Ahmedabad, March 14 (CommoditiesControl): The cumin market is witnessing a persistent decline in prices alongside a surge in arrivals, as the situation like financial crisis dampens purchasing activity. As the expiry date approaches in the futures market, buyers are showing reluctance due to prevailing financial uncertainties. Additionally, the arrival of cumin from Rajasthan is on the rise, with traders anticipating peak arrivals in April.

Traders in Rajkot anticipate subdued selling activity as March draws to a close, with expectations of increased arrivals from the onset of April. Presently, Unja Mandi witnesses an average arrival of around 50,000 sacks, including 5,000-7,000 sacks from Rajasthan and 15,000-20,000 sacks sourced from recycling processes involving Jasdan-Jamjodhpur Mandi and other Saurashtra markets.

Today, the entire state received 80,000-85,000 bags of cumin, resulting in a notable price decline of Rs 100 per 20 kg.

According to reports from traders, around 45,000 bags of new cumin arrived in Unja, with each bag weighing 55 kg. Rough cumin prices ranged between Rs 4300-4400 per 20 kg, while the best quality commanded prices of Rs 4900-5200 per 20 kg. Bombay Bold variety was priced between Rs 5300-6000 per 20 kg, with trade volumes reaching around 28,000-30,000 sacks.

In Rajkot mandi, arrivals have ceased for the past two days, although pending stocks were traded at prices ranging from Rs 4500-5160. Conversely, Gondal Mandi saw the arrival of 2,500 bags, with prices ranging from Rs 4650-5100 per 20 kg based on quality assessments.

Overall, the prevailing financial crisis coupled with increasing arrivals from Rajasthan is likely to exert further downward pressure on cumin prices.

.jpeg)

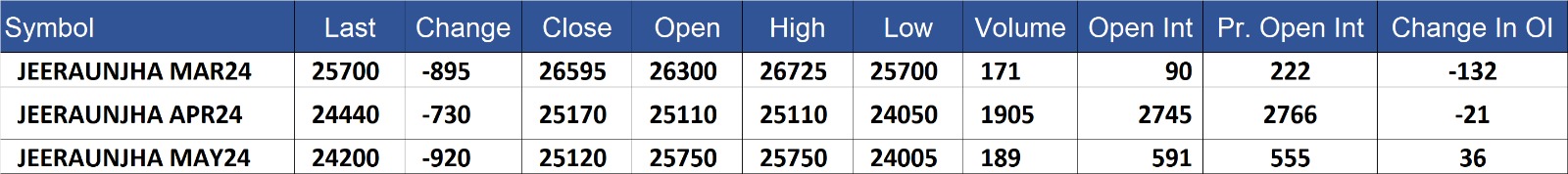

Jeeraunjha contract for MAR delivery settled at Rs 25700/quintal showing an fall of Rs -895 over previous close of Rs 26595/quintal,The contract moved in the range of Rs 25700-26725 for the day. Open interest decreased by -132 MT to 90 MT, while trading volume decreased by -126 to 171 MT.

Jeeraunjha contract for APR delivery settled at Rs 24440/quintal showing an fall of Rs -730 over previous close of Rs 25170/quintal,The contract moved in the range of Rs 24050-25110 for the day. Open interest decreased by -21 MT to 2745 MT, while trading volume increased by 798 to 1905 MT.

Jeeraunjha contract for MAY delivery settled at Rs 24200/quintal showing an fall of Rs -920 over previous close of Rs 25120/quintal,The contract moved in the range of Rs 24005-25750 for the day. Open interest increased by 36 MT to 591 MT, while trading volume increased by 48 to 189 MT.

Currently The spread between MAR and APR contract is 1260 Rs/quintal.

Currently The spread between APR and MAY contract is 240 Rs/quintal.

Currently The spread between MAR and MAY contract is 1500 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 14-Mar-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)