Jodhpur, February 5 (Commoditiescontrol): Guar seed and gum prices witnessed a decline in major markets across the country, as well as in futures trading, on Monday. The drop was attributed to profit-booking activities, coupled with weak demand for guar seed and gum on the day.

Market sources reported an average price range for guar seed in auctions at Rs 4600-5050 per quintal, with around 14,000 bags of guar seed arrivals today. In all paid transactions, guar seed prices were quoted at Rs 5270 per quintal. Guar gum prices in the benchmark market of Jodhpur stood at Rs 10,300 per quintal. Approximately 700 tonnes of guar gum were reportedly sold across major markets in the country.

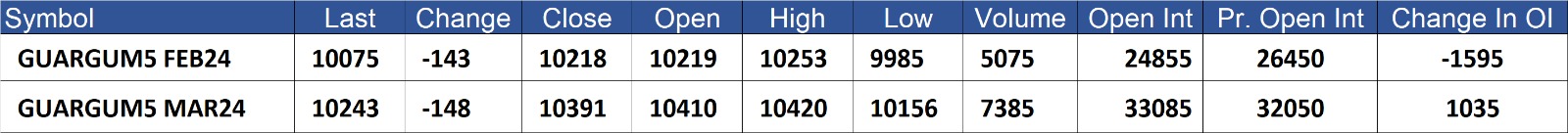

On the NCDEX, guar gum futures for delivery in February ended Rs 143 or 1.40% down at Rs 10,075 per quintal, with the session's low and high recorded at Rs 9,985 and Rs 10,253, respectively. Similarly, guar gum futures for delivery in March closed Rs 148 or 1.42% down at Rs 10,243 per quintal, with the low and high of the session reported at Rs 10,156 and Rs 10,420, respectively.

Guar seed futures for delivery in February settled Rs 72 or 1.34% down at Rs 5,290 per quintal on the NCDEX, with the session's low and high recorded at Rs 5,261 and Rs 5,378, respectively. Guar seed futures for delivery in March closed Rs 71 or 1.31% down at Rs 5,348 per quintal, with the low and high of the session reported at Rs 5,315 and Rs 5,426, respectively.

GuarSeed contract for FEB delivery settled at Rs 5290/quintal showing an fall of Rs -72 over previous close of Rs 5362/quintal,The contract moved in the range of Rs 5261-5378 for the day. Open interest decreased by -2460 MT to 43055 MT, while trading volume decreased by -4610 to 10720 MT.

GuarSeed contract for MAR delivery settled at Rs 5348/quintal showing an fall of Rs -71 over previous close of Rs 5419/quintal,The contract moved in the range of Rs 5315-5426 for the day. Open interest increased by 3630 MT to 49595 MT, while trading volume increased by 2655 to 17610 MT.

Currently The spread between FEB and MAR contract is -58 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 05-Feb-2024, was 32444 MT

.jpeg)

GuarGum contract for FEB delivery settled at Rs 10075/quintal showing an fall of Rs -143 over previous close of Rs 10218/quintal,The contract moved in the range of Rs 9985-10253 for the day. Open interest decreased by -1595 MT to 24855 MT, while trading volume decreased by -1310 to 5075 MT.

GuarGum contract for MAR delivery settled at Rs 10243/quintal showing an fall of Rs -148 over previous close of Rs 10391/quintal,The contract moved in the range of Rs 10156-10420 for the day. Open interest increased by 1035 MT to 33085 MT, while trading volume increased by 290 to 7385 MT.

Currently The spread between FEB and MAR contract is -168 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 05-Feb-2024, was 32090 MT

(By Commoditiescontrol Bureau: +91 9820130172)