MUMBAI (Commoditiescontrol) - Cotton moved steady during the first few days of the week ending 23rd May 2015, but then movement in the fibre was mostly negative during the remaining days of the week, as estimated in the last week's report. Click here to read last week's report.

Usual demand from local mills helped prices trade steady against tight availability in the market yards. Normal arrivals across the country have slowed down significantly, with major markets receiving huge upcountry demand, especially the central Indian markets. All India cotton arrivals as on 23rd May is estimated at 353 lakh bales, as per traders.

Most of the stockists are holding onto their stocks at the moment as moisture content in cotton bales left with them reduced to around 2-3 percent, resulting in weight loss of the bales due to rising temperature throughout the country. They are learnt to release their stocks sometime in June or July, when monsoon arrives as bales would regain moisture then.

Besides, the Cotton Association of India (CAI) has further revised its cotton crop estimate for the season 2014-15 that begin on October 1, 2014 at 384.50 lakh bales (170kg each) from 391 lakh bales estimated a month ago. CAI’s April estimate is well below Cotton Advisory Board (CAB) India cotton production projection for 2014-15 at 390 lakh bales.

However, the soft commodity gave away the momentum and fell due to weak demand in yarn, negligible demand in cotton oil cake (CoC) and cotton seed. Cotton yarn prices reduced by Rs. 3-5/kg in the last few days, according to market sources. Polyester prices remained firm last week due to rise in crude oil prices.

.jpg)

Government’s decision to direct state authorities to close down textile units in various states on the grounds of releasing hazardous waste to nearby water sources, is impacting the industry. Market players were optimistic in cotton considering the bullish trend in markets. Therefore, ginning mills had build huge stocks as demand in yarn was constantly rising. But, now demand in yarn has slowed down, hurting cotton prices. Grey markets have large inventory as printing process has slowed down, which would halt arrivals of finished product in market yards, eventually leading to tight liquidity on the whole.

Poor demand in cotton yarn from domestic and overseas buyers has resulted in inventory built up leading to financial crunch in the industry, said a spinning mill owner from Surat on anonymity.

Further, reports of timely arrival of monsoon this year have dampened market sentiments. If it happens, cotton sowing in the country would certainly begin on time, which would result in increased ending stock, both in domestic and global markets.

Yet another factor weakening sentiments is that sowing of next crop is pretty much in full-swing in many major cotton belts in the country. In irrigated areas of Telangana’s Adilabad District, around 12-15 percent sowing has been done so far. About 5-15 percent sowing has been completed so far in Khandesh and Vidharba districts of Maharashtra. In few areas of Karnataka, nearly 5-12 percent cotton sowing has been achieved. Sowing began in few areas in Nimad line of Madhya Pradesh. Around 5-7 percent sowing is estimated to have completed. Around 5-7 percent of sowing done in few areas of Ahmedabad. Haryana completed around 60 percent sowing followed by Rajasthan completing 55-60 percent sowing and Punjab achieving about 50-55 percent of sowing so far.

The government’s nodal agency, the Cotton Corporation of India (CCI) had released fair amount of cotton stocks from its warehouses, but failed to record good sales at its E-auction held throughout the week. It sold only 21,500 bales cotton out of over 2 lakh bales put up for sale even as arrivals remained visibly thin. The agency could not record a good sale even after it was forced to lower down its floor prices by Rs. 300/candy in all the centres. This has also played its role in dampening buyers’ sentiment.

.jpg)

Haryana Cotton Sowing Reached 50% Of Target

Cotton sowing is progressing in full-swing in northern state Haryana. According to state agriculture department, around 50 percent sowing is completed in the state so far. But it is slightly lower than the corresponding period of last season. Meanwhile, the state is performing well in sowing of other summer crops namely maize, Jowar, guar, summer moong and sugarcane.

The department released weekly sowing report recently. According to the report, cotton acreage reached at 2.94 lakh hectares (ha) in Haryana till 18 may this year against target of 6 lakh ha Last year, cotton was sown in 3.08 lakh ha in the same period. Normal area is 5.80 lakh ha for the crop. According to the department, around 50 percent sowing completed against the target. Although, cotton acreage was lagging behind by 14,000 ha compared to last year’s same period sowing.

Stock Position At Exchange Warehouses

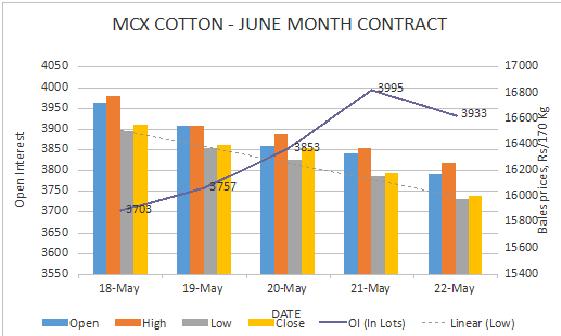

Cotton stocks at National Commodity and Derivatives Exchange (NCDEX) accredited warehouses remained unchanged at 400 bales as on 22nd May, 2015. Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses decreased 5,600 bales to 1,09,600 bales as on 22nd May compared to 1,15,200 bales as on 14 May.

