Ahmedabad, March 15 (CommoditiesControl): The cumin market in Gujarat continues to grapple with oversupply as arrivals remain high, leading to an increase in pending stocks across mandis. Today witnessed the arrival of around 55,000-60,000 bags of cumin in Gujarat, exacerbating the existing situation where around 20,000-22,000 bags of cumin are lying without trade due to a lack of demand. Consequently, market prices softened further, dropping by Rs 50 per 20 kg.

Export data for January 2024 reveals a significant uptick in cumin exports, reaching 13231.19 tonnes compared to 8049.71 tonnes in the same period last year, marking an impressive increase of 64%.

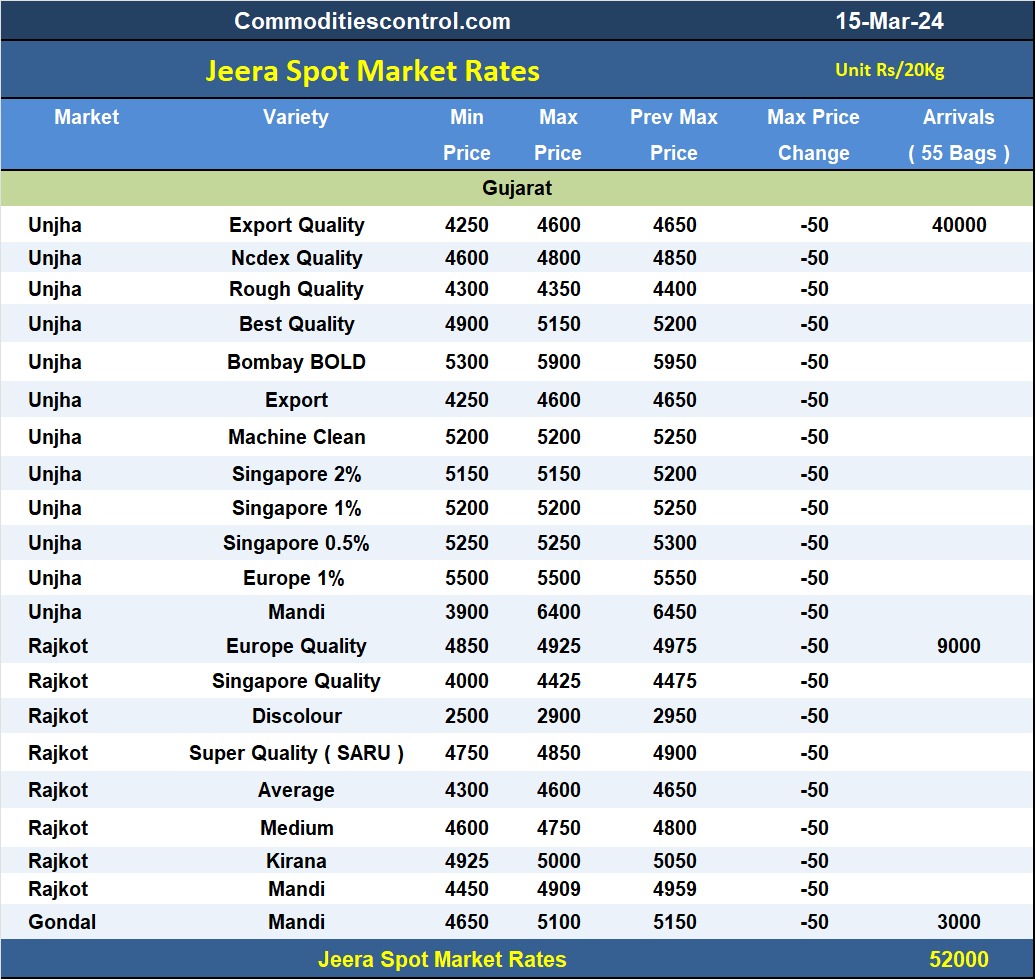

Despite the substantial arrivals, prices witnessed a decline of Rs 50 per 20 kg across the state. In Unja, around 40,000 bags of new cumin arrived, with prices ranging from Rs 4300-4350 for rough quality, Rs 4900-5150 for the best quality, and Rs 5300-5900 for Bombay Bold variety. However, only around 22000-25000 sacks were traded.

In Rajkot Mandi, where around 9000 bags arrived, prices ranged from Rs 4450-4909 per 20 kg. Meanwhile, in Gondal Mandi, where 3000 bags were recorded, prices fluctuated between Rs 4650-5100 per 20 kg depending on the quality.

With exports showing robust growth, stakeholders in the cumin trade are optimistic about the long-term prospects, despite the current challenges posed by oversupply in the domestic market.

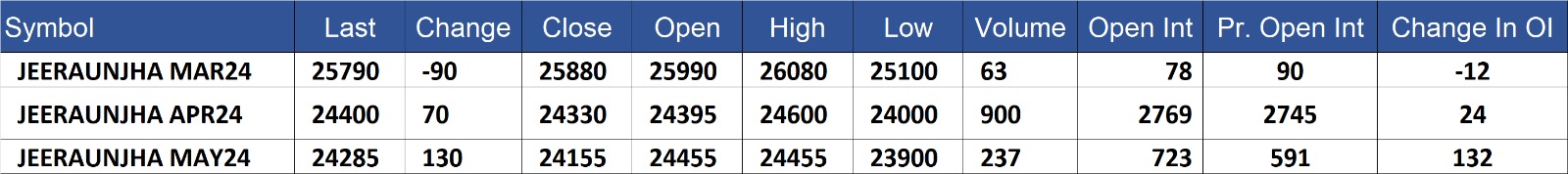

Jeeraunjha contract for MAR delivery settled at Rs 25790/quintal showing an fall of Rs -90 over previous close of Rs 25880/quintal,The contract moved in the range of Rs 25100-26080 for the day. Open interest decreased by -12 MT to 78 MT, while trading volume decreased by -108 to 63 MT.

Jeeraunjha contract for APR delivery settled at Rs 24400/quintal showing an rise of Rs 70 over previous close of Rs 24330/quintal,The contract moved in the range of Rs 24000-24600 for the day. Open interest increased by 24 MT to 2769 MT, while trading volume decreased by -1005 to 900 MT.

Jeeraunjha contract for MAY delivery settled at Rs 24285/quintal showing an rise of Rs 130 over previous close of Rs 24155/quintal,The contract moved in the range of Rs 23900-24455 for the day. Open interest increased by 132 MT to 723 MT, while trading volume increased by 48 to 237 MT.

Currently The spread between MAR and APR contract is 1390 Rs/quintal.

Currently The spread between APR and MAY contract is 115 Rs/quintal.

Currently The spread between MAR and MAY contract is 1505 Rs/quintal

JeeraUnjha stock in NCDEX accredited warehouse as on 15-Mar-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)