New Delhi, February 27 (Commoditiescontrol): Guar seed and gum prices experienced a rebound on Tuesday as buying activities surged at lower levels. Market sources reported an average price range of Rs 4700-5050 per quintal for guar seed in auctions, with arrivals totaling around 15,000 bags on the day.

Guar seed prices gained Rs 30 per quintal, while gum prices saw an increase of Rs 50 per quintal. In overall pricing, guar seed was quoted at Rs 5350 per quintal, and guar gum prices reached Rs 10,500 per quintal in the benchmark market of Jodhpur.

On the National Commodity and Derivatives Exchange (NCDEX), guar gum futures for delivery in March ended Rs 41 or 0.40% higher at Rs 10,321 per quintal. The session's low and high were recorded at Rs 10,275 and Rs 10,430, respectively.

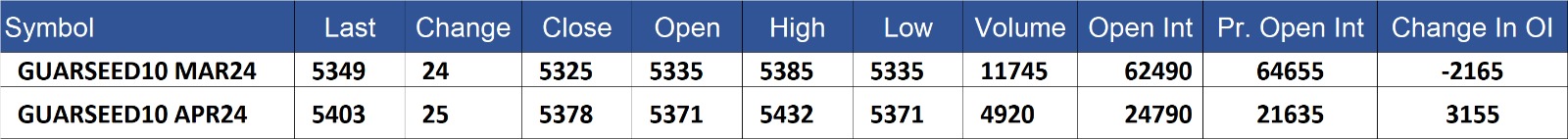

Similarly, guar seed futures for delivery in March settled Rs 24 or 0.45% higher at Rs 5,349 per quintal on the NCDEX. The session's low and high were reported at Rs 5,335 and Rs 5,385, respectively.

The market trends indicate a positiveness in guar seed and gum prices, fueled by increased buying interest at lower levels, creating an optimistic outlook for the near term.

GuarSeed contract for MAR delivery settled at Rs 5349/quintal showing an rise of Rs 24 over previous close of Rs 5325/quintal,The contract moved in the range of Rs 5335-5385 for the day. Open interest decreased by -2165 MT to 62490 MT, while trading volume decreased by -435 to 11745 MT.

GuarSeed contract for APR delivery settled at Rs 5403/quintal showing an rise of Rs 25 over previous close of Rs 5378/quintal,The contract moved in the range of Rs 5371-5432 for the day. Open interest increased by 3155 MT to 24790 MT, while trading volume decreased by -1125 to 4920 MT

Currently The spread between MAR and APR contract is -54 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 27-Feb-2024, was 34592 MT

GuarGum contract for MAR delivery settled at Rs 10321/quintal showing an rise of Rs 41 over previous close of Rs 10280/quintal,The contract moved in the range of Rs 10275-10430 for the day. Open interest decreased by -2660 MT to 35340 MT, while trading volume decreased by -460 to 6310 MT.

GuarGum contract for APR delivery settled at Rs 10450/quintal showing an rise of Rs 39 over previous close of Rs 10411/quintal,The contract moved in the range of Rs 10445-10571 for the day. Open interest increased by 2740 MT to 18210 MT, while trading volume increased by 345 to 4400 MT.

Currently The spread between MAR and APR contract is -129 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 27-Feb-2024, was 29141 MT

(By Commoditiescontrol Bureau: +91 9820130172)