Mumbai, March 19 (Commoditiescontrol): Turmeric prices in major spot markets have largely remained stable, with the exception of Nanded, where prices experienced a decline of Rs 500 per quintal upon the market's reopening after being closed for 2-3 sessions.

Dull spot demand following a sharp price increase led to a correction in prices across major spot markets. However, export inquiries are reportedly emerging, offering potential support to prices.

Arrivals saw a decrease to 39,900 bags from 54,412 bags in the previous session. This decline can be attributed to a few markets closing in Maharashtra, coupled with lower arrivals in Erode and Nizamabad. Nizamabad recorded 15,000 bags, Erode 6,300 bags, Sangli 16,500 bags, and Nanded 1,400 bags. Market updates suggest that arrivals were 20-30% lower than anticipated due to a significant reduction in output.

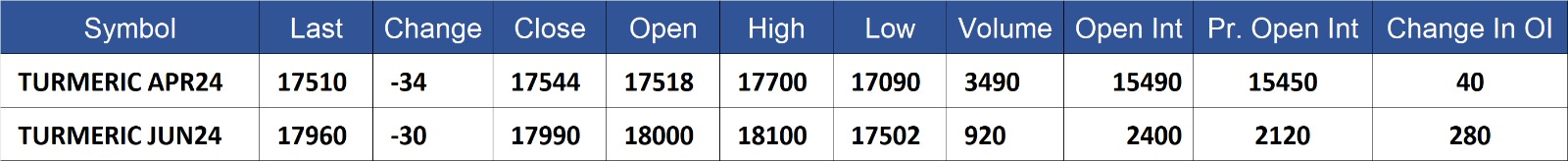

On the NCDEX markets, turmeric futures prices have settled slightly lower, indicating stabilization after a recent rise. Both April and June contracts experienced a 0.2% decrease in prices.

NCDEX Spot (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,384

- Nizamabad - NCDEX Unpolished: 15,324

- Sangli - NCDEX Rajapore: 18,113

NCDEX Future (RS/Qtl):

- Apr-24: 17,510 (-34, -0.2%)

- Jun-24: 17,960 (-30, -0.2%)

.jpeg)

Turmeric contract for APR delivery settled at Rs 17510/quintal showing an fall of Rs -34 over previous close of Rs 17544/quintal,The contract moved in the range of Rs 17090-17700 for the day. Open interest increased by 40 MT to 15490 MT, while trading volume decreased by -1330 to 3490 MT.

Turmeric contract for JUN delivery settled at Rs 17960/quintal showing an fall of Rs -30 over previous close of Rs 17990/quintal,The contract moved in the range of Rs 17502-18100 for the day. Open interest increased by 280 MT to 2400 MT, while trading volume decreased by -70 to 920 MT.

Currently The spread between APR and JUN contract is -450 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)