Jodhpur, March 12 (Commoditiescontrol): Guar seed and gum prices experienced a downturn in both the spot market and futures trading on Tuesday, attributed to sluggish buying activity and rising arrivals.

According to market sources, the average price range for guar seed in auctions was recorded at Rs 4700-4950 per quintal, with arrivals totaling around 9,500 bags for the day. Meanwhile, guar seed prices in all paid markets were quoted at Rs 5220 per quintal. Guar gum prices in the benchmark market of Jodhpur stood at Rs 10,300 per quintal.

On the NCDEX futures platform, guar gum futures for March delivery concluded Rs 49 or 0.48% lower at Rs 10,165 per quintal. The session witnessed a trading range between Rs 10,150 and Rs 10,280.

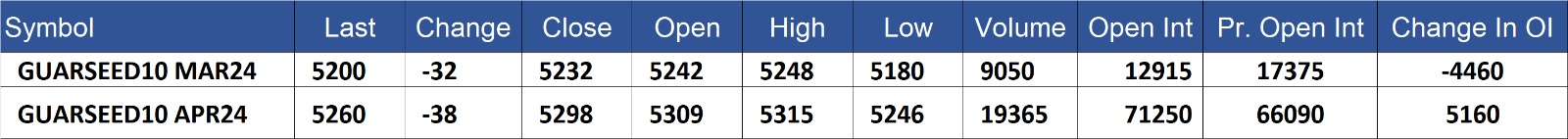

Similarly, guar seed futures for March delivery settled Rs 32 or 0.61% down at Rs 5,200 per quintal on the NCDEX. The trading range for the session fluctuated between Rs 5,180 and Rs 5,248.

Overall, the decline in prices across both guar seed and gum segments can be attributed to subdued buying interest coupled with increased arrivals in the market.

GuarSeed contract for MAR delivery settled at Rs 5200/quintal showing an fall of Rs -32 over previous close of Rs 5232/quintal,The contract moved in the range of Rs 5180-5248 for the day. Open interest decreased by -4460 MT to 12915 MT, while trading volume decreased by -4595 to 9050 MT.

GuarSeed contract for APR delivery settled at Rs 5260/quintal showing an fall of Rs -38 over previous close of Rs 5298/quintal,The contract moved in the range of Rs 5246-5315 for the day. Open interest increased by 5160 MT to 71250 MT, while trading volume decreased by -8020 to 19365 MT.

Currently The spread between MAR and APR contract is -60 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 12-Mar-2024, was 36543 MT

GuarGum contract for MAR delivery settled at Rs 10165/quintal showing an fall of Rs -49 over previous close of Rs 10214/quintal,The contract moved in the range of Rs 10150-10280 for the day. Open interest decreased by -2765 MT to 7400 MT, while trading volume decreased by -3005 to 4355 MT.

GuarGum contract for APR delivery settled at Rs 10274/quintal showing an fall of Rs -37 over previous close of Rs 10311/quintal,The contract moved in the range of Rs 10255-10370 for the day. Open interest increased by 2050 MT to 43525 MT, while trading volume decreased by -5620 to 6345 MT.

Currently The spread between MAR and APR contract is -109 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 12-Mar-2024, was 27655 MT

(By Commoditiescontrol Bureau: +91 9820130172)