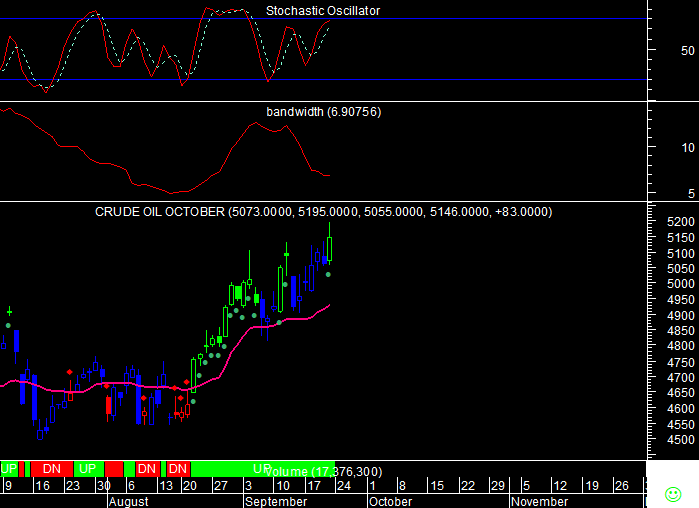

Report for Date: 24/09/2019

Accumulate at 5132-5069 or below with a stop loss of 4900.

Expect higher range of 5209-5349 to be tested.

TREND INFORMATION WITH INTRA-DAY LEVELS

|

CLOSE

|

DRV

|

TREND*

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

5146.00

|

4929.41

|

UP

|

4755.0

|

22.08

|

4929

|

5069

|

5132

|

5209

|

5349

|

*Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV is lower.

PRICE, VOLUME AND OPEN INTEREST STRATEGY

|

Last Close

|

Price G/L%

|

Volume

|

V -G/L%

|

Open Interest

|

OI -G/L %

|

Candle

|

Position

|

|

5146.0

|

1.6

|

17376300

|

80.4

|

15432

|

16.1

|

Positive

|

Addition Long

|

TECHINCAL INDICATORS TABLE

|

RSI

|

1-ROC-RSI

|

Stochastic

|

1-ROC-

Stochastic

|

MACD

|

1-ROC

MACD

|

RS

|

1-ROC

RS

|

|

64.69

|

6.71

|

78.94

|

4.79

|

84.97

|

6.64

|

66.13

|

11.38

|

Note: UP Green= Shows Up Trend as Close > DRV (Pink Line), DN Red= Shows Down Trend as Close < DRV(Pink Line), Red Color Bar= Down Trend + Bandwidth Is Rising, Green Color Bars= Up Trend + Bandwidth Is Rising, Blue Color Bars= Sideways(Trend could be up or down + Bandwidth is falling), Pink Color line= DRV, V marked= Increase in Volume in relation to last few days. Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV. Bandwidth Indicator= Helps to determine directional speed in the direction of the trend. Falling Bandwidth would indicates loss of momentum being witnessed or likely to be witnessed. Sideways movement may emerge or upside or downside could be locked until Bandwidth does not turn up. Rising Bandwidth can bring about directional momentum.

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.