MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Moong, White Pea, Chana, Masoor, Green and White Pea extended gains for the second straight week ended Saturday (October 01-06) on improved millers' trade activity ahead of festive period.

Week Highlights

# SEBI Approves Option Trading In Four Commodities Soy Oil, Chana, Soybean and Guargum.

# Madhya Pradesh Government Reduces Mandi Fees From Rs 2/100Kg To Rs 1.50/100Kg.

Commodity Attracts Mandi Fees Of Rs 1.5 Or Below Will Remain Unchanged.

# India April To August Pulses Export Jumps At 144,608 MT Vs 66,687 MT Last Year.

# The Union Cabinet approved a Rs 220 per quintal hike in Chana MSP to Rs 4,620 and Rs 225 per quintal hike in Masoor MSP to Rs 4,475 for 2018-19 season.

# Maharashtra Government Urges Urad/Moong Farmers To Register Under NCDEX e-Market Portal By Oct 9 For Procurement. Government Will Also Procure Soybean, Registration Will Close Oct 31.

# RBI Keeps Repo Rate Unchanged At 6.5%. Rupee Hits New Record Low Of 74.12 On Friday.

# Madhya Pradesh Government Announces Bhavantar Yojana For Soybeann/Maize From Oct 20-Jan 19. Buy Urad,Mung,Sesame, Ground Nut & Ramtil At MSP From Oct 20-Jan 19. Tur Buying From Mar 1-May 30.

# India Government Revises Exchange Rate For Import/Export. Import: Rs 74.60/Dollar, Export: 72.90/Dollar, Effective From Oct 5.

.jpg)

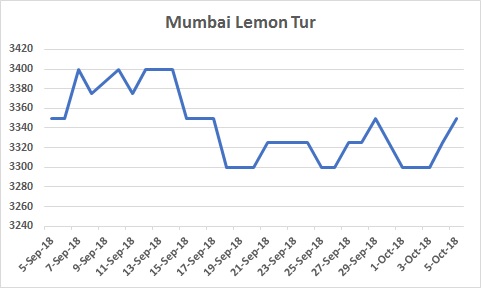

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained by Rs 50 to Rs 3,350/100Kg at Mumbai amid better enquiries from mills due to cheaper prices. However, overall sentiments are still bearish due to supply from overseas at cheaper prices.

On other hand in Mumbai, Mozambique origin red and white tur traded flat each at Rs 3,151/100Kg and Rs 3,351, respectively amid limied buying support from mills due to average quality supply. New Mozambique origin red and white tur also traded unchanged at Rs 3,400/100Kg and Rs 3,525, respectively.

Domestic tur in bilty trade at Akola moved up by Rs 25 at Rs 3,825-3,850/100Kg.

Meanwhile, millers instead of buying pulses from spot market are preferring to buy raw material from Nafed, which is available at competitive rates as Nafed is consistently liquidating tur below MSP.

Demand and sales counters in Tur dal remained slow as per requirement. Latur origin Phatka variety priced unchanged at Rs 5,600/100Kg for Mumbai delivery on slack trade activity. Similarly, Khamgaon origin phatka variety at Rs 5,600/100Kg, Gujarat origin Wasat Phatka variety at Rs 6,000-6,300/100Kg and Jalna origin phatka variety at Rs 5,900/100Kg (Mumbai Delivery).

Moreover, sentiments are still under pressure as there is sufficient stock still lying with government to cater consumption demand ahead for three months before arrivals of new crop. Private traders are also having some stock but they are bearing losses as they had procured it earlier at higher levels.

.jpg) Burma Urad:

Burma Urad:

Burma urad FAQ variety gained by Rs 50 at Rs 3,800/100Kg in Mumbai due to increased buying support from mills on the back of better quality supply, compared to new domestic urad.

In Chennai, Urad FAQ/SQ new moved up by Rs 200-300 each at Rs 3,675/100Kg and Rs 4,600, respectively in ready delivery as per condition amid improved millers' buying at lower rates. Also, sellers who had sold urad in forward business are active in purchasing to fulfill their deals.

