MUMBAI (Commoditiescontrol) - Cotton prices on domestic markets all over India traded mostly on the upside during the week ending April 25, 2015 on strong demand coupled with several other reports that are making rounds in markets. The highest gain of the week is recorded on Saturday, though being the last day of the week, with prices of J34 cotton quoting at Rs. 3,740/maund (37.3kg each) in Bathinda and S6 cotton trading at Rs. 34,500/candy (356kg each) in Gujarat.

Firstly, demand from mills and spinners was strong in the wake of dearth of supply. Most of the textile mills in the country are left with very little stock with them. Hence, they showed increased interest in buying to build inventory for their future requirements. Market experts say that mills will have to buy from any available sources, be it the Cotton Corporation of India (CCI), state agencies or private traders/ginners to meet their short and long-term requirements.

Secondly, the country’s cotton consumption at present is at around 1 lakh bales (170kg each) per day, but the CCI is not offloading more than 50,000-55,000 bales per day. In other words, there is a mismatch in supply and demand currently. This is the reason that most of the private traders/ginners have also recorded huge business during the week.

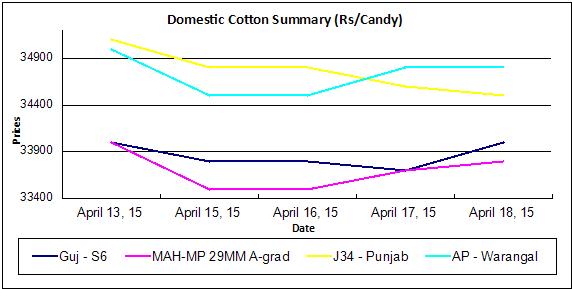

Spot Rate Chart

Thirdly, the Indian Meteorological Department (IMD) predicting below-normal rainfall for the country during this season provided a renewed boost to buying sentiment. Many of the market people are of the opinion that if the monsoon is below normal, it would be difficult to plant cotton on time. Delay in sowing would result in delayed arrival of next year crop in markets. Apart from this, production and yield also may come with its own issues. Considering all these factors, textile mills and spinners may aggressively source cotton to build up their inventories in the sessions to come.

Thirdly, the Indian Meteorological Department (IMD) predicting below-normal rainfall for the country during this season provided a renewed boost to buying sentiment. Many of the market people are of the opinion that if the monsoon is below normal, it would be difficult to plant cotton on time. Delay in sowing would result in delayed arrival of next year crop in markets. Apart from this, production and yield also may come with its own issues. Considering all these factors, textile mills and spinners may aggressively source cotton to build up their inventories in the sessions to come.

Prices of cotton complex including seed, khal, kapas, were initially steady to firm, but gradually moved up Rs. 40-50/100kg later in the week.

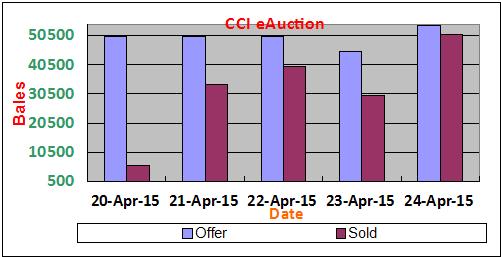

The government nodal agency CCI had raised its bid prices by Rs. 100-400/candy at its auction centres across the country in the week. But even so, it managed to sell 1,60,600 bales (2014-15 season). The agency had also held an open-auction of cotton for 2013-14 season at Bathinda and Coimbatore. On Thursday, it sold 12,000 fully pressed (FP) bales cotton at the open auction in Coimbatore. In the auction, the agency sold Ahmedabad S6 cotton of 27MM at Rs. 31,700, 31,900, 32,500, 32,700, 33,000, 33,300. It sold Warangal 29MM cotton at Rs. 33,500. 30MM cotton was sold at 33,800/candy. At Bathinda, it sold 3,955 FP bales at Rs. 33,200 to a north-Indian mill. The same buyer had bought 1,300 bales of Punjab premium at Rs. 33,700 and another 2,700 bales of Super at Rs. 32,700. This sale of CCI can be considered its highest intra-day sale for the season. CCI’s yesterday’s E-auction of cotton is its biggest one day auction sale in the current season, of 50,800 bales across various centres.

The government nodal agency CCI had raised its bid prices by Rs. 100-400/candy at its auction centres across the country in the week. But even so, it managed to sell 1,60,600 bales (2014-15 season). The agency had also held an open-auction of cotton for 2013-14 season at Bathinda and Coimbatore. On Thursday, it sold 12,000 fully pressed (FP) bales cotton at the open auction in Coimbatore. In the auction, the agency sold Ahmedabad S6 cotton of 27MM at Rs. 31,700, 31,900, 32,500, 32,700, 33,000, 33,300. It sold Warangal 29MM cotton at Rs. 33,500. 30MM cotton was sold at 33,800/candy. At Bathinda, it sold 3,955 FP bales at Rs. 33,200 to a north-Indian mill. The same buyer had bought 1,300 bales of Punjab premium at Rs. 33,700 and another 2,700 bales of Super at Rs. 32,700. This sale of CCI can be considered its highest intra-day sale for the season. CCI’s yesterday’s E-auction of cotton is its biggest one day auction sale in the current season, of 50,800 bales across various centres.

