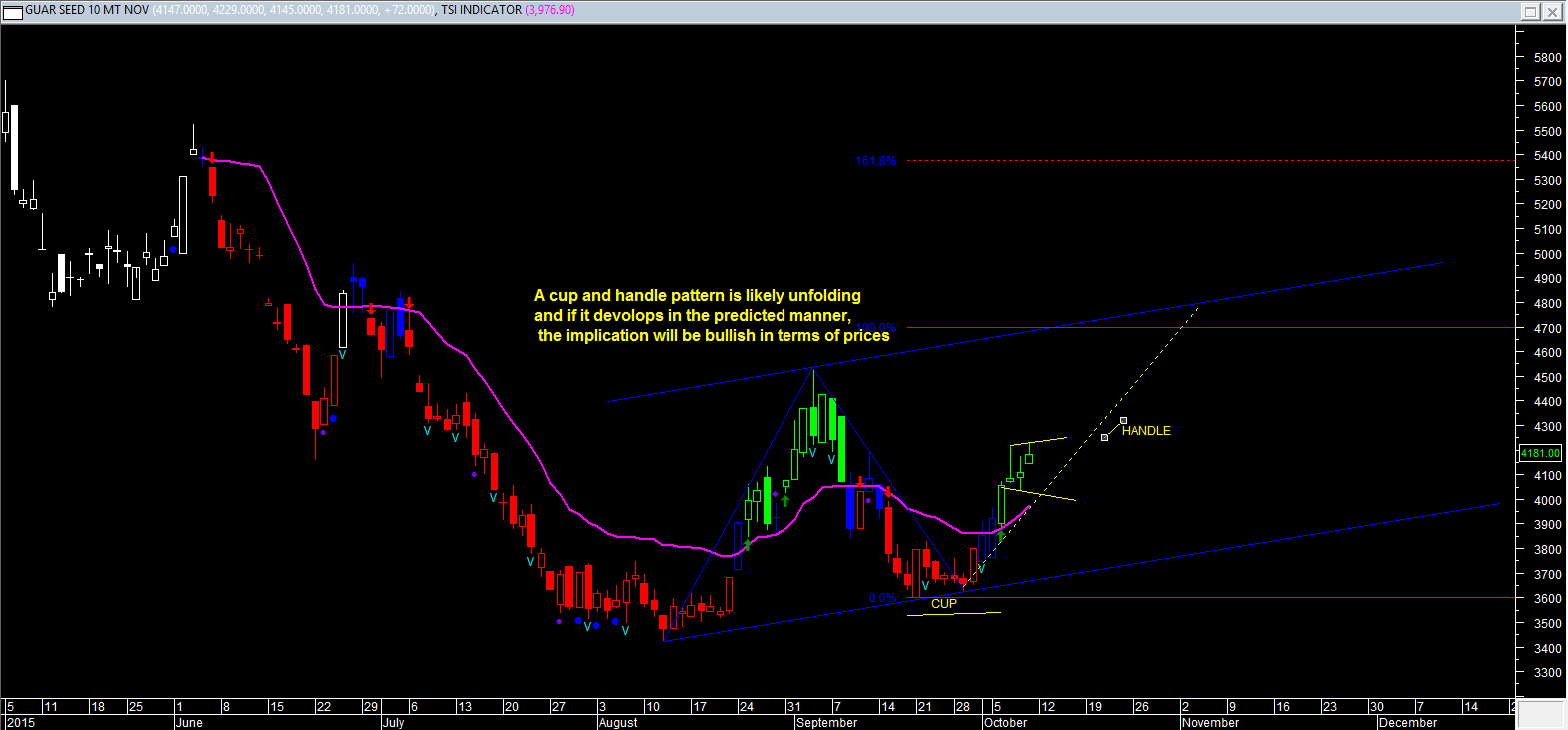

NCDEX Guar seeds10 Nov: A Bullish Cup and Handle Pattern Is Likely Emerging

Report for Date: 12/10/15

The trend is up in Guar seeds futures on National Commodity & Derivatives Exchange (NCDEX).

Nov 2015 futures contract settled at 4181 per quintal Friday.

It looks like that a bullish Cup and Handle pattern is under development in daily chart of Guar seed futures. (Shown in the chart).

We assumed that cup like structure has completed from 15 Sep 2015 to 07 Oct 2015 price range and the later part of the pattern which is called “Handle” is in progress now.

The suspected “handle” is likely to be unfolding and then after an upside breakout may start a rally in guar seed prices in coming sessions.

During the formation of the handle, a corrective decline towards 4005-3960 is likely to be seen and the same can be used to go long.

Keep a stop loss of 3850 for the long positions.

If the pattern unfold as per the expectations, It may have an upside potential towards 4500-4700 levels.

INTRA-DAY LEVELS FOR NCDEX GUAR SEED NOV 2015 CONTRACT

|

STRATEGY

|

CLOSE

|

DRV

|

TREND*

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

Hold Long

|

4181

|

3937

|

UP

|

3799

|

30.09

|

4057

|

4141

|

4185

|

4225

|

4309

|

*Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV. Positional Traders: If trend is up then traders long can hold long position with closing stop loss of DRV: Close >DRV. If trend is down then traders can hold short position with a closing stop loss of DRV: Close <DRV.

PRICE, VOLUME AND OPEN INTEREST STRATEGY

|

Last Close

|

Price G/L%

|

Volume

|

% V Inc/Dec

|

Open Interest

|

% OI Inc/Dec

|

Candle

|

Position

|

|

4181

|

1.75

|

165890

|

0.72

|

62070.00

|

4.02

|

Indecisive

|

Unwinding

|

TECHINCAL INDICATORS TABLE

|

RSI

|

1-ROC-RSI

|

Stochastic

|

1-ROC-

Stochastic

|

MACD

|

1-ROC

MACD

|

RS

|

1-ROC

RS

|

|

65.77

|

3.43

|

81.15

|

-2.14

|

52.37

|

49.08

|

62.10

|

6.05

|

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.

View Full Image

|