MUMBAI (Commoditiescontrol) - Raw and white sugar futures closed firm on Friday on Intercontinental Exchange (ICE), but ended this week with loss of 6%.

On Friday, March raw sugar futures contract ended up 0.17 cents, or 1.30%, at 13.25 cents per pound on ICE US Exchange, after falling at 13.02 cents low, a lowest level since September 28.

Sugar futures also dropped by 6.56% during a week, while raw sugar futures seen a steep fall since last two weeks, due to weak fundamentals.

Raw sugar futures also slumped about 12.6% so far in January month.

Sugar futures prices weighed down over the concern of surplus sugar supplies in current season 2017-18 (October-September). Global sugar production is estimated to increase further in current season, as Brazilian mills are expected produce more sugar instead of ethanol in next sugar season 2018-19 (April-March).

Brazil is the largest sugar producer and exporter of the world.

Sugar output of a South American country is estimated to rise as, federal government considering to remove the import tariff on ethanol.

Earlier in August month in last year, the foreign trade chamber of Brazil, known as Camex had imposed 20% tariff on imported ethanol for volume that exceeds more than 600 million liters. To help out the domestic ethanol producers, to improve demand for domestic ethanol, although biofuel prices could also rise in local markets.

While according to recent study, the price of ethanol in Brazil is linked to the price of gasoline, however there is no meaning of the import duty on ethanol.

However, with ample availability of imported ethanol from USA, Brazilian sugarcane crushing millers will favour sugar production over ethanol in coming season. Although, sugar output is expected to rise in the country. While global sugar production surplus will also increase further due to that.

Total global sugar surplus is estimated to be around 104.3 lakh tonne in 2017-18, according to Green Pool, the Australian-based commodity analyst. While London-based International Sugar Organization (ISO) projected a sugar surplus of 50.3 lakh tonnes.

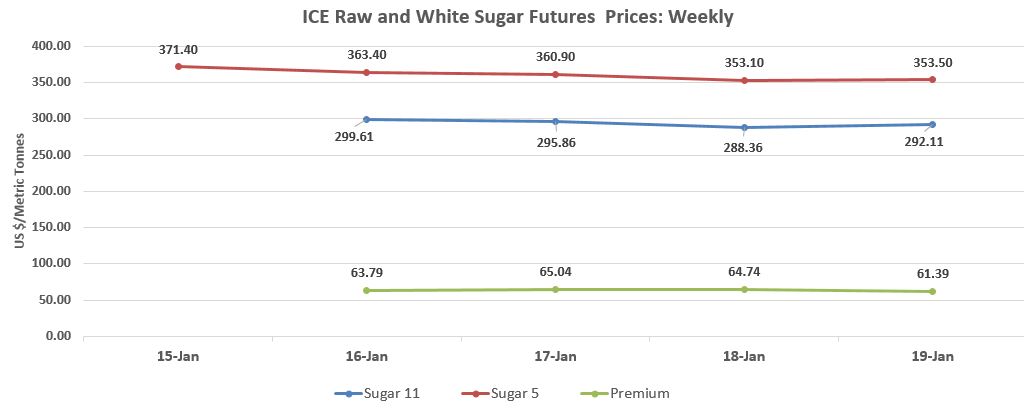

On other hand, March white sugar futures also closed with a marginal rise of 40 cents, or 0.11%, at $353.50 per tonne on ICE Europe Exchange., while earlier it fell upto $351.70, a lowest level for the contract.

White futures also lost 5.7% during a week, while slipped almost 10% in January so far.

London sugar futures hit four year low in last session, as higher sugar supplies estimated from the European Union, Thailand, Pakistan, India and other white sugar producing countries.

India, is expected to surplus production of 10 lakh tonnes in 2017-18. The industry body Indian Sugar Mills Association (ISMA) revised upward its production forecast by 4% to 261 lakh tonnes ongoing season.

India is a biggest sugar consumer as well as second largest producer of the world.

Meanwhile, the south Asian country may export some quantity of sugar in current season. And also expected export higher amount of sugar in upcoming sugar season 2018-19.

India's sugar mills have produced 135 lakh tonnes of sugar as on January 2017.

On other hand, European Union, net importer, is also likely to become a leading exporter in current season, with bumper sugar production of 201 lakh tonnes in 2017-18. European Union had removed the bloc's system of sugar production quotas from October 2017 leading to higher production.

Thailand, a second biggest sugar exporter also having better cane crop in current season, and country estimated to have 120 lakh tonnes of sweetener production in 2017-18. While country may exports 85 to 90 lakh tonnes out of the total output.

Thai mills have produced 32.23 lakh tonnes of sugar so far, up 52% from last year.

However, international sugar futures prices are expected to remain under pressure over the excess sugar supplies during season.

On other hand, the March/March whites-over-raws premium, a measure of the profitability of refining, recovered slightly in past week, but dropped later at $61 on Friday. Current spot white premium is hovering below the total operational cost of refineries, which made it unattractive for them. Although, raw sugar purchase also dropped due to lesser premium.

(By Commoditiescontrol Bureau: +91-22-40015532)