NCDEX, MCX Weekly Update

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

.jpg)

NCDEX CoC Weekly Technical Update. Click Here

.jpg)

Cotton Price Settlement On Exchanges As On 20 May, 2015

Cotton final settlement prices of National Commodity and Derivatives Exchange (NCDEX) contracts which expired 20 May, 2015 stood at Rs. 16,847.80/bale for 29MM cotton. Meanwhile, prices of kapas khali (CoC) prices settled at Rs. 1,822.40/100kg.

Cotton final settlement prices of ACE Commodity Exchange contracts expired on 20 May, 2015 settled at Rs 35,620/candy.

U.S. Market Through The Week

U.S cotton dropped to fifth straight session on Friday and witnessed weekly loss of 5.29 percent on stronger dollar and reduced demand.

Weekly U.S. government export data released on Wednesday also weighed on the market having indicated that high prices had crimped demand. The report eased concerns over tight nearby supplies in the world's top exporter, which had lifted prices to two-year highs in late March.

Also adding pressure this week was the attempt by Chinese government to shrink its growing inventories with a plan to switch to a subsidy program in its key growing region this year. This move is widely expected to significantly dampen demand in the world's top consumer in the 2014-15 crop year that began on Aug. 1.

Chinese government is getting ready to start offering their own stocks, the stuff they've been accumulating over the years, according to market sources.

According to most recent data released by U.S. Commodity Futures Trading Commission (CFTC), cotton speculators on ICE exchange cut net long position by 5,641 contracts to 35,641 in week ended May 19.

.jpg)

TOP STORIES THROUGH THE WEEK

Lower Cotton Acreage In China To Boost Prices

Cotton area in China this season is to hit its lowest since 1940s, lifting its prices higher. Further, shifting of cotton farmers to other crops such as soyabean may also present bullish tone in the days to come. However, a direct link between seed planting and the size or quality of the crop cannot be made now as things depend on the weather conditions.

PYMA For Substantial Reduction In Tax Rates

Pakistan Yarn Merchants Association (PYMA) has demanded substantial rate cut in sales tax and income tax in the forthcoming Federal Budget, to enhance business activities as well as exports with a view to strengthen and push forward the economy of the country. Taxes rate in Pakistan is quite high as compared to regional countries particularly GST is 17 percent whereas in India It Is 12.36 percent, in Indonesia 10 percent, in Japan 8 percent, in Singapore 7 percent, in Malaysia 6 percent and in Taiwan it is 5 percent. Moreover, the rate of income tax in Pakistan is comparatively higher than regional countries. This has generated tax evasion tendencies in the country. PYMA leaders pointed out that with the reduction in tax rates not only the industrial and business activities will be promoted but also country's exports will be enhanced.

Increase In Service Tax To Be Effective From 1st June

An increase in service tax to 14 percent from 12 percent will be now effective from 1st June, 2015. Increasing service tax was proposed in the Union Budget 2015, but a date was to be notified. The provisions levying education Cess and secondary and higher education Cess would also cease to have effect from same date i.e. 1st June, 2015, as the same would be subsumed in the service tax rate of 14 percent.

El Nino Conditions Strengthen In Tropical Pacific Region

The Australian Bureau Of Meteorology said that El Nino conditions are strengthening in the tropical pacific region. Super typhoon Dolphin, may also be bolstering the case of El Nino by default in the latest update, The Bureau said. Trade winds have remained consistently weaker than average since the start of the year. Meanwhile, The Bureau said it did not find support from the upper levels of the atmosphere for the impending onset of southwest monsoon along the Kerala coast.

Tight Availability Of Quality Cotton Hurts China

Share of high quality cotton fell to 13 percent and 18.3 percent on a national basis and Xinjaing basis during 2008-2012 in China, as per data from china fiber inspection bureau. This is 68 percent and 55 percent lower than previous levels. High quality cotton (grade 1 and 2, or a color grade of 11 and 21) used to represent 40 percent of total output. Govt data shows that Chinese cotton planting fell from 86.3 million mu to 63.3 million during 2008-2014, production dropped from 7.49 million tonnes to 6.16 million tonnes.

