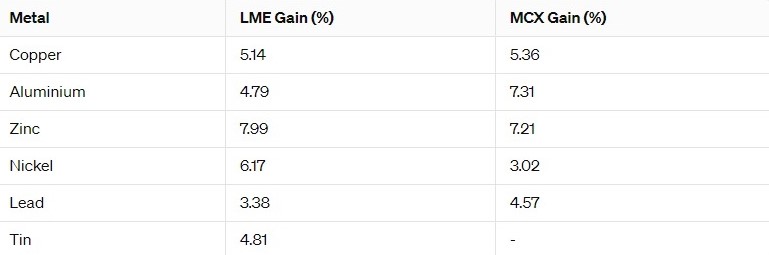

Mumbai, 05 April (CommoditiesControl): Most base metals closed the week with robust gains. This surge was supported by a softer dollar, plans for output cuts from Chinese firms, and optimism stemming from recent data in the country.

The rally in base metal prices was bolstered by a weaker dollar, which made dollar-denominated metals cheaper for holders of other currencies. Additionally, plans for output cuts from Chinese firms contributed to the upward momentum.

Furthermore, optimism was fueled by Fed Chair Jerome Powell's reaffirmation of his stance on potential rate cuts.

The release of stronger-than-expected manufacturing data from China earlier in the week added to the positive sentiment, boosting optimism regarding metal demand in the world's largest consumer of metals.

(By Commoditiescontrol Bureau; +91-9820130172)