In the meantime, the China Cotton Association (CCA) in its latest survey stated that the country’s cotton planting intention may fall by 27.4 percent compared to 63.397 million MU last year (1MU=0.0667 Hectare). Cotton acreage in east China, north China and northwest China may fall by 43.7 percent.

According to trading sources, U.S cotton has posted huge gains in the last few sessions, that suggest Indian cotton would be more competitive in international markets and garner enhanced export orders from overseas.

Total arrivals this week across India as on 25 April stood at 2.5 lakh bales, as per our sources. Arrivals across the country till date in the current season, that started in October 2014, stands at 3.28 crore bales, as trade sources.

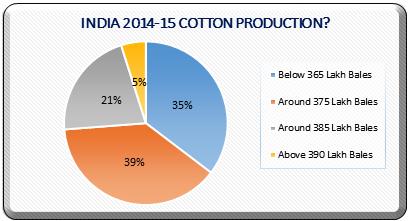

Cotton Output In 2014-15 Seen At 375 Lakh Bales - CC Survey

In the wake of numerous guesses on cotton output for 2014-15 season, we at commoditiescontrol.com approached people associated with the industry to get their views on production for the year. Our survey on ‘India 2014-15 Cotton Production” suggested that production in the country will be at around 375 lakh bales mainly attributed to low yield in the country, especially in Gujarat and Maharashtra. Around 315-320 lakh bales of cotton have already been arrived in domestic markets or are stocked with the CCI (83 lakh bales of the total 86 lakh bales procured). The survey indicates that around 55-60 lakh bales of cotton is expected to arrive in the next five months i.e by the end of cotton season on September 2015. The survey includes people who are into cotton trading, broking, textiles, importers and exporters and finally we are sharing their views with our readers.

In the wake of numerous guesses on cotton output for 2014-15 season, we at commoditiescontrol.com approached people associated with the industry to get their views on production for the year. Our survey on ‘India 2014-15 Cotton Production” suggested that production in the country will be at around 375 lakh bales mainly attributed to low yield in the country, especially in Gujarat and Maharashtra. Around 315-320 lakh bales of cotton have already been arrived in domestic markets or are stocked with the CCI (83 lakh bales of the total 86 lakh bales procured). The survey indicates that around 55-60 lakh bales of cotton is expected to arrive in the next five months i.e by the end of cotton season on September 2015. The survey includes people who are into cotton trading, broking, textiles, importers and exporters and finally we are sharing their views with our readers.

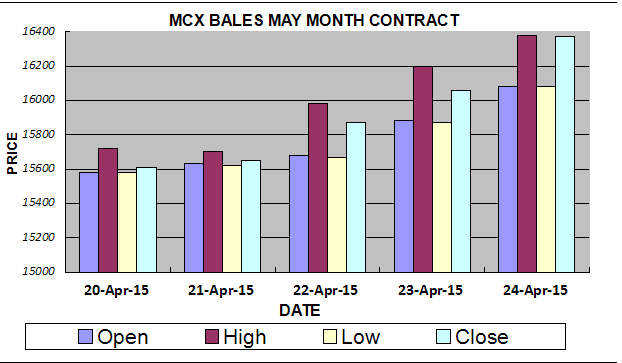

Cotton Price Settlement On Exchanges As On 20 April

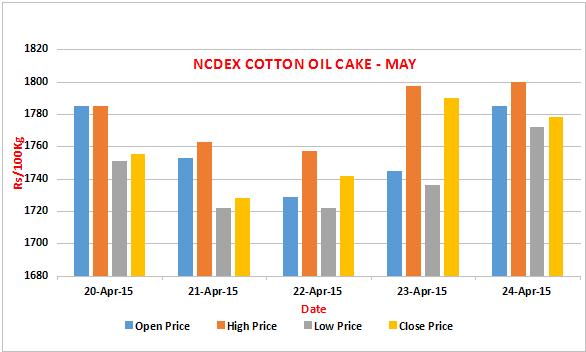

Cotton final settlement prices of National Commodity and Derivatives Exchange (NCDEX) contracts which expired 20 April,2015 stood at Rs. 16,030.15/bales for 29MM cotton. Meanwhile, prices of kapas khali (CoC) prices settled at Rs. 1,746.35/100kg.

On ACE Commodity Exchange, cotton final settlement prices of 118 bales cotton was at Rs. 33,520/candy.

Stock Position At Exchange Warehouses

Cotton stocks at National Commodity and Derivative Exchange (NCDEX) accredited warehouses as on April 24 stood at 2,700 bales, while cotton oil cake (CoC) increased to 39,589. At Multi Commodity Exchange (MCX) accredited warehouses, cotton stock increased to 1,18,700 as on April 23.

