Mumbai, March 21 (CommoditiesControl): Turmeric prices in major spot markets displayed predominantly weak sentiment, except for Duggirala, Nizamabad, and Basmatnagar, where prices remained stable. However, Erode, Warangal, and Nanded markets saw a decline of Rs 200-500 per quintal attributed to lower futures prices. Spot demand remained subdued following a sharp price increase, prompting a correction in major spot markets. Market participants reported export inquiries, which are anticipated to lend support to prices in the near term.

Arrivals witnessed a decrease to 40,300 bags from 46,600 bags in the previous session, primarily due to reduced arrivals in Nizamabad and the closure of Hingoli. Notable arrival figures included 10,000 bags in Nizamabad, 9,300 bags in Erode, 16,500 bags in Sangli, 3,000 bags in Basmatnagar, and 1,500 bags in Nanded. Market updates highlighted that arrivals were 20-30% lower than anticipated, mainly due to significantly reduced output.

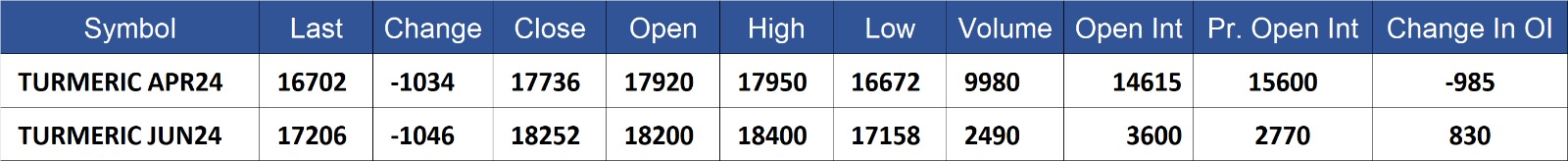

Turmeric futures prices on the NCDEX markets experienced a sharp decline, settling near the lower circuit as profit booking ensued at higher price levels. Prices witnessed a substantial drop of 5.8% in April contracts and 5.7% in June contracts.

NCDEX Spot (RS/Qtl)

- Nizamabad - NCDEX Polished: Rs 16,412

- Nizamabad - NCDEX Unpolished: Rs 15,693

- Sangli - NCDEX Rajapore: Rs 18,180

NCDEX Future (RS/Qtl)

- Apr-24: Rs 16,702 (-1,034, -5.8%)

- Jun-24: Rs 17,206 (-1,046, -5.7%)

.jpeg)

Turmeric contract for APR delivery settled at Rs 16702/quintal showing an fall of Rs -1034 over previous close of Rs 17736/quintal,The contract moved in the range of Rs 16672-17950 for the day. Open interest decreased by -985 MT to 14615 MT, while trading volume increased by 6565 to 9980 MT.

Turmeric contract for JUN delivery settled at Rs 17206/quintal showing an fall of Rs -1046 over previous close of Rs 18252/quintal,The contract moved in the range of Rs 17158-18400 for the day. Open interest increased by 830 MT to 3600 MT, while trading volume increased by 1245 to 2490 MT.

Currently The spread between APR and JUN contract is -504 Rs/quintal

(By Commoditiescontrol Bureau: +91 9820130172)