Mumbai, April 25 (CommoditiesControl): Malaysian palm oil futures experienced a slight uptick on Thursday, tracking movements in Chicago soy oil futures, as the contract sought stability following a recent decline, while awaiting fresh market catalysts.

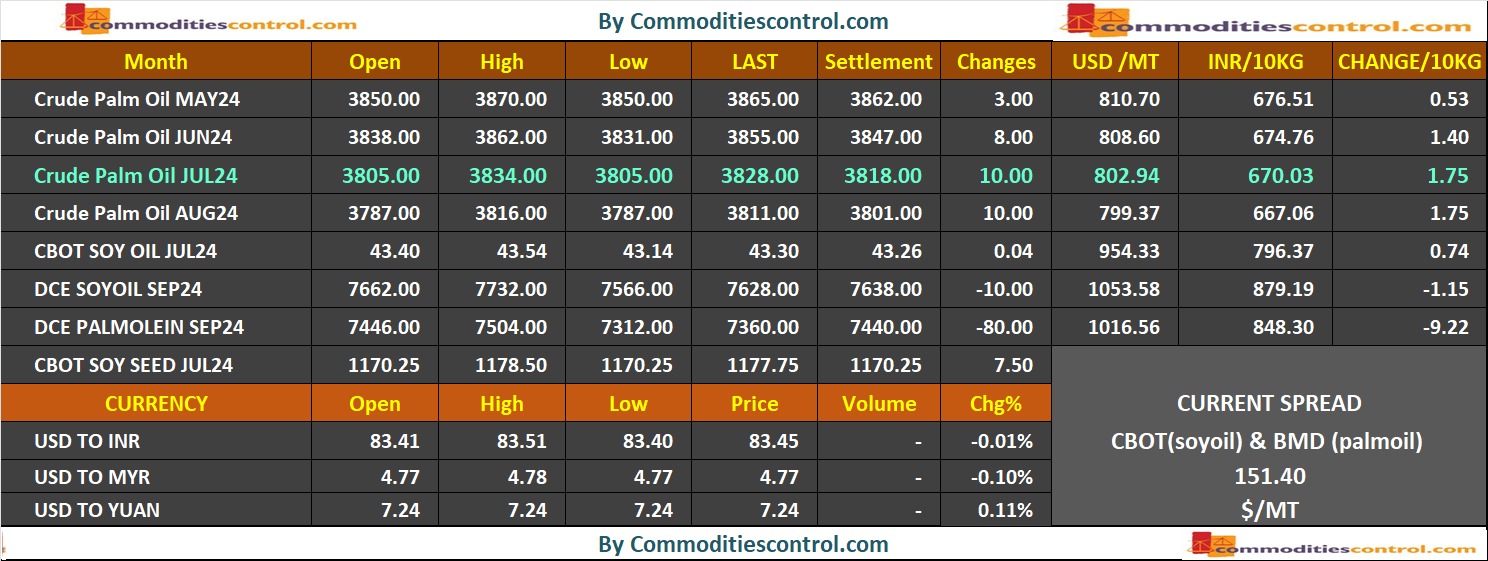

During the midday break, the benchmark palm oil contract for July delivery on the Bursa Malaysia Derivatives Exchange showed an increase of 10 ringgit, or 0.26%, reaching 3,809 ringgit per metric ton.

In morning trading, the contract fluctuated between 3,805 ringgit and 3,834 ringgit. This movement follows a 2.48% decline in the previous session, marking its most significant daily loss since April 16.

According to a trade source, the Bursa Malaysia crude palm oil contract is in a holding pattern for May, anticipating a rise in production coupled with a decrease in exports.

Reports from cargo surveyors Intertek Testing Services and Amspec Agri indicated a decline in Malaysian palm oil exports ranging between 9% and 11.5% in April compared to the previous month.

Indonesia, the largest global exporter of palm oil, opted to maintain its export tax and levy for May at $52 per ton and $90 per ton, respectively.

Meanwhile, soy oil prices on the Chicago Board of Trade saw a marginal increase of 0.07%. The Dalian Commodity Exchange remains closed until May 5 in observance of International Labour Day holidays.

Investors may eye a buying opportunity in Malaysian palm oil if it closes above 3835, aligning with the 21-day EMA on the 15-minute timeframe, with a target range of 3860-3885 and a stop loss at 3820.

Global Futures of Palm oil and Soy oil

(By CommoditiesControl Bureau; +91-9820130172)