In forward business at Chennai, Urad FAQ/SQ ruled firm at Rs 3,650/100Kg and Rs 4,525, respectively for October delivery from 10th-30th.

Moreover, demand in processed Urad was reported to be thin from consumption centres. Bikaner origin branded Urad dal offered at Rs 5,100-5,400/100Kg for Mumbai delivery. Tiranga brand of Mumbai was at Rs 5,500/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 5,400/100Kg for Mumbai delivery.

Since Urad/Moong prices in Maharashtra have been trading below the MSP, farmers are waiting with hope that the government will soon begin procurement. Significantly, with the state government threatening to crack the whip on traders who will purchase below MSP from farmers, the fear of being punished still prevails among traders. Traders now insist on ‘No Objection’ letters from farmers to be given to Commission Agents that they are happy with the purchase and have no complaints about the purchase or trade.This is being done to prevent any possible complaint that may come from farmers at a later stage.

Most of the pulses is sold under the non-FAQ category. If the commodity is considered as non-FAQ then the rule of MSP purchase does not apply. Most of the pulses are graded as non-FAQ with the permission of the farmer, commission agent and a written compliance letter is taken from him that he has no objections to the sale of the pulses.

As per market talk, prices are expected to remain under pressure if import of Urad continues at cheaper prices coupled with increase in new crop arrivals in the major states. Arrivals of new domestic crop continued at markets but quality was reported to be average, dagi and with moisture content. On the other hand, governement has not yet started procurement at MSP from farmers.

However, prices of urad will get support if cheaper imports will be capped by the government. In addition, reduced sowing in major states as farmers realised lower remuneration from the crop last season, erratic rainfall and concerns over acreage/area/quality are likely to lift prices to some extent.

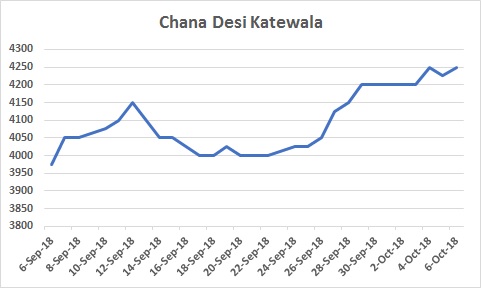

Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices traded higher by Rs 25-50 at Rs 4,250/100Kg amid firm cues from futures after a hike in minimum support price for the rabi pulse, good buying support from mills as monthly demand is expected ahead during festive period and shortage in White Pea supply.

Matar is close substitute of chana and extension of import restrictions may shift demand to chana to some extent.

Australia origin Chana in ready business at Mumbai and Mundra port moved up by Rs 50 each at Rs 4,200/100kg, respectively. However quality of the pulse available in Mumbai for trade was reported to be average.

Burma origin chana traded higher by Rs 100 at Rs 4,250/100Kg on millers' buying.

At National Commodity and Derivatives Exchange (NCDEX), Chana benchmark October contract settled higher by 0.5 per cent or Rs 19 at Rs.4,220/100Kgs on Friday.

Chana stocks at NCDEX accredited warehouses stood at 34,073 metric tonnes (Akola: 32726, Bikaner 583, Jaipur 764) as on 5th October, up 33,581 metric tonnes from the previous session, the exchange data showed.

Australian chana dal traded higher by Rs 200 at Rs 5,100/100 Kg for Mumbai delivery amid good buying activity. Similarly, domestic chana dal of Pistol brand gained by Rs 100 at Rs 5,350 for Mumbai delivery, Samrat brand at Rs 5,800 for Mumbai delivery, Angel brand at Rs 5,700 for Mumbai delivery. While, Chana besan remained flat at Rs 3,100/50Kg. On other hand, Vatana besan up by Rs 150 at Rs 2,950/50 Kg and Vatana dal at Rs 5,000, up Rs 100.