NCDEX, MCX Weekly Update

NCDEX Kapas This Week

.jpg)

NCDEX Cotton Oil Cake This Week

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

NCDEX CoC Weekly Technical Update. Click Here

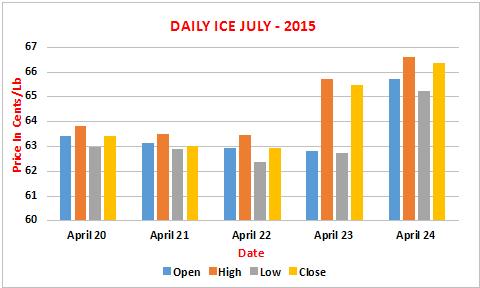

U.S. Market Through The Week

ICE cotton futures opened the week on a bearish note, but pared the losses after the robust export sales report released by the USDA released on Thursday, with a gain of over 5 percent. Also, open interest in July contact continue to increase along with increase in volume also due to speculators’ rollover from the May contract.

Top Stories Through The Week

China Cotton Imports In March

China’s imports of the fibre saw a drastic fall in March 2015 and the first 3 months of the year - January-March, as per official customs data. In March, China's total cotton imports were at 127,919 tonnes, which is 42.14 percent lower than the last year same month. During the first three months, Jan-Mar, the country’s cotton imports posted a drop of 41 percent at 448,202 tonnes compared to a year ago, the customs data showed. Of the total imports, China imported around 26,937 tonnes of cotton from India in March, down 75.72 percent from a year ago. Meanwhile, imports from India during Jan-Mar were at 125,406 tonnes, down 71.68 percent compared to last year. Cotton exports from the U.S. to China in March were recorded at 74,128 tonnes, a fall of 15 percent on year, while between Jan-Mar U.S. cotton imports in China saw a slump of 24.19 percent on year at 155,575 tonnes. Interestingly, China’s cotton imports from Brazil in March showed a rise of 3571 percent to 10,273 tonnes. The major factor behind the growth is attributed to the weakness in Brazilian currency. Also, during Jan-Mar, China imported around 56,728 tonnes of cotton, up 609 percent on year.

USDA Forecasts Global Cotton Output

The USDA has reported that 2014-15 global cotton production may be at 119.2 million bales, down 1 percent from last year. China and india contributes contributes an estimated 30 million bales of cotton production in 2014-15. The report stated that global production this year has declined for three consecutive seasons to its lowest since 2010-11 with falling global prices, with harvested area being the second lowest in 4 years. The USDA estimates world cotton consumption in 2014-15 at 111 million bales, 2 per cent or 2 million bales above the preceding season.

USDA Export Sales Data

U.S. government report showed export sales of 144,900 bales in the prior week, that came well above market expectations. Weekly export sales reached 144,900 bales, according to data released on Thursday, with exports of 324,200 bales.

West Africa 2014-15 Cotton Output - USDA Attache

USDA forecasts West Africa’s 2014-15 (Aug-July) cotton production at 3.5 million bales (1.8 million bales), a 2 percent rise against USDA’s previous official numbers and a 14 percent increase on year. The major cotton growing regions in the country recorded a slight gain this year compared to last year even after irregular monsoon over the country. Burkina Faso remains the top cotton producer in West Africa with 690,000 tonnes followed by Mali at 547,000 tonnes, Cote d’ivoire at 436,000 tonnes, Chad at 130,000 tonnes and Senegal at 26,000 tonnes.

Cotton Area To Reduce In Gujarat

Farmers in Gujarat may prefer groundnut more than cotton this kharif season as they incur lower profit from cotton. Area under cotton may fall significantly in the main growing regions of Saurashtra and Kutch. Prices of cotton are currently in the range of Rs. 790-910/maund of 20kg in Saurashtra.

India Cotton Export Falls

India exported 4.5 million bales of cotton so far this season, down from 9.9 million bales last year, as per a top official of CCI. The official adds that overall cotton shipments are likely to fall by 29 percent to 7 million bales in the ongoing season. The official attributes the fall in export numbers to the sluggish demand from china and higher world stockpiles.

CCI Pauses Cotton Procurement As Prices Rise

The Cotton Corporation of India (CCI) has halted its cotton procurement operation for the time being in few states after recent surge in prices. CCI CMD, Mr. B.K. Mishra told a news agency that CCI need not intervene in the market as of now since with cotton prices moving up, arrivals are weakening. Prices have increased marginally by Rs. 50-100/bale resulting in market prices of Rs. 4,100-4,150/bale both in Gujarat and South. CCI is not willing to sell cotton at base price despite huge demand from mills in south. Mr. Mishra said that the agency may take a call with regards to floating a global tender for offloading its stocks. He said the cci doesn’t intend to offload huge stocks immediately as it could worsen an already glut-like situation in the market and hurt realisations of farmers selling cotton now.

OUTLOOK FOR NEXT WEEK

Market sentiment will remain bullish next week on prevailing reports and support from strong dollar, limited inventory with the millers, tight supply and lower planting intentions for next year.

(By Commoditiescontrol Bureau; +91-22-61391533)