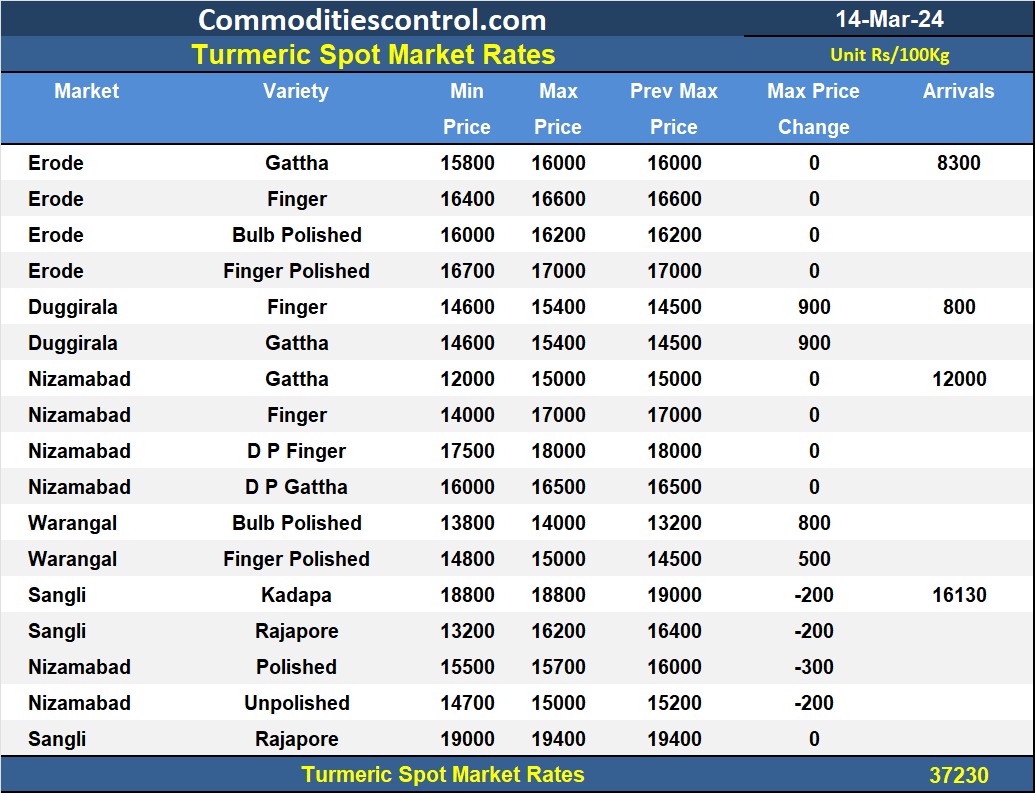

Mumbai, March 14 (Commoditiescontrol): Turmeric prices across major spot markets have demonstrated stability, except for Duggirala and Warangal, which witnessed an increase of Rs 800-1,000 per quintal after reopening following a day of closure. This surge is attributed to robust Ramadan demand. Despite the sharp rise, spot market prices have maintained stability.

Arrivals dipped to 37,320 bags from the previous session's 47,500, primarily due to reduced arrivals in major markets and the closure of some markets in Maharashtra. Notable figures include 12,000 bags in Nizamabad, 8,300 in Erode, 16,000 in Sangli, and 800 in Duggirala. Market reports suggest arrivals were 20-30% lower than anticipated, owing to markedly reduced output.

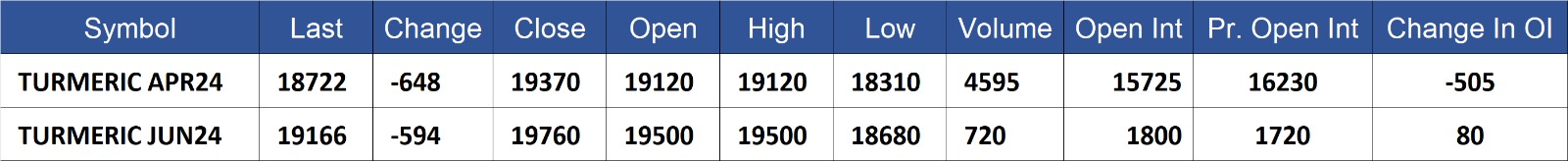

Contrarily, turmeric futures prices on the NCDEX markets deviated from the recent upward trend, experiencing a decline due to profit booking after several consecutive sessions of sharp increases. Over the past 2-3 sessions, prices have been consolidating. Notably, April and June contracts saw a decline of 3.4% and 3.0% respectively. While demand remains robust, sellers are expected to exercise caution amidst the significant price surge, contributing to price stability.

NCDEX Spot Prices (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,735

- Nizamabad - NCDEX Unpolished: 15,950

- Sangli - NCDEX Rajapore: 19,010

NCDEX Future Prices (RS/Qtl):

- Apr-24: 18,722 (-648, -3.4%)

- Jun-24: 19,166 (-594, -3.0%)

Turmeric contract for APR delivery settled at Rs 18722/quintal showing an fall of Rs -648 over previous close of Rs 19370/quintal,The contract moved in the range of Rs 18310-19120 for the day. Open interest decreased by -505 MT to 15725 MT, while trading volume decreased by -120 to 4595 MT.

Turmeric contract for JUN delivery settled at Rs 19166/quintal showing an fall of Rs -594 over previous close of Rs 19760/quintal,The contract moved in the range of Rs 18680-19500 for the day. Open interest increased by 80 MT to 1800 MT, while trading volume increased by 130 to 720 MT.

Currently The spread between APR and JUN contract is -444 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)