Jodhpur, March 19 (Commoditiescontrol): Guar seed and gum prices remained nearly steady in the physical market on Tuesday, while futures concluded on a firm note.

According to market sources, the average price range for guar seed in auctions was quoted at Rs 4700-4850 per quintal, with arrivals totaling around 8,800 bags today.

In spot markets, guar seed prices were quoted at Rs 5150 per quintal. Meanwhile, guar gum prices stood at Rs 10,100 per quintal in the benchmark market of Jodhpur.

On the futures front, guar gum futures for delivery in April closed Rs 54 or 0.54% higher at Rs 10,035 per quintal on the NCDEX. The session's low and high were recorded at Rs 9,905 and Rs 10,050, respectively.

Similarly, guar seed futures for delivery in March settled Rs 24 or 0.46% up at Rs 5,200 per quintal on the NCDEX.

For futures contracts maturing in April, guar seed prices settled Rs 98 or 1.66% higher at Rs 5,995 per quintal on the NCDEX. The session saw a low of Rs 5,842 and a high of Rs 5,998.

The firmness in guar seed and gum prices can be attributed to improved buying activity in the market, indicating positive sentiment among traders and investors.

GuarSeed contract for MAR delivery settled at Rs 5200/quintal showing an rise of Rs 24 over previous close of Rs 5176/quintal,The contract moved in the range of Rs 5200-5200 for the day. Open interest decreased by -250 MT to 520 MT, while trading volume decreased by -310 to 10 MT.

GuarSeed contract for APR delivery settled at Rs 5180/quintal showing an rise of Rs 2 over previous close of Rs 5178/quintal,The contract moved in the range of Rs 5136-5188 for the day. Open interest decreased by -1325 MT to 75095 MT, while trading volume decreased by -4315 to 13165 MT.

Currently The spread between MAR and APR contract is 20 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 19-Mar-2024, was 36874 MT

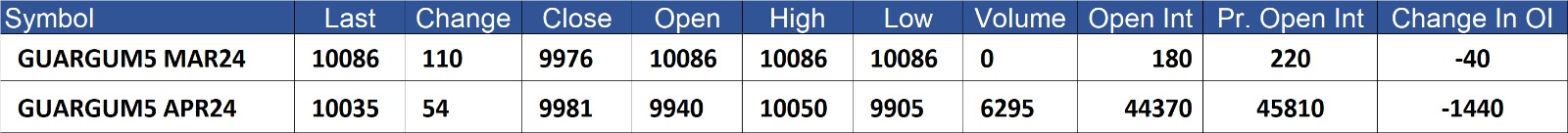

GuarGum contract for MAR delivery settled at Rs 10086/quintal showing an rise of Rs 110 over previous close of Rs 9976/quintal,The contract moved in the range of Rs 10086-10086 for the day. Open interest decreased by -40 MT to 180 MT, while trading volume was simillar by 0 to 0 MT.

GuarGum contract for APR delivery settled at Rs 10035/quintal showing an rise of Rs 54 over previous close of Rs 9981/quintal,The contract moved in the range of Rs 9905-10050 for the day. Open interest decreased by -1440 MT to 44370 MT, while trading volume decreased by -1490 to 6295 MT.

Currently The spread between MAR and APR contract is 51 Rs/quintal

GuarGum stock in NCDEX accredited warehouse as on 19-Mar-2024, was 27560 MT

(By Commoditiescontrol Bureau: +91 9820130172)