Ahmedabad, April 5, 2024 (CommoditiesControl): Cumin prices experienced a softening trend today, declining by Rs 50 per 20 kg due to a notable absence of demand in the export market. Despite the ongoing cumin season, traders note that arrivals are lower compared to expectations for this time of the year. The market sentiment was impacted by discussions surrounding the lack of export business, exerting downward pressure on prices.

Last year, farmers witnessed exceptionally high prices for cumin. Presently, various reports circulating on platforms like WhatsApp and other social media channels are hinting at a potential rise in cumin prices. Consequently, farmers are refraining from selling their cumin produce in anticipation of better prices. However, the current lack of significant export demand coupled with higher production levels compared to the previous year make it challenging for prices to surge. Traders predict a potential softening of export prices by Rs 200-300 in the coming weeks.

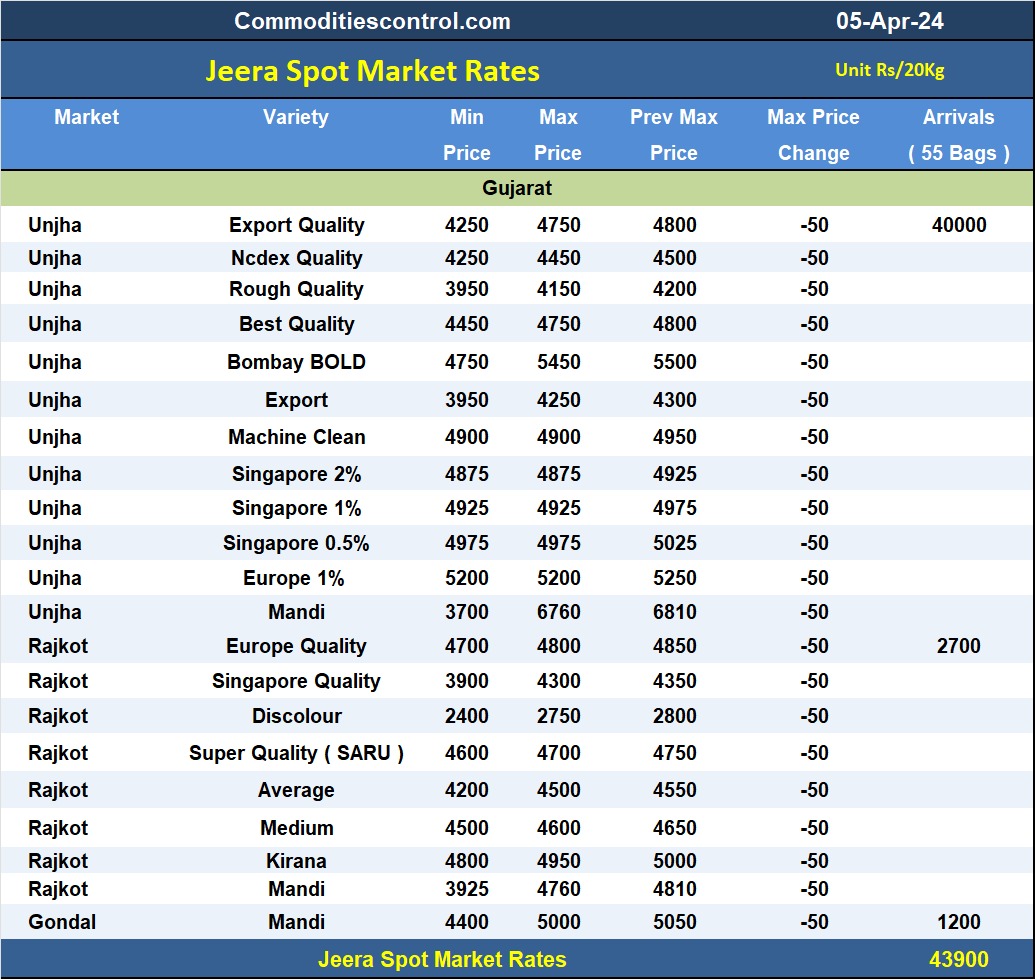

In Unja, approximately 40,000 bags of cumin arrived, with prices ranging from Rs 3950-4150 per 20 kg for rough quality, Rs 4450-4750 per 20 kg for the best quality, and Rs 4750-5450 per 20 kg for Bombay Bold variety. Additionally, around 20,000 sacks were traded nearby.

In Rajkot Mandi, 2700 bags of cumin were reported, priced between Rs 3925-4760 per 20 kg. Meanwhile, in Gondal Mandi, 1200 bags arrived, fetching prices ranging from Rs 4400-5000 per 20 kg based on quality.

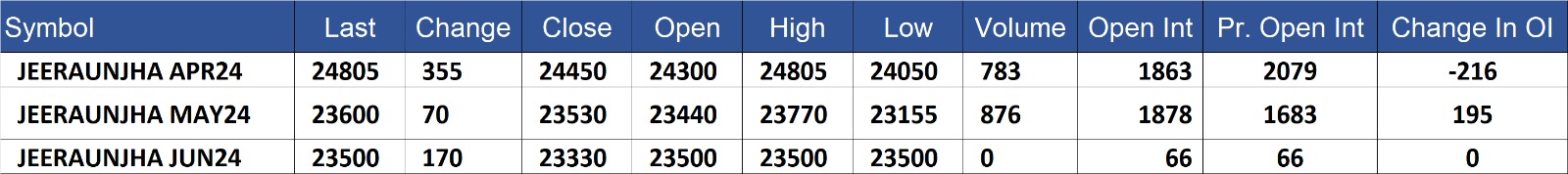

Jeeraunjha contract for APR delivery settled at Rs 24805/quintal showing an rise of Rs 355 over previous close of Rs 24450/quintal,The contract moved in the range of Rs 24050-24805 for the day. Open interest decreased by -216 MT to 1863 MT, while trading volume decreased by -3 to 783 MT.

Jeeraunjha contract for MAY delivery settled at Rs 23600/quintal showing an rise of Rs 70 over previous close of Rs 23530/quintal,The contract moved in the range of Rs 23155-23770 for the day. Open interest increased by 195 MT to 1878 MT, while trading volume decreased by -21 to 876 MT

Jeeraunjha contract for JUN delivery settled at Rs 23500/quintal showing an rise of Rs 170 over previous close of Rs 23330/quintal,The contract moved in the range of Rs 23500-23500 for the day. Open interest was simillar by 0 MT to 66 MT, while trading volume decreased by -3 to 0 MT

Currently The spread between APR and MAY contract is 1205 Rs/quintal

Currently The spread between MAY and JUN contract is 100 Rs/quintal.

Currently The spread between APR and JUN contract is 1305 Rs/quintal

JeeraUnjha stock in NCDEX accredited warehouse as on 05-Apr-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)