Mumbai, March 15 (CommoditiesControl): Turmeric prices in major spot markets exhibited a mixed trend, with prices declining between Rs 500 and 700 per quintal in major Maharashtra markets while witnessing a rise of Rs 400 per quintal in Erode markets. This variance in prices can be attributed to subdued spot demand following a sharp increase in prices, prompting a correction in major spot markets.

Arrivals surged to 58,300 bags from 37,320 in the previous session, driven by the opening of all Maharashtra markets and increased arrivals in Erode and Sangli. Nizamabad reported 12,000 bags, Erode 10,300, Sangli 20,200, Basmatnagar 4,000 bags, and Hingoli 10,000. Despite the increase in arrivals, it's noted that they were 20-30% lower than anticipated due to significantly lower output.

Meanwhile, turmeric futures prices on NCDEX markets experienced a sharp decline, being locked in a lower circuit following profit booking after a notable rise over the previous 5-6 sessions. Both April and June contracts witnessed a 6% decrease in prices.

NCDEX Spot Prices (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,535

- Nizamabad - NCDEX Unpolished: 15,736

- Sangli - NCDEX Rajapore: 18,546

NCDEX Futures Prices (RS/Qtl):

- Apr-24: 17,620 ( -1,124, -6.0%)

- Jun-24: 17,834 ( -1,088, -6.0%)

(1).jpeg)

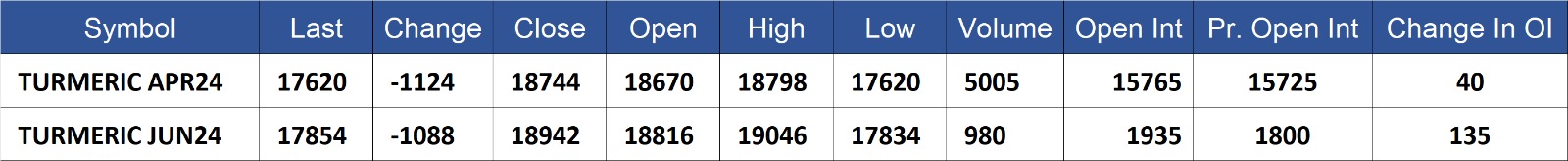

Turmeric contract for APR delivery settled at Rs 17620/quintal showing an fall of Rs -1124 over previous close of Rs 18744/quintal,The contract moved in the range of Rs 17620-18798 for the day. Open interest increased by 40 MT to 15765 MT, while trading volume increased by 410 to 5005 MT.

Turmeric contract for JUN delivery settled at Rs 17854/quintal showing an fall of Rs -1088 over previous close of Rs 18942/quintal,The contract moved in the range of Rs 17834-19046 for the day. Open interest increased by 135 MT to 1935 MT, while trading volume increased by 260 to 980 MT.

Currently The spread between APR and JUN contract is -234 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)