New Delhi, April 5, 2024 (Commoditiescontrol): Turmeric spot prices exhibited a mixed trend in major markets, with Erode, Nizamabad, and Warangal experiencing increases ranging from Rs 200 to Rs 500 per quintal, while Nanded saw a decline of Rs 500 per quintal.

Strong domestic demand contrasted with subdued export demand, with Ramadan demand from Bangladesh failing to meet expectations. However, the overall market sentiment remains buoyant due to expectations of significantly lower production this season, supporting prices in the medium to long term. Sangli market remained closed for the week and is anticipated to resume activity at the beginning of the week following Gudi Padwa celebrations.

Arrivals dipped to 19,000 bags from 20,000 bags in the previous session, with declines observed across all major markets. Nizamabad reported 4,000 bags, while Nanded and Hingoli reported 5,000 and 10,000 bags, respectively. Market participants noted that arrivals were 20-30% lower than anticipated due to reduced output.

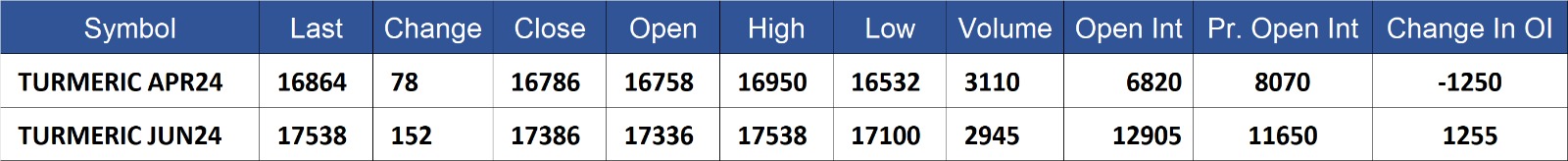

Meanwhile, turmeric futures prices on the National Commodity & Derivatives Exchange (NCDEX) market recorded a slight uptick. Prices increased by 0.5% in April contracts and 0.9% in June contracts. NCDEX futures prices are expected to remain supported in the coming days.

NCDEX Spot (RS/Qtl)

- Nizamabad - NCDEX Polished: 16,577

- Nizamabad - NCDEX Unpolished: 15,642

- Sangli - NCDEX Rajapore: 18,360

NCDEX Future (RS/Qtl)

- Apr-24: 16,864 (+78, +0.5%)

- Jun-24: 17,538 (+152, +0.9%)

Turmeric contract for APR delivery settled at Rs 16864/quintal showing an rise of Rs 78 over previous close of Rs 16786/quintal,The contract moved in the range of Rs 16532-16950 for the day. Open interest decreased by -1250 MT to 6820 MT, while trading volume increased by 65 to 3110 MT.

Turmeric contract for JUN delivery settled at Rs 17538/quintal showing an rise of Rs 152 over previous close of Rs 17386/quintal,The contract moved in the range of Rs 17100-17538 for the day. Open interest increased by 1255 MT to 12905 MT, while trading volume increased by 55 to 2945 MT

Currently The spread between APR and JUN contract is -674 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)