Jodhpur, March 5 (Commoditiescontrol): Guar seed and gum prices witnessed a significant decline in both the physical market and futures on Tuesday due to substantial selling pressure. Bearish cues from the broader market contributed to the downward pressure, and traders noted a decrease in buying activities.

According to market sources, the average price range for guar seed in auctions was reported at Rs 4700-4950 per quintal, with around 12,000 bags of guar seed arriving on the day. In the benchmark market of Jodhpur, guar seed prices were quoted at Rs 5160 per quintal. Guar gum prices in the same market stood at Rs 10,200 per quintal.

On the NCDEX, guar gum futures for March delivery ended Rs 197 or 1.93% lower at Rs 10,000 per quintal. The session's low and high were recorded at Rs 9,930 and Rs 10,235, respectively. Meanwhile, guar seed futures for March delivery settled Rs 106 or 2.01% down at Rs 5,161 per quintal on the NCDEX, with a session range of Rs 5,150 to Rs 5,280.

The heavy selling pressure and subdued buying activities have contributed to the decline in guar seed and gum prices.

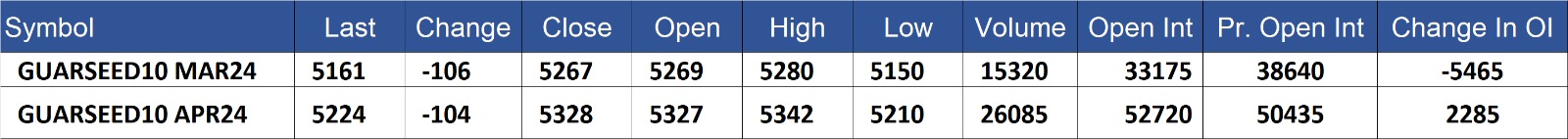

GuarSeed contract for MAR delivery settled at Rs 5161/quintal showing an fall of Rs -106 over previous close of Rs 5267/quintal,The contract moved in the range of Rs 5150-5280 for the day. Open interest decreased by -5465 MT to 33175 MT, while trading volume decreased by -8190 to 15320 MT.

GuarSeed contract for APR delivery settled at Rs 5224/quintal showing an fall of Rs -104 over previous close of Rs 5328/quintal,The contract moved in the range of Rs 5210-5342 for the day. Open interest increased by 2285 MT to 52720 MT, while trading volume decreased by -1255 to 26085 MT.

Currently The spread between MAR and APR contract is -63 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 05-Mar-2024, was 35936 MT

GuarGum contract for MAR delivery settled at Rs 10000/quintal showing an fall of Rs -197 over previous close of Rs 10197/quintal,The contract moved in the range of Rs 9930-10235 for the day. Open interest decreased by -2670 MT to 20435 MT, while trading volume increased by 3515 to 7375 MT.

GuarGum contract for APR delivery settled at Rs 10122/quintal showing an fall of Rs -195 over previous close of Rs 10317/quintal,The contract moved in the range of Rs 10034-10350 for the day. Open interest increased by 1740 MT to 33000 MT, while trading volume increased by 6120 to 11375 MT.

Currently The spread between MAR and APR contract is -122 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 05-Mar-2024, was 28677 MT

(By Commoditiescontrol Bureau: +91 9820130172)