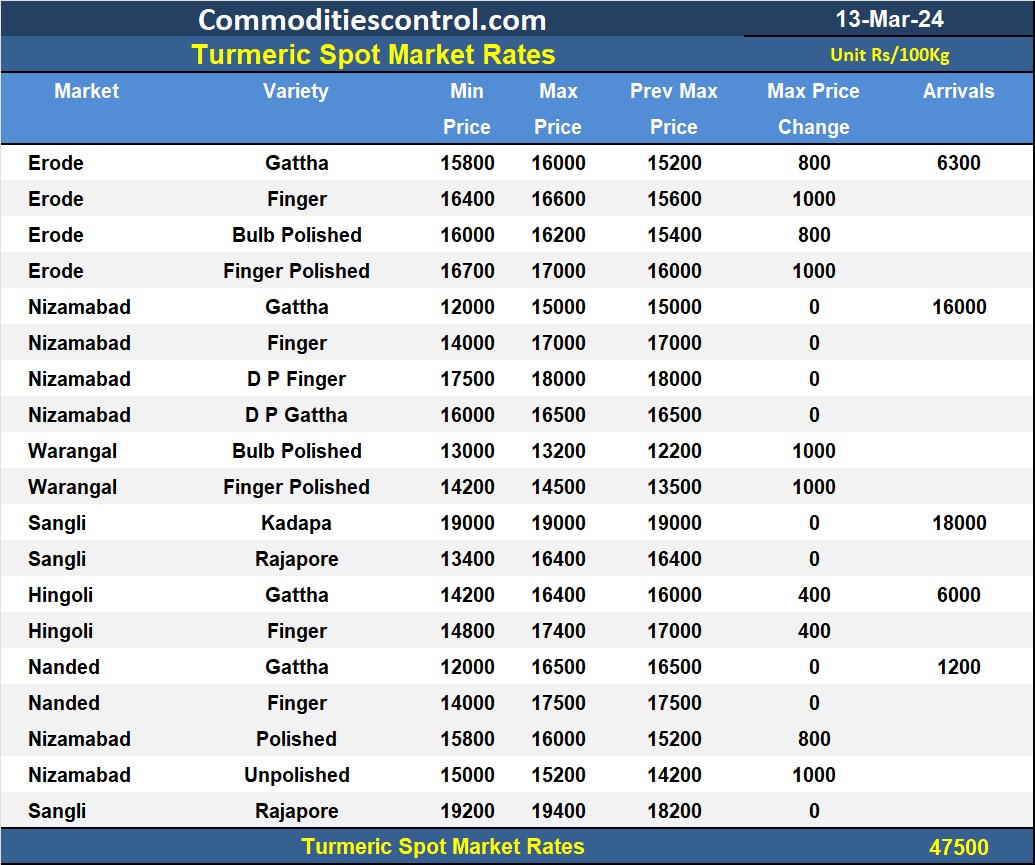

Mumbai, March 13 (Commoditiescontrol): Turmeric prices in major spot markets have witnessed a notable increase, rising by Rs 800-1,000 per quintal, fueled by robust demand during Ramadan. The rally in spot market prices has resumed its upward trajectory, supported by both domestic and export inquiries, alongside lower output levels.

Arrivals in major markets surged to 47,500 bags from 41,300 bags in the previous session, with Nizamabad receiving 18,000 bags, Erode 6,300 bags, Sangli 16,000 bags, and Nanded 1,200 bags. However, arrivals were reported to be 30-40% lower than anticipated due to significantly reduced output levels.

Meanwhile, turmeric futures prices on NCDEX markets experienced a marginal recovery driven by heavy buying activity. Prices surged during the morning session and ended moderately higher due to profit booking at elevated price levels. Notably, prices rose by 2.3% in April contracts and 1.1% in June contracts. Anticipated lower-than-usual arrivals, as farmers and village-level aggregators stockpile material in anticipation of higher prices later in the season, have contributed to the upward momentum.

Although demand remains strong, sellers may be hesitant to sell their produce at the sharply increased prices, potentially maintaining stability in the market.

NCDEX Spot (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,923

- Nizamabad - NCDEX Unpolished: 16,040

- Sangli - NCDEX Rajapore: 19,153

NCDEX Future (RS/Qtl):

- Apr-24: 19,100 (+428, +2.3%)

- Jun-24: 19,300 (+212, +1.1%)

Turmeric contract for APR delivery settled at Rs 19100/quintal showing an rise of Rs 428 over previous close of Rs 18672/quintal,The contract moved in the range of Rs 18560-19776 for the day. Open interest increased by 330 MT to 16230 MT, while trading volume increased by 660 to 4715 MT.

Turmeric contract for JUN delivery settled at Rs 19300/quintal showing an rise of Rs 212 over previous close of Rs 19088/quintal,The contract moved in the range of Rs 18988-20122 for the day. Open interest increased by 100 MT to 1720 MT, while trading volume increased by 45 to 590 MT.

Currently The spread between APR and JUN contract is -200 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)