Ahmedabad, March 19 (CommoditiesControl)* - An atmosphere of fear engulfed the cumin market in Gujarat today, exacerbated by a worsening money crisis and reports of traders facing bankruptcy in Rajkot's cumin market. The prevailing apprehension has led to softening prices, with cumin experiencing a decline of Rs 100-150 per 20 kg.

Traders from Unja and Saurashtra, the primary centers of cumin arrival, expressed heightened concerns over the situation. The fear stemmed from discussions surrounding the potential bankruptcy of two to four traders, intensifying the already tense market environment.

A local businessman from Unja highlighted that despite the spice season, local activities remain minimal. However, the significant influx of cumin arrivals continues to exert pressure on prices. While some shipments have started arriving from Rajasthan, the anticipation of increased arrivals in April is expected to further impact the market dynamics.

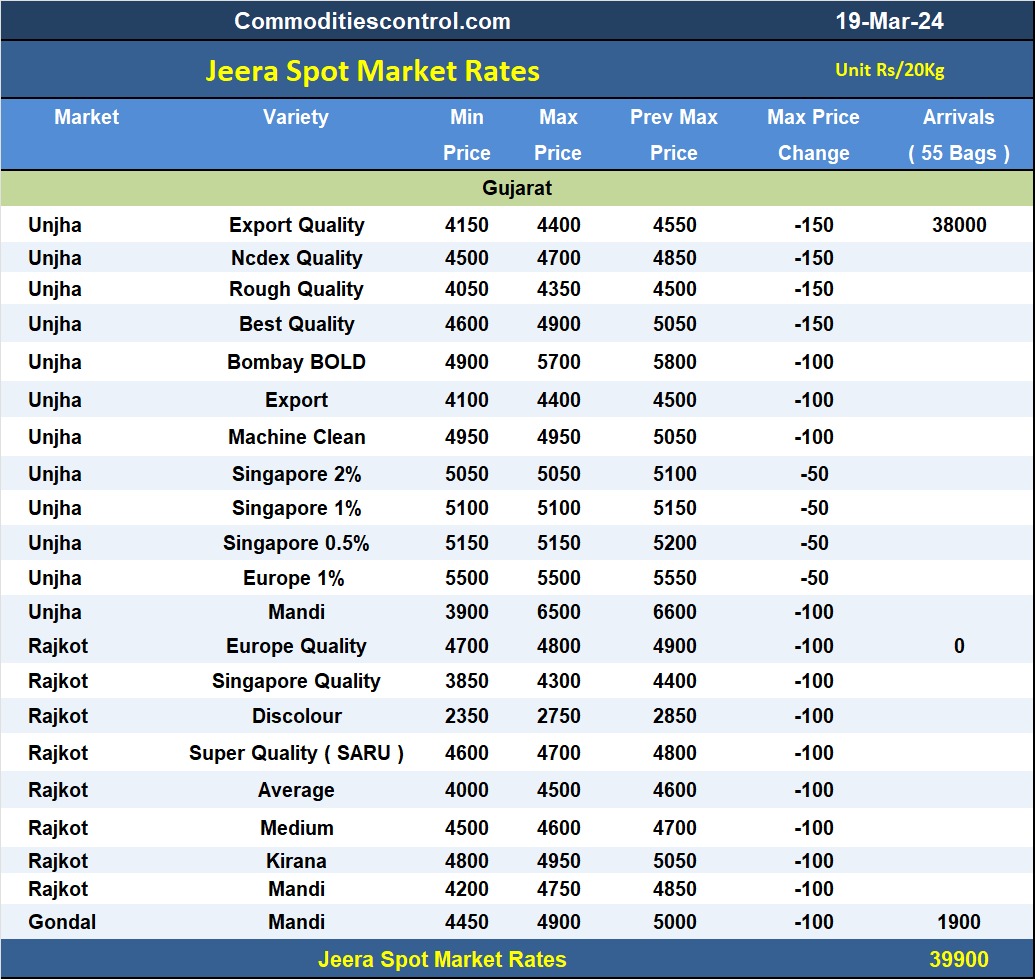

Approximately 70,000 bags of cumin were reported to arrive in Gujarat today, with Unja witnessing arrivals of around 38,000-40,000 bags. Rough cumin was priced at Rs 4050-4350 per 20 kg, while the best quality commanded prices of Rs 4600-4900 per 20 kg. Meanwhile, Bombay Bold variety was priced at Rs 4900-5700 per 20 kg. However, actual transactions were estimated to involve only around 20,000-21,000 bags.

In Rajkot Mandi, new arrivals were halted, but pending goods saw trading activity, with 3500 bags traded at prices ranging from Rs 4200 to Rs 4750 per 20 kg. Approximately 5000 bags remain pending in the Rajkot market. Similarly, in Gondal Mandi, 1900 bags were traded against pending arrivals, fetching prices of Rs 4450-4900 per 20 kg.

The uncertain situation in Gujarat's cumin market underscores the challenges faced by traders amidst a deepening money crisis and looming concerns over bankruptcy. Market participants are closely monitoring developments as they navigate through this period of instability.

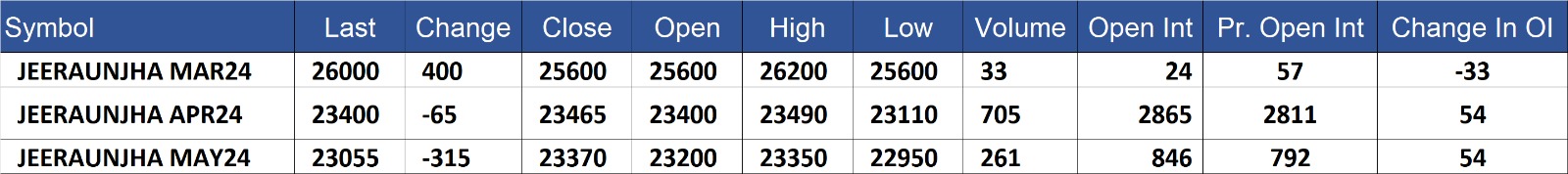

Jeeraunjha contract for MAR delivery settled at Rs 26000/quintal showing an rise of Rs 400 over previous close of Rs 25600/quintal,The contract moved in the range of Rs 25600-26200 for the day. Open interest decreased by -33 MT to 24 MT, while trading volume increased by 12 to 33 MT

Jeeraunjha contract for APR delivery settled at Rs 23400/quintal showing an fall of Rs -65 over previous close of Rs 23465/quintal,The contract moved in the range of Rs 23110-23490 for the day. Open interest increased by 54 MT to 2865 MT, while trading volume decreased by -582 to 705 MT.

Jeeraunjha contract for MAY delivery settled at Rs 23055/quintal showing an fall of Rs -315 over previous close of Rs 23370/quintal,The contract moved in the range of Rs 22950-23350 for the day. Open interest increased by 54 MT to 846 MT, while trading volume decreased by -72 to 261 MT.

Currently The spread between MAR and APR contract is 2600 Rs/quintal.

Currently The spread between APR and MAY contract is 345 Rs/quintal.

Currently The spread between MAR and MAY contract is 2945 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 19-Mar-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)