Mumbai, March 01 (Commodities Control): Turmeric prices in major markets have reported a steady to firm sentiment. In Erode and Duggirala, prices increased by Rs 2200-4400 per quintal, while in other centers, prices remained stable. This positive momentum is supported by expectations of lower output due to a significant decline in acreage and yields. Both domestic and export inquiries are anticipated to boost demand, although increased arrivals are causing price volatility in both futures and spot markets.

Arrivals:

- Total arrivals: 27,200 bags (down 6,800 bags from the previous session)

- Nizamabad: 9,000 bags

- Erode: 5,500 bags

- Sangli: 9,000 bags

- Hingoli: 1,000 bags

- Nanded: 1,300 bags

Arrivals are reported to be 30-40% lower than expected, reflecting a significant decrease in output.

Turmeric Futures on NCDEX:

- Prices fell after rising for 4-5 sessions, driven by profit booking at higher levels.

- Decline in April contract: 1.8%

- Decline in June contract: 1.7%

The market expects volatility to persist with a positive short-term bias as new arrivals commence. Anticipation of higher prices later in the season is leading farmers and village-level aggregators to stockpile material, contributing to lower-than-usual arrivals.

NCDEX Spot (Rs/Qtl):

- Nizamabad - NCDEX Polished: 15,165

- Nizamabad - NCDEX Unpolished: 14,492

- Sangli - NCDEX Rajapore: 16,821

NCDEX Future (Rs/Qtl):

- Apr-24: 16,860 (-302, -1.8%)

- Jun-24: 17,250 (-290, -1.7%)

.jpeg)

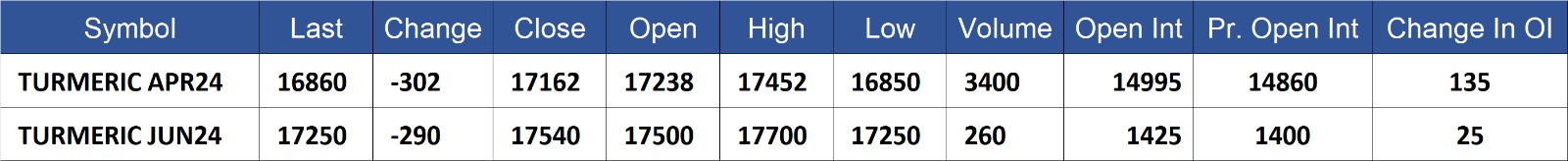

Turmeric contract for APR delivery settled at Rs 16860/quintal showing an fall of Rs -302 over previous close of Rs 17162/quintal,The contract moved in the range of Rs 16850-17452 for the day. Open interest increased by 135 MT to 14995 MT, while trading volume decreased by -1385 to 3400 MT.

Turmeric contract for JUN delivery settled at Rs 17250/quintal showing an fall of Rs -290 over previous close of Rs 17540/quintal,The contract moved in the range of Rs 17250-17700 for the day. Open interest increased by 25 MT to 1425 MT, while trading volume decreased by -215 to 260 MT.

Currently The spread between APR and JUN contract is -390 Rs/quintal

(By Commoditiescontrol Bureau: +91 9820130172)