Mumbai, March 22 (CommoditiesControl): Turmeric prices in major spot markets displayed a mixed trend, with declines noted in Erode and Sangli, while Warangal witnessed an increase. The Finger variety experienced a decrease in prices in Erode after a previous sharp rise earlier in the week. However, prices in other markets remained stable. The surge in prices on NCDEX futures suggests a potential upward movement in spot prices expected in the upcoming sessions.

Despite slow trading activity due to year-end closing activities and the Holi festival, spot demand remained robust following a recent price drop. Export inquiries have been reported, indicating potential support for prices in the market.

Arrivals dipped to 36,800 bags from 40,300 bags in the previous session, primarily due to lower arrivals in Nizamabad and Erode. Arrivals have witnessed a significant decline over the last few sessions as prices fell. Notably, arrivals were 20-30% lower than expected, attributed to substantially lower output.

Turmeric futures prices on the NCDEX markets have rebounded from previous losses, driven by bargain buying, keeping prices relatively stable. Prices saw a notable increase of 5.2% in April contracts and 5.5% in June contracts.

NCDEX Spot Prices (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,528

- Nizamabad - NCDEX Unpolished: 15,748

- Sangli - NCDEX Rajapore: 18,495

NCDEX Future Prices (RS/Qtl):

- Apr-24: 17,636 (+878, +5.2%)

- Jun-24: 18,200 (+944, +5.5%)

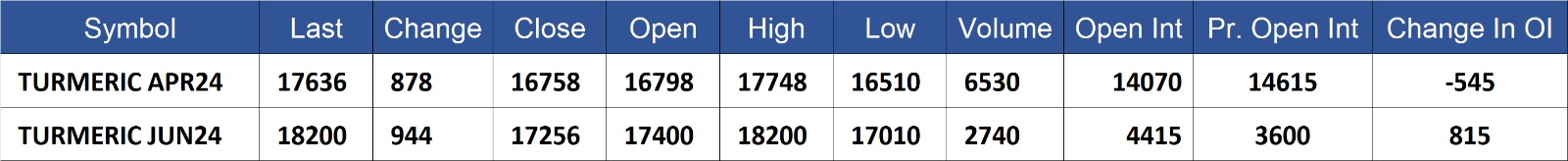

Turmeric contract for APR delivery settled at Rs 17636/quintal showing an rise of Rs 878 over previous close of Rs 16758/quintal,The contract moved in the range of Rs 16510-17748 for the day. Open interest decreased by -545 MT to 14070 MT, while trading volume decreased by -3450 to 6530 MT.

Turmeric contract for JUN delivery settled at Rs 18200/quintal showing an rise of Rs 944 over previous close of Rs 17256/quintal,The contract moved in the range of Rs 17010-18200 for the day. Open interest increased by 815 MT to 4415 MT, while trading volume increased by 250 to 2740 MT.

Currently The spread between APR and JUN contract is -564 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)