Jodhpur, March 26 (Commoditiescontrol): Guar seed and gum prices witnessed a notable decline in both the spot market and futures trading on Tuesday, primarily driven by profit-booking activities.

According to market sources, the average price range for guar seed in auctions was quoted at Rs 4600-4850 per quintal, reflecting a downward trend. Arrivals of guar seed stood at approximately 8,100 bags for the day.

In the paid markets, guar seed prices were reported at Rs 5080 per quintal, indicating a notable decrease. Similarly, guar gum prices in the benchmark market of Jodhpur were observed at Rs 10,000 per quintal, signaling a decline in prices.

On the futures front, guar gum futures for delivery in April concluded Rs 217 or 2.18% lower at Rs 9,835 per quintal on the NCDEX. The session saw a trading range between Rs 9,762 and Rs 10,080, reflecting heightened volatility amidst profit-booking activities.

Likewise, guar seed futures for delivery in April settled Rs 101 or 1.96% down at Rs 5,061 per quintal on the NCDEX. The trading session witnessed a range between Rs 5,050 and Rs 5,168, indicative of the market's bearish sentiment.

The decline in both guar seed and gum prices can be attributed to profit-booking activities, where market participants opted to capitalize on previous gains. This downward movement underscores the current market trends, which may continue to influence prices in the near term.

GuarSeed contract for APR delivery settled at Rs 5061/quintal showing an fall of Rs -101 over previous close of Rs 5162/quintal,The contract moved in the range of Rs 5050-5168 for the day. Open interest decreased by -2755 MT to 64390 MT, while trading volume increased by 6230 to 14720 MT.

GuarSeed contract for MAY delivery settled at Rs 5125/quintal showing an fall of Rs -105 over previous close of Rs 5230/quintal,The contract moved in the range of Rs 5118-5233 for the day. Open interest increased by 2390 MT to 20395 MT, while trading volume increased by 2095 to 4885 MT.

Currently The spread between APR and MAY contract is -64 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 26-Mar-2024, was 37194 MT

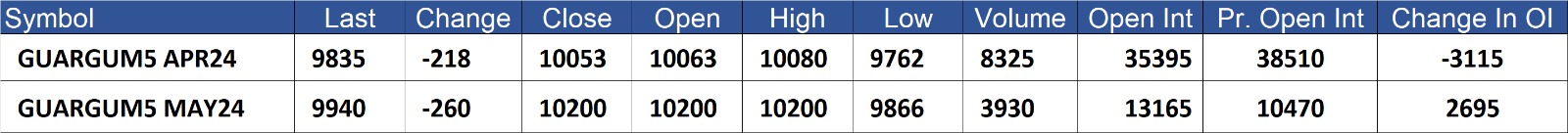

GuarGum contract for APR delivery settled at Rs 9835/quintal showing an fall of Rs -218 over previous close of Rs 10053/quintal,The contract moved in the range of Rs 9762-10080 for the day. Open interest decreased by -3115 MT to 35395 MT, while trading volume increased by 2750 to 8325 MT.

GuarGum contract for MAY delivery settled at Rs 9940/quintal showing an fall of Rs -260 over previous close of Rs 10200/quintal,The contract moved in the range of Rs 9866-10200 for the day. Open interest increased by 2695 MT to 13165 MT, while trading volume increased by 560 to 3930 MT.

Currently The spread between APR and MAY contract is -105 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 26-Mar-2024, was 26941 MT

(By Commoditiescontrol Bureau: +91 9820130172)