Yarn Imports By China Rise Amid Improved Demand For Quality Styles

China’s yarn imports are estimated to have increased to 72,000-75,000 tonnes by mid May, a rise of over 5,000 tonnes compared to April end. Current imports are mainly from India, Vietnam, Pakistan, Uzbekistan And Indonesia. Foreign C32s, C40s carded and combed imports from Indian, Vietnamese; Pakistani with steady quality reported a pick up in inquiry and sales. China is calling for some control of flooding yarn imports lately. Possible choices include quota, higher import duty and a tighter control of customs clearance. A yarn trader said that advanced delivery and shipping increased this month, some yarn makers have to seek supplies elsewhere for delivery. Improving sales of cotton yarn, grey fabrics and garment orders are also supporting the rising yarn imports.

U.S. Cotton Weekly Export Sales Between 1-7 May, 2015

U.S. cotton weekly export sales, net upland sales of 59,300 Rb for 2014-2015 were up 22 percent from the previous week, but down 30 percent from the prior 4-week average. Increases were reported for Turkey (26,800 Rb), Thailand (10,500 Rb, including 500 Rb switched from Japan), Vietnam (9,400 Rb, including 5,100 Rb switched from South Korea, 400 Rb switched from Japan, and decreases of 1,600 Rb), Indonesia (8,400 Rb), Taiwan (6,300 Rb), and Peru (2,900 Rb). Decreases were reported for Egypt (6,600 Rb), South Korea (2,900 Rb), El Salvador (900 Rb), and Honduras (700 Rb). Net sales of 36,200 Rb for 2015-2016 were reported primarily for South Korea (15,800 Rb) and Peru (13,700 Rb).

USDA Sees U.S. Cotton Crop In 2015 Down 11 Percent

U.S. cotton crop in 2015 forecast at 14.5 million bales, 11 percent lower than 2014 final crop estimate, as per USDA. 2015 cotton area is expected at 9.55 million acres, 13.5 percent below 2014, based on prospective plantings report. Texas planted 16 percent of its crop, compared with an average of 26 percent, while for the southeastern states, cotton plantings by May 10 ranged from 19-29 percent as against with the 5- year average of 27-40 percent. The initial 2015 U.S. yield estimate is below the final 2014 estimate as the share of total U.S. harvested acres in the lower yielding southwest region is expected to rise. U.S. cotton demand including exports in 2015/16 is projected to rise 1 per cent to 14.5 million bales.

China Cotton Import In April

China April cotton imports were seen at 160,761 tonnes, down 28.32 Percent on year, according to a custom data. China Jan-April cotton imports 609,005 tonnes, down 38.1 percent on year.

IMPORTS FROM INDIA

--India April Cotton Exports To China were seen at 25,060 tonnes, down 77.01 percent on year

--India Jan-April cotton exports to China 150,465 tonnes, down 72.73 percent on year

IMPORTS FROM U.S

--U.S. April cotton exports to China at 101,754 tonnes, up 24.82 percent on year

--U.S. Jan-April cotton exports to China 257,329 tonnes, down 10.25 percent on year

IMPORTS FROM BRAZIL

--Brazil April cotton exports to China at 8,852 tonnes, up 876 percent on year

--Brazil Jan-April cotton exports to China 65,580 tonnes, up 636 percent on year

--Weakness in Brazilian currency results higher imports from Brazil

Cotton Area In North Xinjiang Records Steep Fall

Cotton area saw a broad-based decline in north Xinjiang except for PCC No.5 division. No.5 division cotton area increased 3 percent this year to 700,000 Mu compared to 680,000 Mu last year, due to a long tradition of cotton growing in the region. previous attempt to slash acres for other economic crops has fallen flat as cotton growers insisted on cotton growing for a better return. In No. 6 division, cotton area fell 45 percent or half million Mu this year due to its focus towards other crops. Last year, the division had planted 1.1 million Mu. The reduced acres are mostly planted with corn and oil sunflower. For No.7 and No.8 division, acreage fell 120,000 or 9 percent and 150,000 Mu or 6 percent respectively.

Kharif Crop Planting Update

India's kharif sowing area has crossed 56.22 lakh hectares (ha) as on 22nd May compared to 49.04 lakh ha same time last year, ministry of agriculture confirmed in a release. Cotton has been planted in 6.12 lakh ha. Cotton sowing was yet to be started during the same time last year.

OUTLOOK FOR NEXT WEEK

Cotton prices are most likely to trade easy in the next week too with demand remaining subdued. Mills and spinners may maintain wait and watch approach. They may depend on CCI for their immediate requirement. Demand in yarn may also continue to be sluggish. As per government data, cotton sowing this year has been done very much, with north India completing about 60 percent of sowing so far, raises the probability of early arrival of new crop. There are expectations in markets that cotton sowing in north India will increase 5-7 percent this year.

(By Commoditiescontrol Bureau; +91-22-61391533).