Mumbai, April 4 (CommoditiesControl): Turmeric prices maintained stability across major spot markets, due supported by steady demand following a recent correction in prices. This support, coupled with expectations of significantly lower production this season, is anticipated to underpin prices in the medium to long term.

Market reports indicate that turmeric prices remained unchanged in key spot markets, with robust demand helping sustain market values. The outlook for production this season suggests a notable decline, which is likely to further support prices over the coming months.

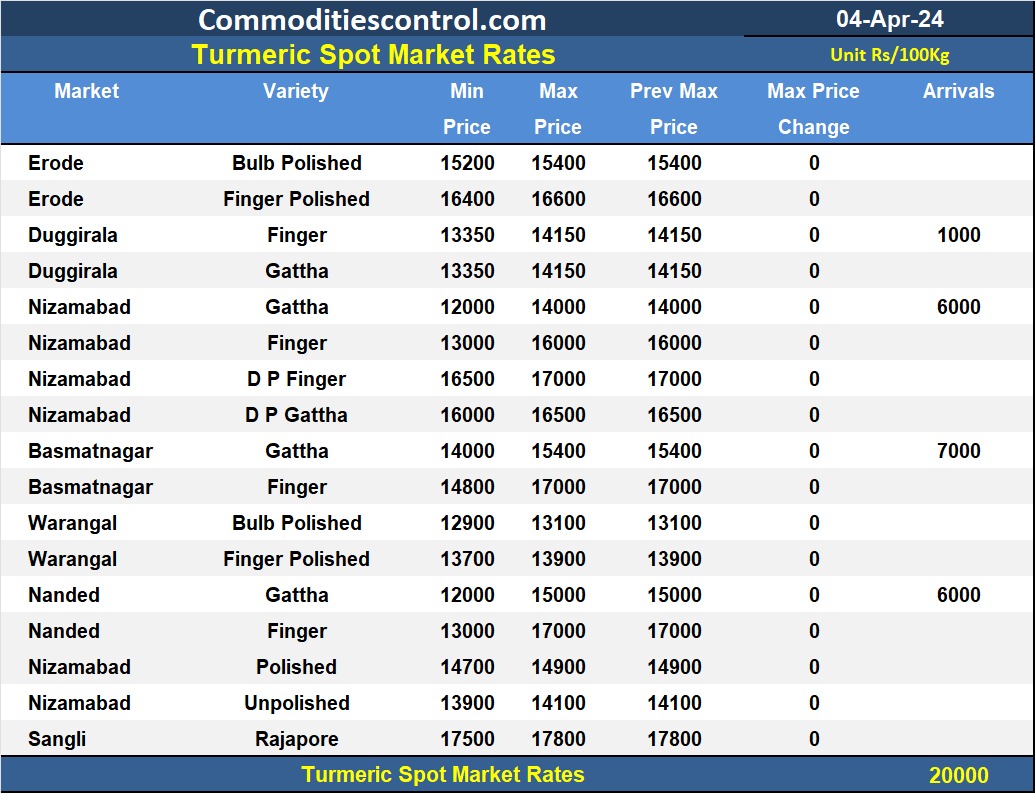

Arrivals witnessed a decline, totaling 20,000 bags compared to 36,400 bags in the previous session, with reductions observed across all major markets. Nizamabad reported 6,000 bags, Basmatnagr reported 7,000 bags, and Nanded reported 6,000 bags. Market participants note that arrivals were 20-30% lower than normal, primarily attributed to the anticipated decrease in output.

Meanwhile, turmeric futures prices on the NCDEX markets stabilized after experiencing significant increases over the previous two sessions. Prices for April and June contracts showed marginal fluctuations, with April contracts recording a slight decline of 0.2%, while June contracts remained stable.

NCDEX Spot Prices (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,395

- Nizamabad - NCDEX Unpolished: 15,692

- Sangli - NCDEX Rajapore: 18,360

NCDEX Future Prices (RS/Qtl):

- Apr-24: 16,800 (-28, -0.2%)

- Jun-24: 17,390 (+4, +0.0%)

Turmeric contract for APR delivery settled at Rs 16800/quintal showing an fall of Rs -28 over previous close of Rs 16828/quintal,The contract moved in the range of Rs 16624-17036 for the day. Open interest decreased by -1135 MT to 8070 MT, while trading volume decreased by -205 to 3045 MT.

Turmeric contract for JUN delivery settled at Rs 17390/quintal showing an rise of Rs 4 over previous close of Rs 17386/quintal,The contract moved in the range of Rs 17216-17600 for the day. Open interest increased by 1380 MT to 11650 MT, while trading volume increased by 180 to 2890 MT.

Currently The spread between APR and JUN contract is -590 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)