Ahmedabad, March 7 (Commodities Control): Cumin prices experienced a surge today, fueled by a combination of improved export trade and increased local demand. The futures market also mirrored this trend, showing a rise in cumin prices. Prices in the region have seen an increase of 50-100 rupees per 20 kilograms, while cumin arrivals at local mandis continue to grow steadily.

NCDEX Futures indicated short covering in MArch contract and fresh long built up for April contract.

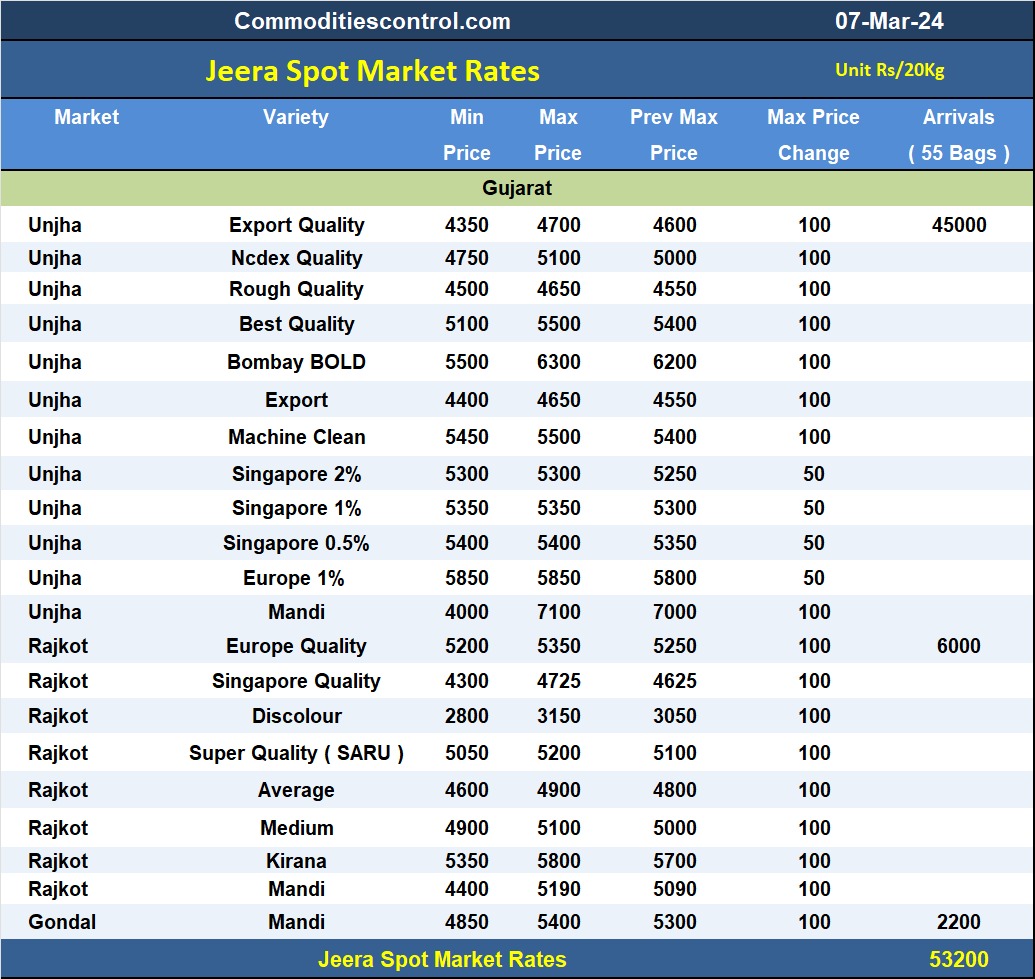

Unjha Traders attribute the positive movement to healthy export trade. Ready shipment prices for cumin at Dubai's Jebel Ali port reached 3400 dollars per ton CIF Singapore quality yesterday evening. According to traders, the Unjha mandi received a substantial influx of over 45,000 bags (1 bag = 55 kilograms) of new cumin today. Prices varied depending on quality, with rough cumin trading at 4500-4650 rupees per 20 kilograms, best quality cumin fetching 5100-5500 rupees per 20 kilograms, and Bombay Bold commanding a price of 5500-6300 rupees per 20 kilograms. Cumin arrivals across the entire region surpassed 80,000 bags today.

In the Rajkot mandi, cumin arrivals were approximately 6,000 bags, with prices ranging between 4400-5190 rupees per 20 kilograms. The Gondal mandi saw cumin arrivals of 2,200 bags, priced between 4850-5400 rupees per 20 kilograms.

Traders anticipate a temporary pause in market activity tomorrow, Friday, due to the Mahashivratri festival. Market direction is likely to be influenced by cumin arrivals on Saturday. However futures market cues indicate higher prices of cummin seed in near term.

In NCDEX Futures Jeeraunjha contract for MAR delivery settled at Rs 26750/quintal showing an rise of Rs 550 over previous close of Rs 26200/quintal,The contract moved in the range of Rs 26095-27095 for the day. Open interest decreased by -324 MT to 852 MT, while trading volume decreased by -369 to 732 MT.

Jeeraunjha contract for APR delivery settled at Rs 25250/quintal showing an rise of Rs 550 over previous close of Rs 24700/quintal,The contract moved in the range of Rs 24695-25495 for the day. Open interest increased by 192 MT to 2589 MT, while trading volume decreased by -96 to 1212 MT.

Jeeraunjha contract for MAY delivery settled at Rs 25350/quintal showing an rise of Rs 765 over previous close of Rs 24585/quintal,The contract moved in the range of Rs 23995-25550 for the day. Open interest increased by 51 MT to 393 MT, while trading volume increased by 90 to 150 MT.

Currently The spread between MAR and APR contract is 1500 Rs/quintal

Currently The spread between APR and MAY contract is -100 Rs/quintal.

Currently The spread between MAR and MAY contract is 1400 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 07-Mar-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)