Ahmedabad, February 16 (CommoditiesControl): The cumin market in Gujarat experienced a notable surge today as the state witnessed arrival of around 18,000 to 20,000 bags of new cumin, with each bag 55 kg. While the possibility of further increase in arrival in the coming days, the market displayed stability with no significant movement.

With the arrival of mostly moist goods, some traders raised concerns about the quality of cumin seeds, with reports of seeds turning black. However, the overall market remained steady, and the price of cumin exhibited stability across the state.

Despite the arrival of new cumin, market analysts predict no major shifts in the current scenario. The market's trend will depend on selling trends in the upcoming days. Although the futures market showed a slight improvement today, traders are speculating that the price of cumin may witness a decline to Rs 24,000 per quintal later this month.

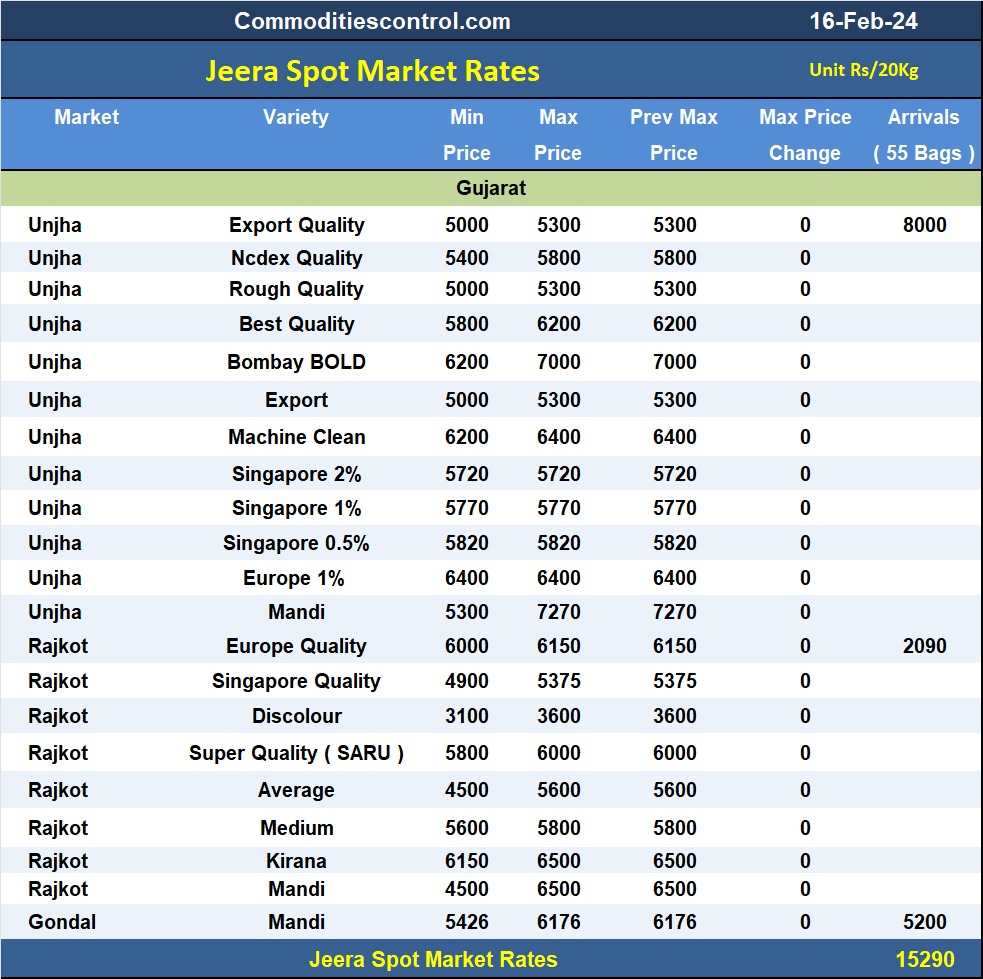

In Unja, around 7,000 to 8,000 bags of new cumin arrived, with prices varying based on quality. Rough cumin fetched Rs 5,000-5,300 per 20 kg, the best quality ranged between Rs 5,800-6,200 per 20 kg, and Bombay Bold commanded a range of Rs 6,200-7,000 per 20 kg. Approximately 10,000 to 11,000 sacks were traded in the mandis.

Rajkot mandi reported prices ranging from Rs 4,500-6,500 per 20 kg, with an arrival of 2,090 quintals. In Gondal Mandi, where 5,200 bags arrived, prices were observed at Rs 5,426-6,176 per 20 kg, depending on the quality.

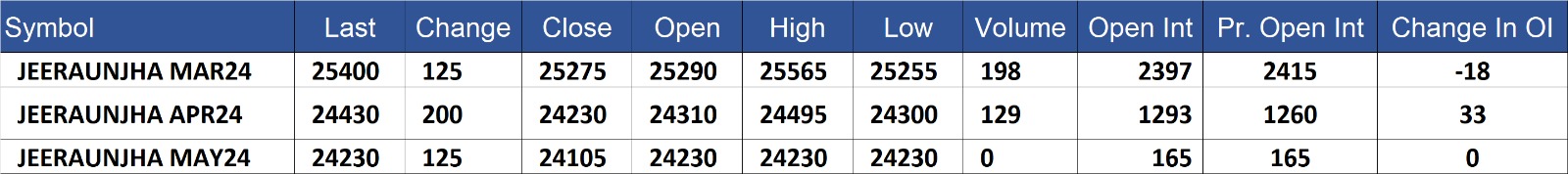

Jeeraunjha contract for MAR delivery settled at Rs 25400/quintal showing an rise of Rs 125 over previous close of Rs 25275/quintal,The contract moved in the range of Rs 25255-25565 for the day. Open interest decreased by -18 MT to 2397 MT, while trading volume decreased by -315 to 198 MT.

Jeeraunjha contract for APR delivery settled at Rs 24430/quintal showing an rise of Rs 200 over previous close of Rs 24230/quintal,The contract moved in the range of Rs 24300-24495 for the day. Open interest increased by 33 MT to 1293 MT, while trading volume decreased by -54 to 129 MT.

Jeeraunjha contract for MAY delivery settled at Rs 24230/quintal showing an rise of Rs 125 over previous close of Rs 24105/quintal,The contract moved in the range of Rs 24230-24230 for the day. Open interest was simillar by 0 MT to 165 MT, while trading volume was simillar by 0 to 0 MT.

Currently The spread between MAR and APR contract is 970 Rs/quintal.

Currently The spread between APR and MAY contract is 200 Rs/quintal.

Currently The spread between MAR and MAY contract is 1170 Rs/quintal

JeeraUnjha stock in NCDEX accredited warehouse as on 16-Feb-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)