Report for Date: 11/01/17

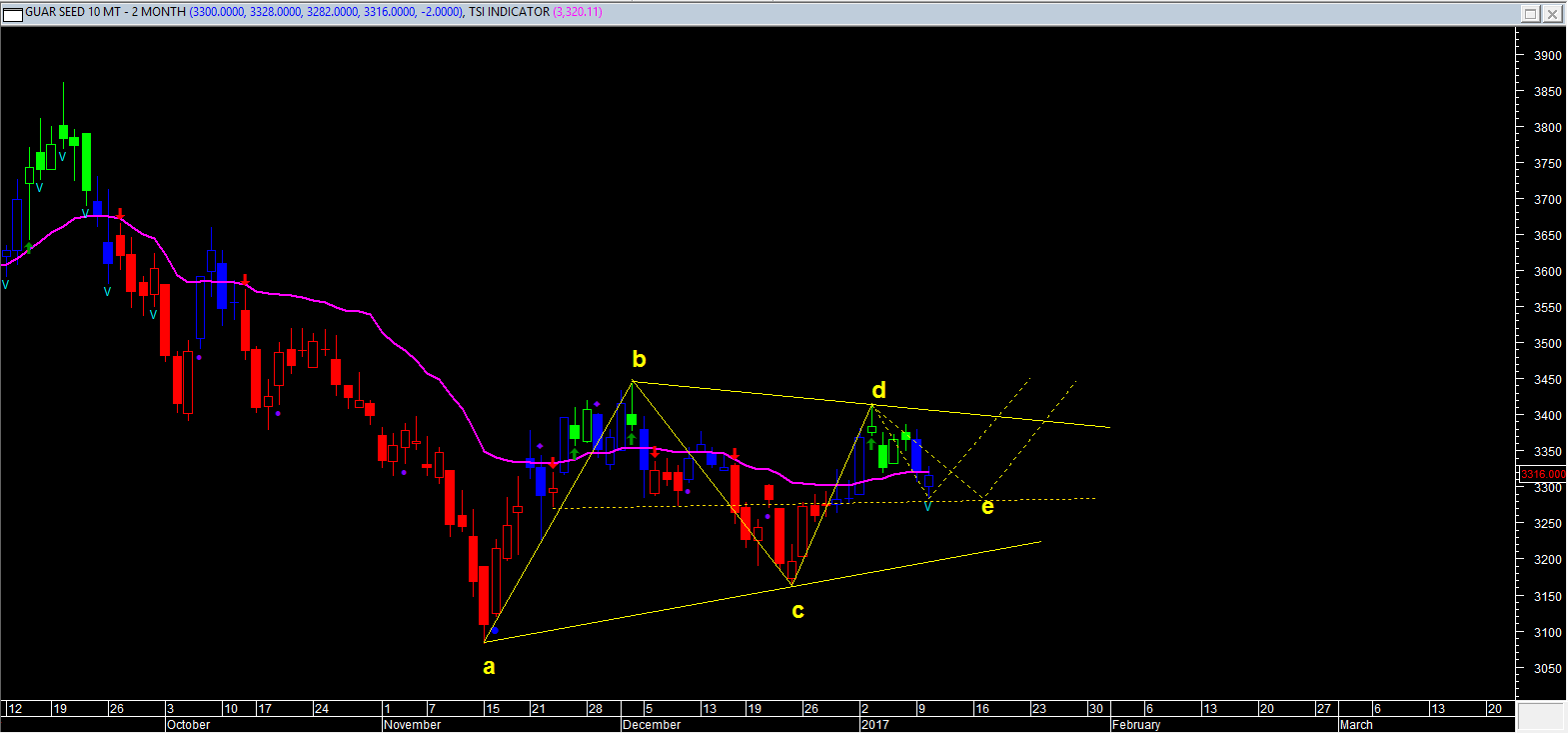

NCDEX Guar seeds10 Feb: Wave e Of The Triangle Is Likely Completes

The trend is sideways in Guar seed futures on NCDEX.

Feb 2017 futures contract settled at Rs 3316 per quintal Tuesday.

A triangle is likely unfolding in daily chart.

We suspect that we are in wave “e” of the triangle and once wave “e” gets completed, a sharp rise breaking out above point “d” may be seen in coming sessions.

The elapse time of wave “e” cannot be defines so waiting for the conclusion of wave “e” and the entire triangle is the set way to approach for a fresh trade.

A tentative conclusion points for wave “e” was seen at 3290 – 3260 levels and the low registered Tuesday is 3282.

Ideally, hold any pending long positions with a stop loss of 3160.

On breakout above 3411(“d”), prices may try to escalate towards 3520 – 3630 levels or above in coming sessions.

INTRA-DAY LEVELS FOR NCDEX GUAR SEED FEB 2017 CONTRACT

|

STRATEGY

|

CLOSE

|

DRV

|

TREND*

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

Hold Long

|

3316.00

|

3320.11

|

sw

|

3318

|

9.01

|

3243

|

3289

|

3309

|

3335

|

3381

|

*Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV. Positional Traders: If trend is up then traders long can hold long position with closing stop loss of DRV: Close >DRV. If trend is down, then traders can hold short position with a closing stop loss of DRV: Close <DRV.

PRICE, VOLUME AND OPEN INTEREST STRATEGY

|

Last Close

|

Price G/L%

|

Volume

|

% V Inc/Dec

|

Open Interest

|

% OI Inc/Dec

|

Candle

|

Position

|

|

3316.0

|

-0.1

|

44900

|

35.9

|

63820

|

14.6

|

Positive

|

Unwinding

|

TECHINCAL INDICATORS TABLE

|

RSI

|

1-ROC-RSI

|

Stochastic

|

1-ROC-

Stochastic

|

MACD

|

1-ROC

MACD

|

RS

|

1-ROC

RS

|

|

50.01

|

-0.45

|

36.36

|

-25.21

|

4.89

|

-14.03

|

61.67

|

1.83

|

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.