Ahmedabad, March 6 (CommoditiesControl): The coriander market in Gujarat witnessed the highest arrival of the season today, with a staggering 1.40 lakh bags contributing to the surplus. The substantial influx led to a decline in prices both in the spot and futures markets, marking the second consecutive day of price depreciation. Spot market prices saw a drop of Rs 30-40 per 20 kg today, adding to the decline of Rs 60-80 observed over the last two days.

Traders attribute the recent decline to the significant increase in arrivals, expressing optimism that the lower prices will stimulate buying activities in the coming days. They anticipate a market rebound as buying resumes and lends support to coriander prices.

Today's arrivals in the state comprised approximately 1,40,000 bags, with an average coriander price ranging from Rs 1425 to Rs 1925 per 20 kg. In Gondal, where only pending coriander sacks were traded yesterday, 70,000 bags entered the market today, priced at Rs 1551-2151 per 20 kg. In Rajkot mandi, 10,000 bags were reported, with prices ranging from Rs 1270 to Rs 1840.

Other notable arrivals included 9,000 sacks in Halvad, 3,000 sacks in Dhangadhra, 3,200 sacks in Jetpur, 13,000 sacks in Jamjodhpur, 6,000 sacks in Junagadh, 9,000 sacks in Amreli, 2,500 sacks in Jamnagar, and an additional 8,000-10,000 sacks in nearby areas.

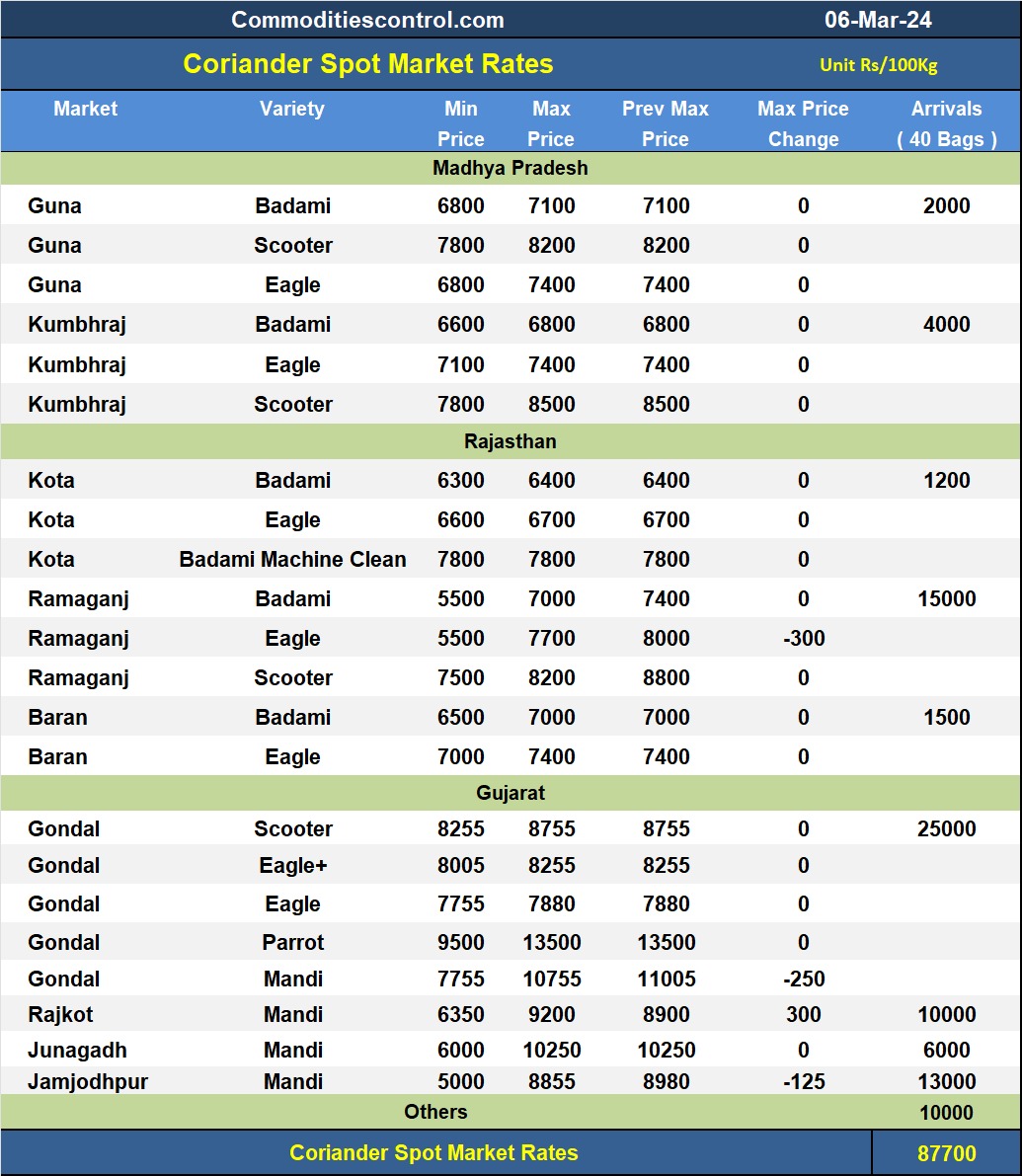

Despite the dip in prices due to increased arrivals, the coriander market is expected to regain stability as buying activities pick up. Meanwhile, coriander prices remained steady in Guna and Kumbhraj markets, with inflows maintaining stability.

In Guna, prices for various coriander varieties ranged from 6800 to 8200, while Kumbhraj Mandi reported prices of Badami at 6600/6800, Eagle at 7100/7400, and Scooter at 7800/8500, with an arrival of 4000 bags.

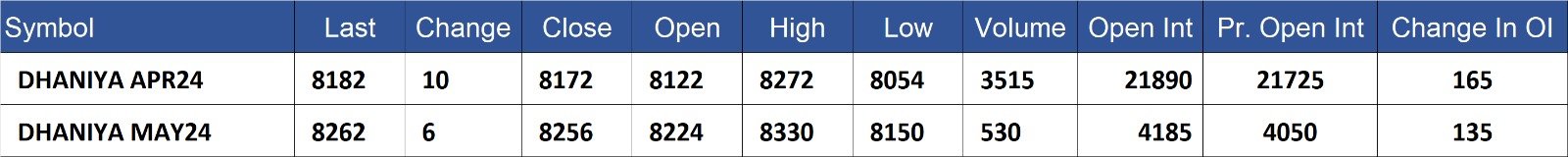

Dhaniya contract for APR delivery settled at Rs 8182/quintal showing an rise of Rs 10 over previous close of Rs 8172/quintal,The contract moved in the range of Rs 8054-8272 for the day. Open interest increased by 165 MT to 21890 MT, while trading volume increased by 1130 to 3515 MT.

Dhaniya contract for MAY delivery settled at Rs 8262/quintal showing an rise of Rs 6 over previous close of Rs 8256/quintal,The contract moved in the range of Rs 8150-8330 for the day. Open interest increased by 135 MT to 4185 MT, while trading volume decreased by -155 to 530 MT.

Currently The spread between APR and MAY contract is -80 Rs/quintal.

Dhaniya stock in NCDEX accredited warehouse as on 06-Mar-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)