Ahmedabad, March 01 (Commodities Control): The cumin market is witnessing a notable improvement in prices, driven by active export trade. Today, around 50,000 bags of new cumin arrived, with an additional 30,000 bags pending from old stocks. This resulted in around 90,000 bags of cumin being available for auction.

Despite slow but robust trades, the upcoming export deliveries scheduled after March 5th have played a crucial role in boosting market sentiment. As a result, the cumin market has witnessed a consistent improvement, with prices recording a rise of Rs 100 per 20 kg for the third consecutive day.

Traders emphasize that the possibility of a downturn below Rs 5000 seems unlikely at the moment. The deliveries for export in March are approaching, and with the potential for increased sales, the recent price surge is expected to encourage farmers to participate more actively in the market.

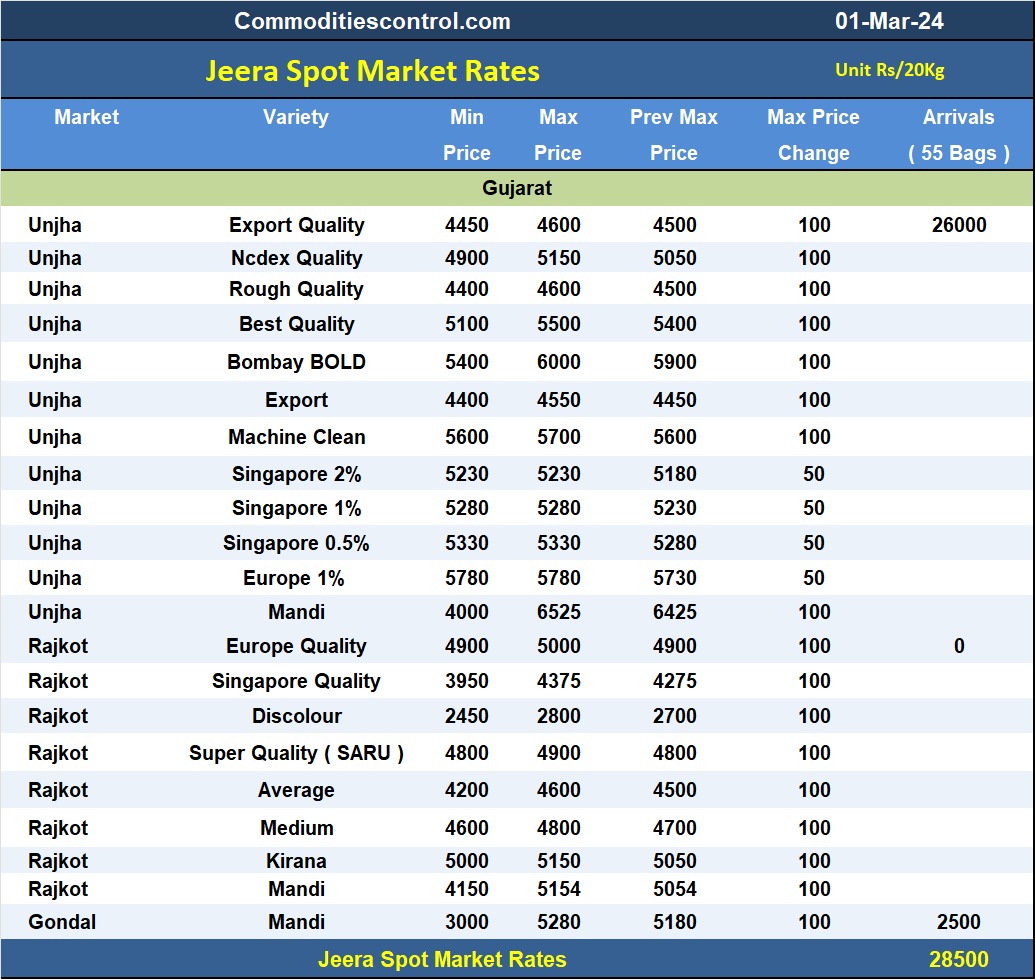

In Unja, where around 26,000 bags of new cumin arrived, the price for rough cumin ranged between Rs 4400-4600 per 20 kg, while the best quality commanded a price of Rs 5100-5500 per 20 kg. Bombay Bold cumin, a premium variety, was priced at Rs 5500-6000 per 20 kg. An additional 18,000 sacks were available from nearby businesses.

Traders in Rajkot Mandi reported a halt in new arrivals due to pending sacks. However, transactions were still conducted at prices ranging from Rs 4150-5154. In Gondal Mandi, around 2500 bags arrived, with an additional 11,000 bags pending. Prices in this market varied from Rs 3500-5280 per 20 kg, depending on the quality of the cumin.

Jeeraunjha contract for MAR delivery settled at Rs 25385/quintal showing an rise of Rs 640 over previous close of Rs 24745/quintal,The contract moved in the range of Rs 24620-25480 for the day. Open interest decreased by -57 MT to 1563 MT, while trading volume increased by 147 to 597 MT

Jeeraunjha contract for APR delivery settled at Rs 24290/quintal showing an rise of Rs 285 over previous close of Rs 24005/quintal,The contract moved in the range of Rs 23800-24510 for the day. Open interest increased by 126 MT to 2037 MT, while trading volume increased by 510 to 825 MT.

Jeeraunjha contract for MAY delivery settled at Rs 24395/quintal showing an rise of Rs 400 over previous close of Rs 23995/quintal,The contract moved in the range of Rs 24195-24700 for the day. Open interest increased by 15 MT to 240 MT, while trading volume increased by 18 to 33 MT.

Currently The spread between MAR and APR contract is 1095 Rs/quintal.

Currently The spread between APR and MAY contract is -105 Rs/quintal.

Currently The spread between MAR and MAY contract is 990 Rs/quintal

JeeraUnjha stock in NCDEX accredited warehouse as on 01-Mar-2024, was NA MT

.jpeg)

(By Commoditiescontrol Bureau: +91 9820130172)