|

|

Red gram (Tur) |

| 07 October 2015 07:29 PM |

|

|

Red gram is commonly known as Tur or Arhar (Pigeon pea) in India and is the second important pulse in the country after gram (chana). The ability of red gram to produce high economic yields under soil moisture deficit makes it an important crop in rainfed and dryland agriculture.

Red gram is a native of India as evident from the presence of several wild relatives and diverse gene pool along with ample evidence in historic literature. India contributes for nearly 90% of world’s total red gram production. However, it is gaining importance in African countries due to its adaptability to limited moisture conditions. All the cultivated types belong to two categories: i) Cajanus cajan var. bicolor: This group includes late maturing varieties, having tall bushy plants and bear flowers at the end of the branches. The pods are relatively longer and contain 4-5 seeds. ii) Cajanus cajan var. flavus: This group includes early maturing varieties, having smaller plants and flowers at several points along the branches. The pods are also shorter which bear 2-3 seeds. Economic Importance: Seeds are rich source of protein and hence become an indispensable part of Indian vegetarian meal. Contains protein - 22.3% Fat - 1.7% and Considerable amount of vitamins and minerals

Climate and cultivation Red gram is mostly cultivated as a kharif crop in India while rabi season cultivation is in practice in the eastern parts. Red gram can withstand high temperatures but the threshold temperature for germination is 13o C. It can withstand up to 35o to 40o C provided soil moisture is adequate. It can be grown under variable soil moisture conditions, with rainfall ranging from 60cm to 140cm.However, higher yields can be realized with irrigation particularly during critical stages including flowering and pod filling. Crop duration varies from 120-150 days depending on the varieties and area of cultivation.  Global Scenario

Tur production, as mentioned earlier, largely concentrated in Asia, particularly in India. Nevertheless, Tur production is picking up in some of the African countries owing to their suitable climatic conditions and global demand. Global production pattern of Tur has remained largely the same over a period. Production in India accounts for about 65% of the total global output as per the latest FAO statistics. Myanmar contributes about 17%, followed by Malawi at 6% and Tanzania at 6% and to the total global output. India is the largest producer as well as the consumer. India’s requirements have steadily been rising with growing population and income levels.

.jpg) Source: FAO, 2013

Domestic Scenario

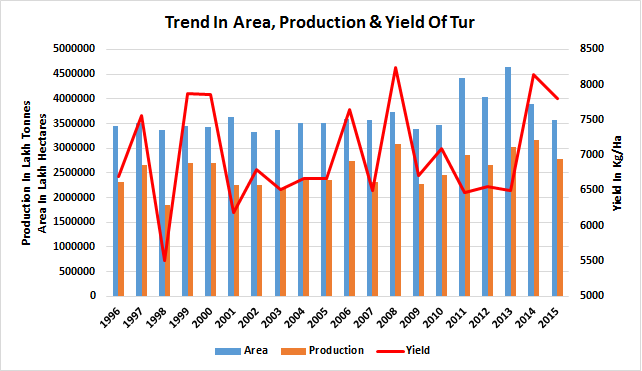

Area and production of tur in India has been more or less stable at 3.5-4 million hectares and 2.5–3 million metric tons respectively during the past two decades. The wide fluctuations in yields could be attributed to the dependence on rainfall as majority of the crop is grown under rainfed conditions.

Source: FAO & GoI

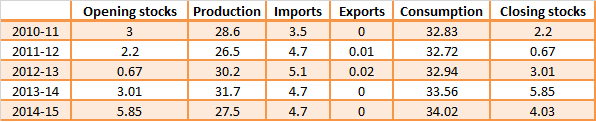

Table 1: Balance sheet of Tur (lakh tons)  Source: Ministry of Agriculture, GoI, Export Import Data Bank, Ministry of Commerce & Industry

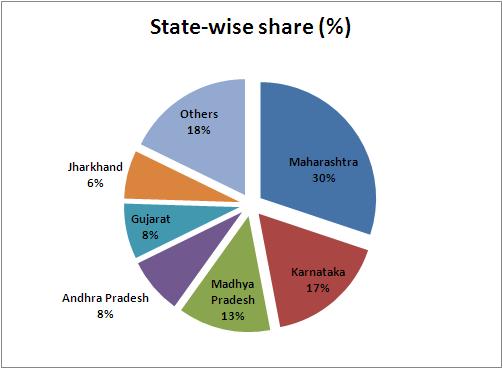

State-wise Production

Maharashtra is the largest producer of Tur, accounting for over 30% of total production in the country, followed by Karnataka, Madhya Pradesh and Andhra Pradesh with 17%, 13% and 8% respectively. These four major states along with Gujarat and Jharkhand accounted for over 80% of total production in the country as per the latest estimates for 2014-15. The production distribution across the major states remained stable but two important changes occurred over a period. The production in Uttar Pradesh declined steadily while that of Karnataka increased in absolute as well as relative numbers. Although production levels are high, the yields of all major producing states particularly, Madhya Pradesh, Karnataka and Andhra Pradesh are much lower than all India level.

Source: GoI, Department of Agriculture & Cooperation (2014-15)

Major Markets

Spot markets Madhya Pradesh: Indore, Bhopal, Vidisha Maharashtra: Jalgaon, Latur, Mumbai, Akola Karnataka: Gulbarga Other major centers: Delhi, Chennai, Kanpur, Hapur, Hyderabad, Vijayawada, Sirsa, Jalandhar Futures markets

Futures’ trading in tur was suspended in 2007.

External Trade Despite being the largest producer, India is the largest net importer of tur in the world. Tur imports into India have been rising although they continued to be erratic, depending on their production pattern in the source countries.

Tur imports have been fluctuating in the range of 0.3 million tons to 0.5 million tons. Myanmar has been the single largest source for red gram imports to India, accounting for about 90% supplemented by Tanzania and Kenya. Major export destination: NA

Major import sources: Myanmar, African countries. Factors to be considered while trading: Carryover stocks and the stocks-to-consumption ratio. Imports and the crop situation in the countries from where imports originate, viz., Myanmar. As the pulses can be substituted for one other, the price of other major pulses like chana, moong and masoor also have a significant bearing on the prices of tur. |

Copyright © CC Commodity Info Services LLP. All rights reserved.