New Delhi, February 20 (Commoditiescontrol): Menatha oil prices remained steady on Tuesday, influenced by subdued buying both in the physical market and futures. The current scenario indicates that the planting of the new crop has already commenced in key growing regions such as Barabanki, Rampur, Chandausi, and Sambhal in Uttar Pradesh.

However, market analysts suggest that the acreage of mentha crops may witness a decline compared to the previous year. This potential reduction is attributed to farmers facing challenges in securing remunerative prices due to the economic slowdown in China, a significant buyer of natural mentha oil from India. Prices have experienced a decline due to sluggish demand from both the local industry and exporters.

In the Chandausi market, mentha oil prices were reported at Rs 990 per kg, while in Barabanki, prices stood at Rs 970 per kg.

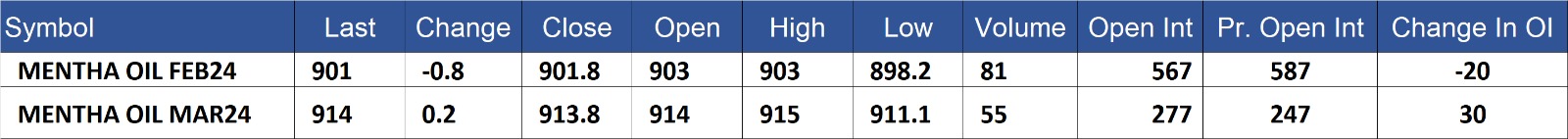

On the MCX, the benchmark contract of mentha oil for February delivery traded flat at Rs 901 per kg, with an open interest of 567 and a volume of 81. Meanwhile, another benchmark contract for February delivery traded Rs 0.5 or 0.05% up at Rs 914 per kg on the MCX, with an open interest of 277 and a volume of 55.

The steadiness in mentha oil prices reflects the current market sentiment characterized by slow demand and cautious buying behavior. As the planting of the new crop progresses and demand dynamics evolve, market participants continue to monitor factors that may influence mentha oil prices in the coming sessions.

Mentha Oil contract for FEB delivery settled at Rs 901/quintal showing an fall of Rs -0.8 over previous close of Rs 901.8/quintal,The contract moved in the range of Rs 898.2-903 for the day. Open interest decreased by -20 MT to 567 MT, while trading volume decreased by -17 to 81 MT.

Mentha Oil contract for MAR delivery settled at Rs 914/quintal showing an rise of Rs 0.2 over previous close of Rs 913.8/quintal,The contract moved in the range of Rs 911.1-915 for the day. Open interest increased by 30 MT to 277 MT, while trading volume decreased by -24 to 55 MT.

Mentha Oil contract for MAR delivery settled at Rs 914/quintal showing an rise of Rs 0.2 over previous close of Rs 913.8/quintal,The contract moved in the range of Rs 911.1-915 for the day. Open interest increased by 30 MT to 277 MT, while trading volume decreased by -24 to 55 MT.

Currently The spread between FEB and MAR contract is -13 Rs/quintal.

Currently The spread between MAR and MAR contract is 0 Rs/quintal.

Currently The spread between FEB and MAR contract is -13 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)