However, enquiries for processed chana and besan remained limited from mills at higher rates as Nafed active to sale procured stock at existing rates. Millers of Latur were active to sell Chana dal at Rs 5,400/100Kg in forward business for delivery during the Diwali.

In Mumbai, Sudan origin kabuli rose by Rs 100 at Rs 4,250/100Kg amid good buying support from besan flour millers, firm trend in Chana, better quality supply and competitive prices as compared to chana & white pea. Similarly, Kabuli chana of Burma traded higher by Rs 150 at Rs 4,350/100Kg.

Kabuli chana of 42-44 and 44-46 counts gained by Rs 200/100Kg at Indore market on fresh local and exporters buying against increased arrivals.

Kabuli Chana dollar variety ruled unchanged at Rs.5,000-5,800/100Kgs as per quality at Indore.

.jpg) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in both vessel and Container gained by Rs 50/100Kg in Mumbai on selective buying support from mills on hopes that the governement may raise the import duty on masoor to 70% from 30% to curb imports. While, Australia origin Masoor priced unchanged.

Canada crimson variety masoor in vessel and container traded at Rs 3,800-3,850/100Kg and Rs 3,900-4,050, respectively. Stock of Canada masoor old in vessel was low and offered as per quality. MMTC was active in selling procured old masoor stock at Rs 3,650/100Kg, up by Rs 50 in Mumbai.

Australia Masoor nugget variety traded flat at Rs 4,100-4,200/100Kg as per quality against limited stock.

As per market sources, supply of about 32,350 MT of Masoor from Canada in break bulk vessel Sea Breeze which is being discharged at Mumbai port coupled with selling of procured Masoor by Nafed in Madhya Pradesh may limit gains.

Vessel Sea Breeze from Canada has discharged 3522 MT Masoor till date (6 Oct) and 28828 MT Balance is left to discharge.

Demand in processed Masoor has improved from consumption centres. Canada Masoor Khopoli spot gained by Rs 50 at Rs 4,950/100Kg.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira ports gained for the fourth straight week by Rs 100-150/100Kg as per quality after Indian government extended import restrictions up to December-end from September 30.

Buying support from mills and shortage of ready stock also supported the prices.

Moreover, import of pulses will become costlier as so far this year as Rupee hits new record low Of 74.12 on Friday.

Canada White Pea traded at Rs 4,750/100Kg at Mumbai, Rs 4,550-4,600 at Mundra and Rs 4,600 at Hajira port. Russia origin Baltic variety quoted at Rs 4,550 in Mundra. Ukraine White Pea ruled at Rs 4,650 at Mumbai and at Rs 4,575-4,600 at Mundra and Hajira.

However, millers and traders are still preferring to purchase domestic chana or Sudan/Burma origin kabuli chickpea due to cheaper prices as compared to white pea and also amid shortage of white pea stock.

But millers who prefer to process only matar for crushing were active in purchasing due to better quality supply.

Moreover, demand in matar dal/besan were reported good at prevailing rates.

.jpg) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded higher by Rs 300 at Rs 4,900-5,200/100Kg as per quality at Jaipur market on increased buying support from mills due to festive period and lower arrivals at major states. Farmers in major producing centers are bringing lower stocks in the markets as government will start procurement soon at MSP.

Similarly, Moong dal prices also gained by Rs 200 at Rs 6,300-6,400/100Kg depending on the variety.

Mills were seen active in purchasing superior quality new moong from markets or from governement at cheaper rates on expectation of festive demand. Nafed were active to liquidate old procured moong stock in Rajasthan and Madhya Pradesh ahead of election period.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai gained sharply at Rs 7,800/100Kg (cleaned) and Rs 7,600/100Kg (Uncleaned) amid shortage of ready stock and no supply pressure from overseas.

Moreover, prices also gained as Indian government has extended import restrictions for matar up to December-end from September 30.

(By Commoditiescontrol Bureau; +91-22-40015513)