Mumbai, April 15 (CommoditiesControl): Turmeric prices in major spot markets exhibited a mixed trend, with increases noted in Erode. Meanwhile, price declines were observed in Basmatnagar, Warangal, while other centers remained stable.

Despite this, demand remained robust at current price levels following a recent correction. However, muted export demand continues to exert pressure on prices.

Arrivals saw a sharp increase to 50,100 bags from 66,600 bags in the previous session, despite a decline in overall arrivals. Market participants suggest that lower arrivals may be attributed to stockists or farmers holding onto their stocks in anticipation of price hikes. Notable arrivals were reported in Nizamabad (7,000 bags), Erode (2,800 bags), Duggirala (7,000 bags), Sangli (5,000 bags), and Hingoli (25,000 bags). Arrivals continue to remain 20-30% lower than usual due to significantly reduced output.

Turmeric futures prices on the NCDEX witnessed a rebound following strong buying activity at lower price levels. After experiencing a notable decline in the preceding 5-6 sessions due to profit booking, prices rose by 2.0% in April contracts and 1.7% in June contracts. NCDEX futures prices are expected to remain supported in the coming days.

NCDEX Spot (RS/Qtl)

- Nizamabad - NCDEX Polished: 16,000

- Nizamabad - NCDEX Unpolished: 15,125

- Sangli - NCDEX Rajapore: 17,458

NCDEX Future (RS/Qtl)

- Apr-24: 15,958 (+212, +2.0%)

- Jun-24: 16,332 (+220, +1.7%)

.jpeg)

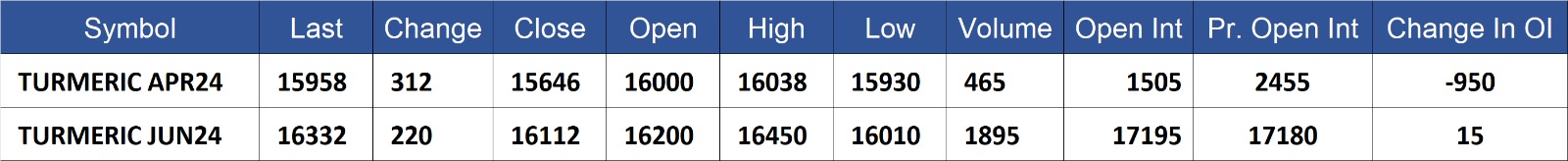

Turmeric contract for APR delivery settled at Rs 15958/quintal showing an rise of Rs 312 over previous close of Rs 15646/quintal,The contract moved in the range of Rs 15930-16038 for the day. Open interest decreased by -950 MT to 1505 MT, while trading volume decreased by -3925 to 465 MT.

Turmeric contract for JUN delivery settled at Rs 16332/quintal showing an rise of Rs 220 over previous close of Rs 16112/quintal,The contract moved in the range of Rs 16010-16450 for the day. Open interest increased by 15 MT to 17195 MT, while trading volume decreased by -5150 to 1895 MT.

Currently The spread between APR and JUN contract is -374 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)