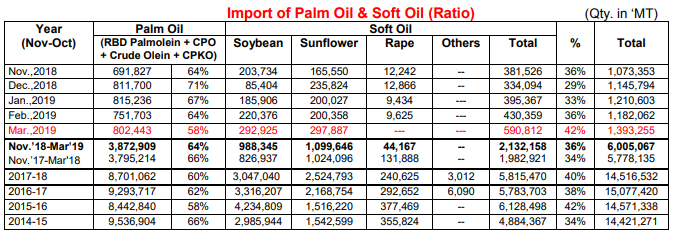

Import of Palm & Soft Oil Ratio : Favouring Palm Oil

During Nov.’18-Mar.’19, Palm Oil import has marginally increased to 3,872,909 tons from 3,795,214 tons during the same period of last year, however Soft Oils import jumped in Mar.’18 and total import increased to 2,132,158 tons from 1,982,921 tons during the same period of last year.

Import of Non-edible Oils

Import of Non-edible oils during March 2019 is reported at 53,302 tons compared to 23,366 tons in March 2018. The overall import of non-edible oils during Nov.18 to Mar.’19 is reported at 304,339 tons (almost doubled) compared to 153,694 tons during the same period last year i.e. up by 98%, thanks to Nil duty on P.F.A.D. and RBD Palm Stearin. P.F.A.D., C.P.S & RBD Palm Stearin are the major import of non-edible oils.